Manhattan, NY Skyline Properties is a locally based brokerage firm that handles many different property types, including ground leases, commercial buildings, apartment buildings, townhouses, mixed-use investment buildings, mixed-use user buildings, live plus income buildings, industrial properties, and development/conversion sites. NYREJ recently interviewed founder and CEO Robert Khodadadian, about how their unique business model has enabled Skyline Properties to deliver superior results to buyers and sellers alike for over 10 years now.

Off-Market Deals

Over the last decade, Khodadadian and his team at Skyline Properties have pioneered a model of brokering deals in the off-market sector where discretion is the watchword for New York City’s most active real estate players. The mission at Skyline is to create off-market opportunities designed to provide sellers with complete discretion while offering buyers the opportunity to buy prime assets without going through the traditional competitive marketing process.

Focusing on off-market opportunities and avoiding the time-consuming process of obtaining exclusive listings has allowed Skyline to be more agile than competing brokers. Traditional brokerage firms often need significant time to prepare glossy marketing materials, figure out listing agreements, and solve internal political disputes. According to Skyline, these matters have little to do with what the buyers and sellers really care about. “The market is now so competitive that many buyers simply won’t participate in the bidding process for traditionally marketed ‘exclusive listings’ from the most well-known brokerage firms,” said Khodadadian.

Although Skyline doesn’t market properties on an exclusive basis, they are dedicated to delivering superior results to buyers and sellers alike. To ensure that Skyline can manage their sellers’ expectations, they make it a priority to provide sellers with a thorough analysis of their investment property and confirm that they are comfortable with the true value of their asset in today’s market before they present the opportunity to prospective buyers. The foundation of Skyline’s success comes from making everything more personal with the buyer and seller. This is done by building close relationships with a number of buyers interested in properties and then getting in touch with sellers before a particular property goes on the market. To date, Skyline has sold $1.2 billion dollars in commercial real estate using this off-market model of bringing buyers and sellers into mutually beneficial transactions.

Customized Canvassing

Over the last few years, Skyline has developed a customized canvassing tool, which is now available for IOS and Android phones, to enable successful transactions for their clients, and which in turn has created an organic expansion of the investment sales team. Headquartered at The Daily News Building in Midtown, the Skyline team has been spearheading New York City investment sales for discerning buyers who are ready to transact this year, but who want to eliminate the inefficiencies of traditional deal sourcing.

Customized canvassing has allowed Skyline to provide acquisition opportunities that fit each buyer’s unique business strategy. For instance, the Feil Organization used Skyline’s customized canvassing services to stay ahead of the competition and execute the purchase of 516-530 West 25th St. Skyline allowed the buyers to focus on purchasing an asset that met their acquisition criteria as opposed to waiting for the asset to become available on the open market, thereby bypassing the process of bidding on a property with an inflated price.

“Active buyers have constant deal flow. Skyline’s approach is to tailor-make the process so that they only see deals that match their acquisition criteria, rather than deals they have seen a dozen times before,” said Daniel Shirazi, EVP of investment sales at Skyline. “In the real estate business, time is money and Skyline gives its clients peace of mind that our deals will never be a waste of their time.” Most importantly, Skyline never sends out deals to clients unless they are in direct contact with the seller and have complete control of the deal.

Ground Leases

Khodadadian and his team have garnered significant attention guiding owners and tenants through the sophisticated yet lucrative process of ground leasing. A ground lease is a long-term net lease of land between an owner (ground lessor) and a tenant (ground lessee). Among other things, this arrangement allows property owners to maximize their asset’s potential without incurring the expenses associated with a conventional sale, such as capital gains tax.

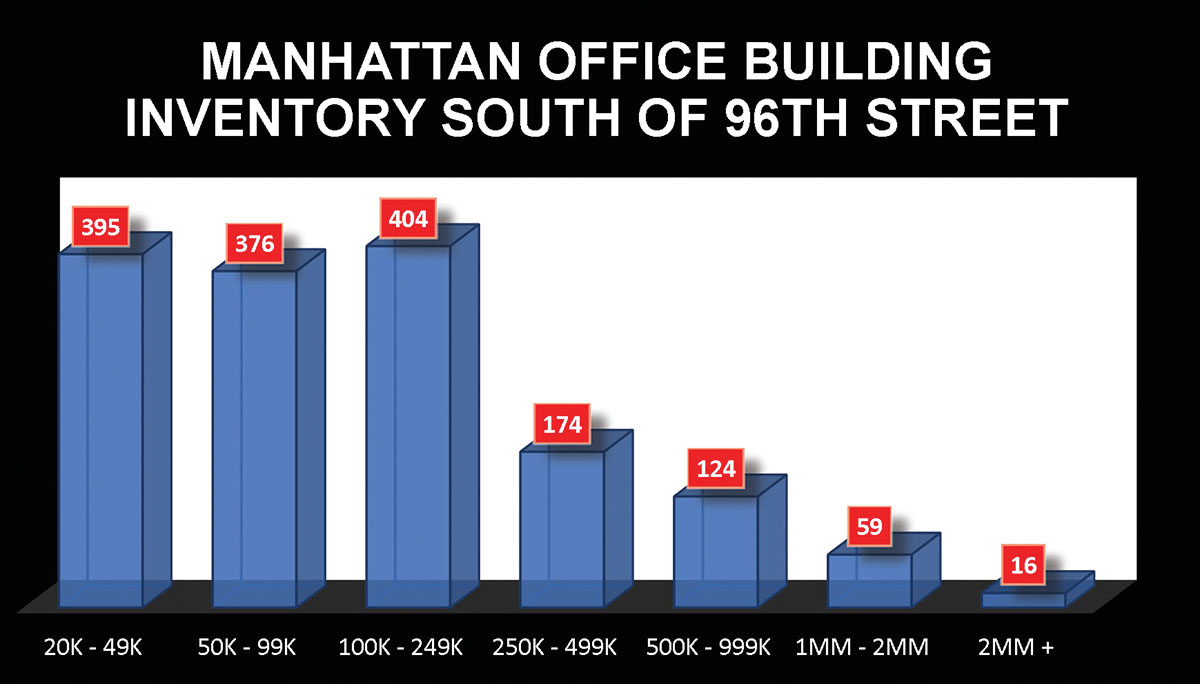

One example of a recent ground lease deal is 236 5th Ave., where the Kaufman Organization inked a long-term ground lease that gave them control of the 11-story 100,000 s/f office building. Kaufman plans to unlock the upside potential through capital improvements, with full knowledge that they now control an asset that is increasingly difficult to acquire. “An investor who’s looking to purchase an office property south of 96th St. should understand that there are only roughly 1,550 office buildings that are over 20,000 s/f, which means there is a finite amount of inventory,” said Khodadadian. “Ground leases have proven effective ways for investors to control a building that a multi-generational owner has no intention of selling.”

Meanwhile, ground leases allow long-time building owners to keep an asset in their family and maintain stable long-term cash flow for future generations. Due to the current state of the market, ground leases are becoming the most tax efficient way for these property owners to get a deal done.

Meanwhile, ground leases allow long-time building owners to keep an asset in their family and maintain stable long-term cash flow for future generations. Due to the current state of the market, ground leases are becoming the most tax efficient way for these property owners to get a deal done.

But most owners either don’t know anything about ground leasing or they’ve only heard part of the story, so Skyline created an informational website (Groundlease.nyc) to help educate them. Owners should understand that a ground lease is just like any other type of real estate transaction in that both sides of the table need to feel like they’re making a deal that works for them.

Ultimately, ground leases make the most sense for long term property owners who aren’t prepared to make the necessary capital improvements required to maximize their property’s upside potential. Someone who owns a plot of land, a property with significant air rights and doesn’t want or need to build, or someone who wants to ensure that their property remains in the family to produce generational income would also benefit from considering a ground lease. While structuring a ground lease is a complex process, Skyline has developed a niche expertise that in recent years has proven to be an attractive option for owners and investors alike.

As the real estate landscape changes, and the industry adapts to current market conditions, Skyline Properties is primed to keep developing creative brokerage techniques and to maintain its strong foothold in the New York City market.

Sign up is quick, easy, & FREE.

.png)