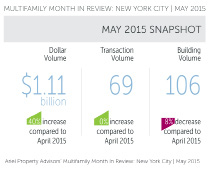

For the month, New York City saw 69 transactions comprised of 106 buildings totaling $1.115 billion in gross consideration. This represents a 62% increase in dollar volume, a 28% increase in transaction volume and a 4 percent increase in building volume compared to May 2014, which saw 54 transactions comprised of 102 buildings totaling $687.878 billion in gross consideration.

"The further we progress into 2015, the more momentum New York City's multifamily market seems to gain," said Shimon Shkury, president of Ariel Property Advisors. "From large institutional sales to smaller deals by private investors, supply simply can't keep up with demand and prices continue to appreciate."

The following is a breakdown of the May 2015 volume by submarket:

Manhattan - Manhattan spearheaded a strong month as the sub-market saw 21 buildings trade across 14 transactions totaling $400.212 million in gross consideration. Selling for the first time since the 1940s, a prime, 211-unit elevatored building at 362-372 2nd Avenue in Gramercy sold for $167.5 million, or just north of $900 per square foot. In the East Village, a rental building constructed in 1997 located at 223-237 East 6th Street sold for $60 million, or $654 per square foot.

Brooklyn - Brooklyn figures only slightly trailed Manhattan in May, as the borough saw 23 transactions consisting of 39 buildings totaling $364.080 million in gross consideration. The sub-market saw the city's largest transaction of the month in Williamsburg, as TIAA-CREF purchased 236 North 10th Street for $169 million, which equates to $699 per square foot. In Crown Heights, a 200-unit elevatored building at 805 Saint Marks Avenue exchanged hands for $44 million - double what the seller paid for the property in 2013.

Northern Manhattan - Although building volume was down 45 percent from last May, dollar volume in Northern Manhattan spiked 31% year-over-year as an increase in large single-asset transactions drove the market. In East Harlem, 1501 Lexington Avenue, a mixed use elevatored building located just one block north of the 96th Street subway station, sold for $92 million or $690 per square foot. Near City College, a package of buildings located at 580 St Nicholas Avenue and 106-108 Convent Avenue sold for $35 million, equating to $422 per square foot.

The Bronx - The Bronx had a solid month, with 18 buildings trading across 15 transactions totaling $126 million in gross consideration. Dollar volume was up 137% year-over-year, largely due to the sale of a 278-unit mixed use elevatored building located at 1749 Grand Concourse for $49.5 million or $117 per square foot. This same asset has traded three times since 2010, highlighting investors' growing appetite for the borough, especially around the Grand Concourse.

Queens - Queens had a typical month as the borough saw 11 buildings trade across 6 transactions totaling $49.2 million in gross consideration. Most of the month's dollar volume came from the $27.5 million sale of 43-31 45th Street, a 276-unit elevatored rental building located in Sunnyside Heights.

For the six months ended in May 2015, the average monthly transaction volume increased to 71 transactions per month. The average monthly dollar volume also increased to $1.162 billion.

*The multifamily transactions included in the analysis occurred at a minimum sales price of $1 million, with a minimum gross area of 5,000 square feet, and with a minimum of 10 units.

More information is available from Mr. Shkury at 212-544-9500, ext. 11, or [email protected]. For a copy of the report, please see http://arielpa.com/report/report-MFMIR-May-2015

Thanks for Reading!

You've read 1 of your 3 guest articles

Register and get instant unlimited access to all of our articles online.

Sign up is quick, easy, & FREE.

Subscription Options

Sign up is quick, easy, & FREE.

Already have an account? Login here