Which commercial real estate sector closed fastest on Long Island from 2010-2020? - by Ron Koenigsberg

Long Island’s commercial real estate market has seen many changes over the last decade. Changes include the emergence of urgent care centers and multifamily developments, to the shake up of brick-and-mortar retail due to the rise of ecommerce.

Long Island’s commercial real estate market has seen many changes over the last decade. Changes include the emergence of urgent care centers and multifamily developments, to the shake up of brick-and-mortar retail due to the rise of ecommerce.

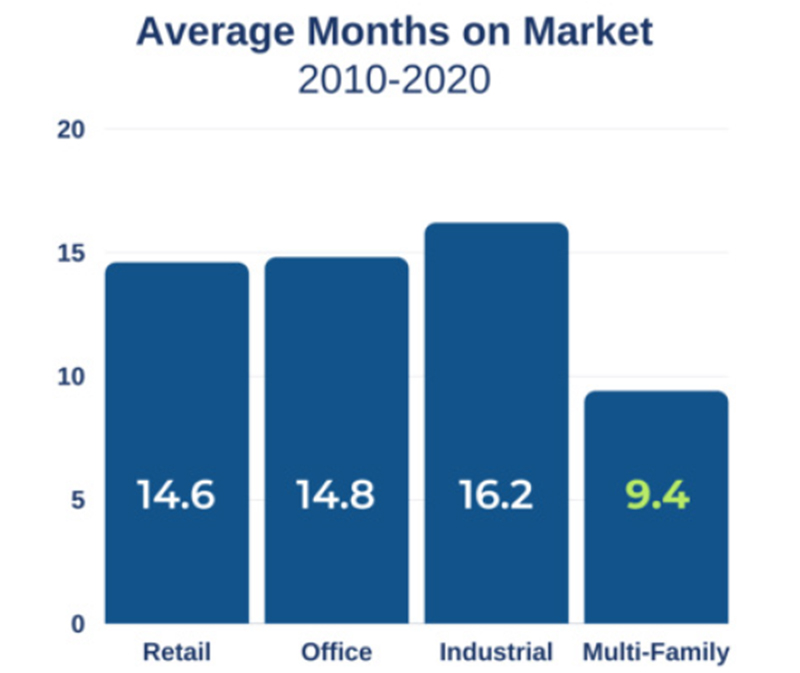

All these changes over the last 10 years incentivized our team to dig into the data. Our team wanted to see the average months on market for the retail, office, industrial, and multifamily sectors—particularly which sector performed the best.

In fact, our research was short. The multifamily sector was the clear leader in this performance criteria as the graph shows (right).

The question then became why.

Why are multifamily properties so attractive to investors over the other property types?

Here are some reasons multifamily properties tend to perform well on the market.

Why Multifamily Properties Are Attractive to Investors

Renewed Demand For Rental Housing

In 2014 and 2015, we reported on the mass exodus of 25-34 year olds with one reason being the lack of affordable and diverse housing. Long Island has a large population of around 8 million. It ranks 18th on the list of the most populated islands in the world.

But, the housing market had to change if Long Island wanted to remain competitive with other areas.

Over the years there were large multifamily developments, many transit-oriented and near commuter rails or ferries. Some developments include The Wel in Lindenhurst and Glen Cove developments such as The Beacon, Village Square, and many more throughout Long Island.

This focus on providing more rental housing on Long Island has attracted more investors to this asset type.

Insurance Companies are Familiar with Multifamily Policies

Other sectors such as retail, office, and industrial often need more underwriting and due diligence by insurance parties. These sectors tend to be seen as “more risky.”

It’s true that multifamily insurance policies can have their own complications. The higher the number of units and the amenities offered per unit, the more complicated the policies get.

But, most insurance companies tend to be well-versed in multifamily policies over other property types. This results in a more straightforward underwriting, and policy approval process on average.

Lenders & Financial Institutions View Multifamily as “Less Risky”

Large apartment buildings can cost more to purchase than a single-family home, and even some retail, office, or industrial properties. Yet, they are often quicker to be approved by a lender versus the traditional home and even some other asset types. Why?

Multifamily assets generate a strong cash flow every month and are viewed as “less risky.”

The risk of vacancies is minimal due to the constant need for living spaces, even during tough times. For example, in times of economic downturn, many people find themselves forced to sell their homes and move into rental housing. Oftentimes, it takes years for them to recover financially.

Due to the demand for multifamily, it is a less risky investment for a lending institution, and can also result in better interest rates for property owners.

Why Investors are Attracted to it

Insurance and financing aside, investors also see this asset class as a strong opportunity. Some benefits of investing in multifamily include:

A. Strong Monthly Cash Flow: Monthly rents are predictable. In strong markets and units with short term leases, units can be turned over and re-leased to ensure an increasing cash flow.

B. High Demand For Rental Housing: Millennials and even baby boomers are opting to rent. The rising median home prices put home ownership out of reach for many millennials. Millennials also value mobility and flexibility over the benefits of owning property.

Also, many baby boomers are drawn to renting because they can enjoy hassle-free, amenity-filled luxury living that appeals to the older demographic.

Other reasons multifamily investments are sought after are its tax benefits, scalability, high appreciation rates and much more.

Conclusion

Long Island is embracing multifamily investments more each year. Throughout the last decade there has been a major push to provide more rental housing, and that has proved beneficial for investment activity. This trend will likely continue due to the demand of this asset type, combined with the other positive insurance, financing, and investment factors.

Ron Koenigsberg is the president of American Investment Properties, Garden City, N.Y.

Suffolk County IDA supports expansion of A&Z Pharmaceuticals

The evolving relationship of environmental consultants and the lending community - by Chuck Merritt

When Environmental Site Assessments (ESA) were first part of commercial real estate risk management, it was the lenders driving this requirement. When a borrower wanted a loan on a property, banks would utilize a list of “Approved Consultants” to order the report on both refinances and purchases.

.gif)

.jpg)