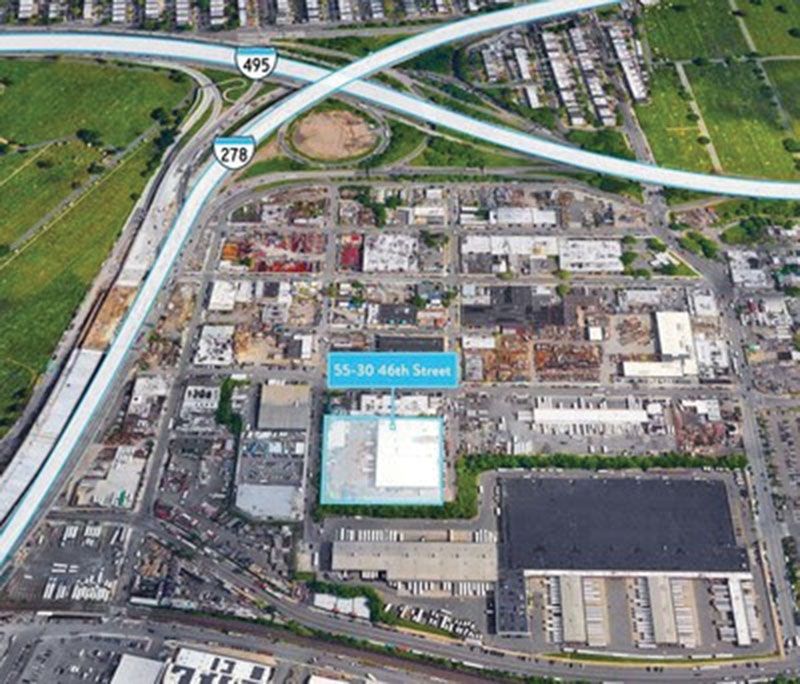

Walker & Dunlop arranges $57 million sale for 70,500 s/f industrial building in Queens

Queens, NY Walker & Dunlop, Inc. served as exclusive advisor in the $57.25 million sale of a 70,500 s/f, specialty industrial building. The facility and 2.9-acre parcel are situated in the Maspeth neighborhood, a sought-after location for last-mile distribution centers serving the New York market that provides exceptional ease of access to industrial tenants as well as national retailers.

The transaction represents the emerging trend of industrial parks being developed within high-barrier-to-entry urban infill locations. The need for such localized distribution facilities to serve as last-mile distribution centers has increased significantly, thanks to increased demand for e-commerce and shortened delivery windows.

The transaction represents the emerging trend of industrial parks being developed within high-barrier-to-entry urban infill locations. The need for such localized distribution facilities to serve as last-mile distribution centers has increased significantly, thanks to increased demand for e-commerce and shortened delivery windows.

Walker & Dunlop’s Mo Beler, led the transaction alongside Aaron Appel, Keith Kurland, Jonathan Schwartz, Adam Schwartz, Michael Diaz, and Taylor Geiger. The team worked with the owner, Gary Korn, of Wharton Equity Partners, to market the property and facilitate the disposition to EverWest Real Estate Investors, a Colorado-based investment fund. Throughout the sale process, Walker & Dunlop worked through complex transaction details, including managing tenant holdovers, collaborating with a variety of consultants, contractors, and third-party experts, as well as arranging a consolidated team of experts for the transaction.

Korn said, “Wharton has worked with Walker & Dunlop’s New York City Capital Markets team for some time, and we were thrilled with both the depth of their industrial expertise and the creativity they brought to this complicated transaction.”

The team helped us to unlock and realize the value of this unique asset and provided us with seamless execution every step of the way.”

Beler said, “We put our deep experience of raising equity in the industrial sector to work for our valued client, Mr. Korn. From the initial engagement, we made sure that we understood both the seller’s and buyers’ needs, resulting in a transaction that benefited all parties.”

Berger and Koicim of Marcus & Millichap sell 17-unit multi-family for $8.8 million

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Strategic pause - by Shallini Mehra and Chirag Doshi

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

.jpg)

.gif)