Navigating 1031 Exchanges in a rising interest rate environment - by Michael Packman

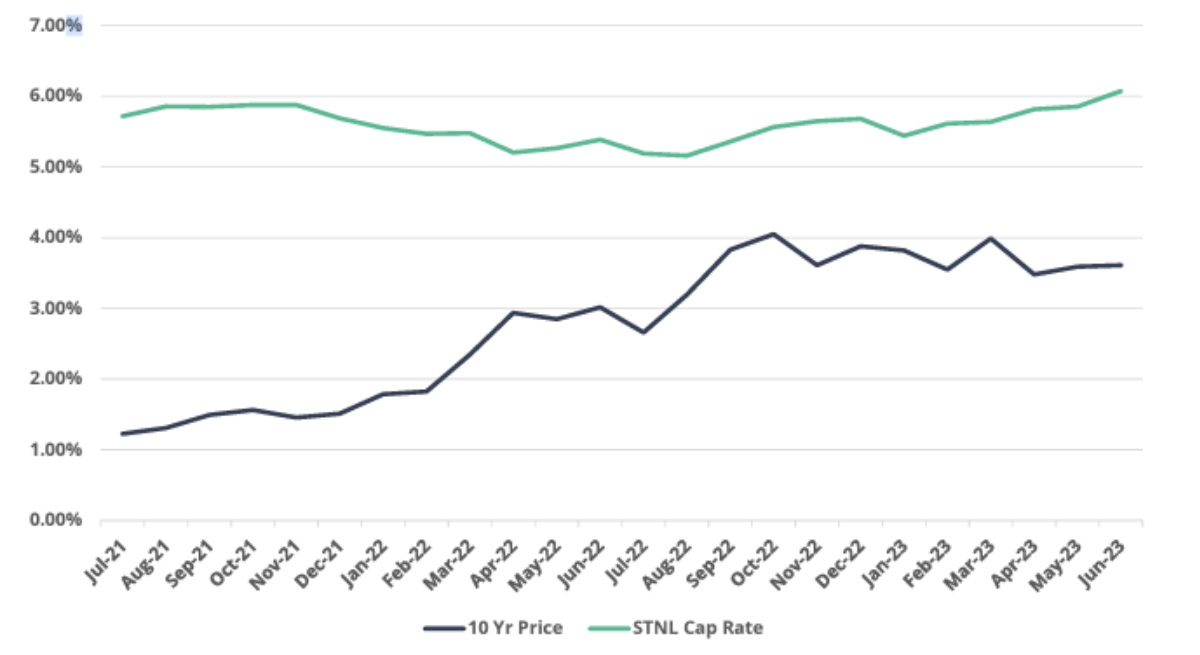

Prior to the July hike, the Fed held rates in June following increases of 25 basis points in February, March and May 2023, and 50 basis points in December 2022. These increases follow four consecutive increases of 75 basis points and increases of 50 basis points in May and 25 basis points in March 2022. Historically when interest rates have risen so have cap rates. However, in the current environment cap rate increases have not kept pace with interest rates, especially in the net lease sector. This has caused transaction volume to slow as the cost of debt has soared from just a year ago, driving leveraged cash flow returns down significantly.

1031 Exchange Challenges

When entering into a 1031 exchange, the IRS requires that you must exchange into a like-kind property of the same or greater value and replace the same percentage of equity and debt as is on the property you are relinquishing (or replace the difference in debt with additional equity). Given the current cost of debt, obtaining financing, or finding a suitable like-kind property at reasonable price point, may prove challenging. However, failing to consider replacement debt can result in triggering a capital gain and unexpected tax liabilities.

Equalizing Debt

When contemplating a 1031 Exchange, investors can innocently blow their exchange or fail to defer all their capital gains tax by not taking into consideration the amount of debt on their relinquished property. This principle is known as “equalizing debt.” It ensures that the investor maintains a similar financial commitment in their replacement property, preserving the tax-deferred nature of the exchange.

Tax Implications

If an investor’s liability decreases during the exchange, it is considered a capital gain by the IRS, just as if they received cash back. This taxable amount is commonly referred to as “boot.” Failing to account for the difference in debt between the relinquished and replacement properties can result in a taxable gain if additional equity is not used to replace the difference in debt.

In the scenario below, an investor sold a property for $1.5M and had $1M of mortgage debt on that property. The investor is securing a lesser amount of debt on the replacement property ($500K), potentially triggering a capital gain.

Example:

The Potential Consequence

Sale price: $1.5 million

Debt on relinquished property: $1 million (mortgage)

Debt on replacement property: $500,000 (mortgage)

Taxable gain: $500,000 (the difference between the two mortgages)

In this scenario, the investor would have a taxable gain of $500,000, which could significantly impact their tax liability and reduce the full tax deferral benefits offered through a 1031 Exchange. Today’s environment can be of benefit to cash buyers as they are not impacted by the increasing cost of debt or loan qualification requirements. Making an offer without financing risk may be more appealing to a seller, potentially giving cash buyers an opportunity to negotiate a lower purchase price.

However, if you do have debt to replace, the challenges of finding a suitable like-kind replacement property and reasonable financing terms make this a tricky environment for exchangers. Property owners purchasing investment real estate in a 1031 exchange may want to take steps to avoid a default on their purchase should their financing terms prove unreasonable or fall through altogether. One of the strategies investors may want to consider is to identify a Delaware Statutory Trust (DST) during their 45-day ID period. DSTs provide investors with the opportunity to invest in larger commercial properties, opening access to institutional-grade real estate that would otherwise be out of reach for many individual investors, many with non-recourse debt already in place.

- By identifying a DST with your QI, even as a back-up option, should you find yourself near the end of your ID period with no suitable like-kind property to purchase, you can invest the proceeds into the DST, defer the capital gain and potentially generate predictable income.

- Should you identify a property that is less than the amount you need to exchange, the leftover proceeds can be invested into a DST to defer capital gains and potentially generate predictable income versus paying taxes on the gain of the remaining amount.

- DST debt may have been acquired at lower interest rates, potentially providing attractive returns, a lower cost of debt, and depreciation.

DSTs may also help 1031 exchangers:

- Diversify their holdings geographically or by asset class.

- Stress less by eliminating the hassles of active property management.

- Generate passive income, as DSTs are professionally managed by the Trust.

- Defer their capital gains taxes on the sale of their appreciated investment property.

- Potentially reducing their tax liability on the income generated by investing in a DST with assets in states with lower or no state income tax.

- Invest in potentially recession-resilient asset classes, like net lease, self-storage, or senior housing.

Navigating the current environment can be challenging and no one knows when interest rates will reverse course. Understanding the regulations around a 1031 exchange, equalizing debt, and ensuring you have a back-up plan if your first choice of new purchase falls through, can help you complete your exchange within the defined timeline, and avoid an unexpected tax bill.

Keystone National Properties (including its subsidiaries and affiliates) does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Michael Packman is founder and CEO of Keystone National Properties (KNPRE), New York, N.Y.

Check out NYREJ's Developing Westchester Spotlight!

NYREJ’s Developing Westchester Spotlight is Out Now!

Explore our Developing Westchester Spotlight, featuring exclusive Q&As with leading commercial real estate professionals. Gain insight into the trends, challenges, and opportunities shaping New England’s commercial real estate landscape.

Oldies but goodies: The value of long-term ownership in rent-stabilized assets - by Shallini Mehra

The strategy of co-op busting in commercial real estate - by Robert Khodadadian

Properly serving a lien law Section 59 Demand - by Bret McCabe

.png)

.gif)

.jpg)

.gif)