News:

Spotlight Content

Posted: October 27, 2015

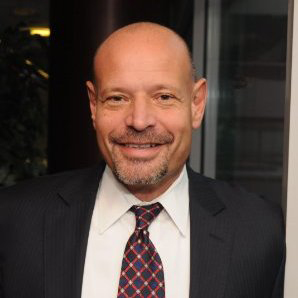

Executive of the Month: Smiles of The Matrix Realty Group: Having patience and perseverance is the key to success

Port Jefferson, NY The NYREJ recently sat down with Aaron Smiles, managing director of commercial leasing at The Matrix Realty Group, to talk about perseverance and success. Incorporated in 1993, The Matrix Group is a privately held real estate investment group and medical and information technology company headquartered on Long Island. The realty group’s diversified portfolio contains 3.2 million s/f of class A office buildings and 9,000 manufactured and multifamily residential units throughout the country.

Q: How and/or when did you get your start in the commercial real estate field?

A: It has been a long and thrilling ride. I started in residential real estate showing houses out on Long Island in a white Trans Am Pace car with an eagle decal on the hood. Needless to say, that portion of my career did not last long. The next logic step was commercial real estate. I started by showing land to residential developers. Then in 1991, the market went bust. I figured out that by partnering with a national auction firm and co-listing properties, I could make it. In two years, we sold at auction $50 million of unsold condominium units/single family homes/finished lots and commercial properties. Banks were our clients. The real estate market was basically frozen. This was a crazy time as some of these banks were also being shut down by the federal government. The RTC (Resolution Trust Corp.) was created. Towards the end of this debacle, I was at a meeting with a bank on a Friday at 3:00 p.m. and the FBI came in and seized the bank. I was led out the door along with bank executives.

During this time I had also sold a 12,000 s/f office building, in Centereach, Long Island - to The Matrix Realty Group. I had met Glen Nelson, CEO of Matrix, at the auction. We developed a working relationship and I began to sell him other commercial real estate buildings and started leasing office space for his company as an independent broker.

My trump card was having the foresight that the only game in town during those rough times was at auction. We would have 30 townhouses on the block and 400 people would show up for bidding. The hotel ball rooms were so packed that fire marshals showed up.

Q: What is the most rewarding part of now representing the Matrix Realty Group’s commercial real estate portfolio?

A: Since joining The Matrix Group, the commercial real estate portfolio has increased by 400%. We now own and manage 3.2 million s/f of class A office space throughout the country.

It is thrilling to see all the hard work of my colleagues come to fruition. Together we scour the country for turn around value added properties and then create energy on site by renovating these assets with infusion capital expenditures. We are also good at developing an urgency to lease up the space with the goal of ultimately re-selling these now signature buildings that have come to life again.

I also really enjoy lease negotiations with our blue chip tenants. It is very rewarding having the opportunity to deal with the business leaders of publically traded companies and privately held ones alike like such as Praxair, General Motors, Blue Cross/Blue Shield, UPS, HUPS, SCANA, AECOM, Paychex, Boehringer Ingelheim, US Sterling, Stiffel Nicholas, TransFirst to name a few.

First and foremost it is a people business. You have to build trust. It is also about the ability to negotiate favorably for both parties. This requires a willing and able owner that is reflective of current market conditions and a willing and able tenant that trusts you to deliver as promised.

I get to speak with people in all related professions and disciplines - from brokers, construction experts to architects. The ability to analyze a construction timeline and budget and then sell it to a potential tenant, along with ownership, is key. No one likes surprises.

I also try and stay on top of work space layouts trends. For example, hoteling, benching and touch down areas are popular today. Then there’s the IT world. That’s always changing and requires continual understanding of terms like, band width, demarcation, cat 6 cable, supplemental HVAC, back up systems, generators, fiber content, redundancy, optical drivers. The list goes on. And it is all really important that it works correctly and delivered on specification.

Tenants want you to be there before, during and after the lease is signed. I’m never completely out of the process – I always get called in for something. I like that. This way the relationships stay current. It makes my day when a tenant renews his lease with us.

Q: What are businesses/companies looking for today in all your corporate office buildings?

A: They are looking for aggressive value, rental incentives, and quality build-outs along with creativity and flexibility in space planning. Business owners examine a landlord’s track record. SF per employee is on the rise. It used to be four people per 1,000 s/f. Now it is not unusual to see eight to ten people per s/f. This may lead to new building codes as parking and HVAC for some existing buildings are not accommodated for these new densities.

Location is a prime factor along with building amenities. Blue chip tenants will not even look at a building if it doesn’t meet certain criteria on paper. These requirements can include on-site childcare, fitness center, cafeteria/coffee shop, restaurants, conference and banquet rooms, covered parking, owner management, security, concierge services, engineering staff, and a work-play environment.

Q: How has the current low interest rate environment impacted commercial real estate?

A: I tell this to everyone I meet in commercial real estate. Now is the best time ever to be involved in real estate. Whether you are a tenant looking to lock in a favorable rate, terms and/or concessions, or if you are buying a house or a or retirement home, buy now because the rates are low. Especially if you are a commercial real estate owner. We all know that there is no better time to buy like now.

Q: Has 2015 been a good year for The Matrix Realty Group?

A: 2015 has been a record year for us. In Hauppauge/Islandia, we signed 31 new leases in 24 months plus 17 renewals. Acquisitions hit a high with the addition of 500,000 s/f trophy class A office campus in Birmingham, AL. Norwalk, CT is now at 50% occupancy with several RFP’s being finalized now. This will bring occupancy to 110%. Look for a full lease up in our recently renovated building within the next couple of months. With the general upturn in the economy, Matrix is well positioned for the next phase of growth.

Q: What is it like getting to work with top management of a billion dollar real estate company that started with absolutely no money and organically grew without the help of investors or partners?

A: It is a privilege being a direct report to Matrix CEO Glen Nelson. Glen takes pride in the fact Matrix has grown due to the sincere and genuine way of doing business the old school way - with a handshake. This philosophy has allowed us to work with the largest Wall Street banks and leading bond credit rating agencies. We are proud to say most of our deals are always one of the largest and usually in the top three securitization pools.

It is hard to believe that what started out as a 12,000 s/f acquisition has blossomed into a 3.2 million s/f of commercial real estate, and an over twenty year relationship.

Working with our top flight team – Leroy Diggs, Gerard McCreight, Patrick Gilchrist, Anthony Prussen, Mike Brown and Vin Grillo to name a few – has also incentivized me. Glen’s ability to calculate risk, execute and perform at all levels of acquisition, disposition, mitigating expenses, and maximizing revenue is truly inspirational. I love being a part of a one of a kind, thriving, honest and honorable entrepreneurial company looking to grow to a 10 billion dollar mark.

Q: What kind of advice would you give to someone just starting out?

A: Having patience and perseverance is the key. Don’t ever give up. Half the job is to show up on time, look and act professional, and know your product. Don’t take rejection personally. I’ll never forget the day before I came up to see Matrix Corporate Center in Danbury. I was raking leaves for extra holiday money as the real estate market was that bad. The next day Glen took me to see the property. During the next two years I was able to lease 240,000 s/f of new leases in the worst real estate market since the Great Depression. Reach out to people. Ask questions. Call me.

Tags:

Spotlight Content

MORE FROM Spotlight Content

Over half of Long Island towns vote to exceed the tax cap - Here’s how owners can respond - by Brad and Sean Cronin

When New York permanently adopted the 2% property tax cap more than a decade ago, many owners hoped it would finally end the relentless climb in tax bills. But in the last couple of years, that “cap” has started to look more like a speed bump. Property owners are seeing taxes increase even when an

Quick Hits

Columns and Thought Leadership

Properly serving a lien law Section 59 Demand - by Bret McCabe

Many attorneys operating within the construction space are familiar with the provisions of New York Lien Law, which allow for the discharge of a Mechanic’s Lien in the event the lienor does not commence an action to enforce following the service of a “Section 59 Demand”.

The strategy of co-op busting in commercial real estate - by Robert Khodadadian

In New York City’s competitive real estate market, particularly in prime neighborhoods like Midtown Manhattan, investors are constantly seeking new ways to unlock property value. One such strategy — often overlooked but

How much power does the NYC mayor really have over real estate policy? - by Ron Cohen

The mayor of New York City holds significant influence over real estate policy — but not absolute legislative power. Here’s how it breaks down:

Formal Legislative Role

• Limited direct lawmaking power: The NYC Council is the primary

Oldies but goodies: The value of long-term ownership in rent-stabilized assets - by Shallini Mehra

Active investors seeking rent-stabilized properties often gravitate toward buildings that have been held under long-term ownership — and for good reasons. These properties tend to be well-maintained, both physically and operationally, offering a level of stability

.png)

.gif)

.jpg)

.gif)