Executive interview with Shimon Shkury, president of Ariel Property Advisors

New York, NY NYREJ recently sat down with Shimon Shkury, founder and president of Ariel Property Advisors, a New York City investment real estate services and advisory company, who shared key highlights from his firm’s newly released, “Multifamily Year in Review New York City: 2015.”

Q: How did the multifamily market perform in 2015?

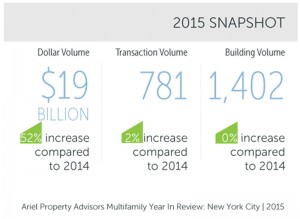

A: The multifamily market continued its upwards trajectory, especially in terms of dollar volume. For 2015, New York City saw $19 billion in total dollar volume, an increase of 52% compared to 2014. Transaction volume and building volume stayed relatively flat when compared to 2014, which indicates the strength of pricing seen citywide.

Q: What contributed to the big gains in 2015?

A: Led by the $5.45 billion sale of Stuyvesant Town – Peter Cooper Village, institutional caliber transactions played a prominent role in 2015 multifamily sales activity.

Core Manhattan has traditionally dominated the majority of the city’s large, institutional-sized deals. This trend was reversed in 2015 as 24 out of 46 transactions over $50 million traded outside of core Manhattan, compared to only 18 out of 44 deals in 2014. Even at the very top of the market, 10 out of 21 deals over $100 million took place outside of core Manhattan.

Examples include Related Companies’ purchase of the Fortress Bronx Portfolio, which consisted of 20 buildings encompassing 739 total units throughout the Bronx, for $112.5 million. In Brooklyn, a six-story waterfront property located at 184 Kent Ave. was sold to Kushner Cos.for $275 million. Queens saw its share of institutional portfolio trades with the Algin Management Co. Flushing portfolio at the helm, a five building package comprising 611 units, which was purchased by Treetop for $139 million.

Q: What pricing trends are you seeing?

A: Some have speculated that multifamily prices began softening over the second half of the year, but our research shows that while Manhattan pricing remained relatively stable compared to 2014, the outer-boroughs experienced modest increases across all fronts. Gains were strongest in the Bronx, where the average price per s/f increased 32% year-over-year, jumping from $121 per s/f to $160 per s/f. Another sign of rising prices is seen by the fact that the median transaction price increased in every submarket, year-over-year. Brooklyn saw the greatest percentage change - 16.7% – as its median price swelled from $4.775 million to $5.575 million. Many buildings last sold between 2012-2014 also traded in 2015 for significantly higher prices.

Q: How did the submarkets perform in 2015?

A: For Manhattan, 2015 can be characterized as a year of stability for multifamily assets. Pricing was slightly up across most metrics, especially the average gross rent multiple that rose to 19.95 from 18.27. Similar drivers that pushed activity in 2014, like the borough’s perceived ‘safe haven’ status among international investors and the continued appetite for multifamily properties suitable for condominium conversion, continued to play a prominent role. The most transactional areas were the Upper East Side, which saw 31 multifamily transactions totaling $500 million in gross consideration, and the Lower Manhattan neighborhoods of the East Village, Lower East Side and Chinatown, which together saw 40 transactions totaling $891 million.

Brooklyn dollar volume flourished in 2015, increasing an impressive 54% year-over-year and 196% compared to 2013. Due to a growing number of institutional transactions, 68% of the borough’s 2015 dollar volume stemmed from deals over $20 million, compared to 54% in 2014. In Williamsburg alone, there were 3 deals priced over $90 million in 2015.

Although Northern Manhattan saw a decrease in activity from 2014, dollar volume increased as pricing trended upwards in 2015. The submarket had a notable amount of re-sales occur in 2015, as many owners who originally purchased properties in recent years took advantage of a hot market. Northern Manhattan’s largest transaction, a 24-building portfolio spread across Washington Heights and Harlem, underscored this trend, selling for $148.5 million in 2015 after the sellers originally purchased the portfolio for $75 million in 2013.

Attracting new investors and developers looking to take advantage of the borough’s relatively high-yielding multifamily offerings, the Bronx posted the strongest pricing gains of any city submarket. Capitalization rates fell by 57 basis points and the average gross rent multiple increased from 8.29 in 2014 to 9.95 in 2015.

Similar to Brooklyn, Queens, saw an increase in the number of large deals in 2015. The borough experienced five sales over $50 million, whereas only three trades eclipsed the same figure in 2014. Flushing, a neighborhood that usually takes a back seat to the northwest neighborhoods of Astoria and Long Island City, had a very strong year and had the top two multifamily sales in 2015.

Q: What do you see on the horizon for the multifamily market this year?

A: While the global economic outlook got off to a shaky start, we believe 2016 will continue to be a very active year for multifamily sales and financing.

Changes in the financing environment have added a level uncertainty that wasn’t as present in recent years.

Similar to what we witnessed in 2012 when people rushed to beat out the sunset of the Bush tax cuts, it’s possible that we will see more real estate transactions as owners seek to lock in today’s low cap rates and low interest rates. Demand will remain strong as buyers continue to seek the cash flow and relative long-term safety that New York multifamily assets uniquely offer investors.

Q: Where can we get a copy of this report?

A: Ariel Property Advisors’ “Multifamily Year in Review - New York City: 2015” and all of our research reports are available on our website at http://arielpa.nyc/investor-relations/research-reports.

Shimon Shkury is the founder and president of Ariel Property Advisors, New York, N.Y.

Delisle and Monahan of Island Associates lease 45,000 s/f to Giunta’s Meat Farms at Strathmore Commons

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Strategic pause - by Shallini Mehra and Chirag Doshi

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

.jpg)

.gif)