Company of the month: Gebroe-Hammer Associates earns top spot as leading multifamily investment brokerage firm

Livingston, NJ Gebroe-Hammer Associates has boosted its standing as the region’s top multifamily investment firm by kicking off the first two months of 2017 with more than 1,700 units sold, signaling multifamily’s enduring reign as the commercial real estate investment asset of choice. In total, the firm’s market specialists arranged over $376 million in sales that extended from Northern New Jersey’s densely populated municipalities and Central/South Jersey’s bedroom communities to Philadelphia.

At the end of last year, Gebroe-Hammer’s brokerage professionals closed 132 deals involving 12,117 units, totaling over $1.83 billion.

“Gebroe-Hammer’s transaction volume indicates multifamily remains the optimum commercial real estate investment – a title held pre-recession, at the peak of the downturn and in these post-recessionary times, which says a lot about the staying power of apartment buildings,” said Ken Uranowitz, president and an industry veteran who has been with Gebroe-Hammer since its inception 41 years ago.

While there may be some uncertainty about potentially rising interest rates and concerns the U.S. economy is due for a recession sooner rather than later, one generally accepted principle is that the health of multifamily investments and tenant demand are showing no signs of slowing down. Absorption is healthy and prospective homebuyers are not expected to abandon apartment living anytime soon, particularly within the densely populated, transit-rich hubs along the Northeast corridor.

“Across the region, the apartment sector is continuing its favorable run in terms of rent gains and occupancy rates,” said Uranowitz, who noted today’s multifamily construction activity is a throwback to the boom years of the late 1990s. In the Garden State alone, development levels during these past three years have not been seen since 1999.

“Remarkably, New Jersey’s recent construction boom hasn’t had any ill effects on existing properties – from newly developed class A+ to 1970s-era class B buildings, particularly those that have undergone recent value-add capital improvements,” he said. “Spanning all class categories, these properties have peacefully coexisted and even fortified the tenant pipeline in a positive way by offering a full spectrum of rent affordability that won’t break the bank accounts of millennials, empty-nesters/retirees or hard-working families.”

This persistent pursuit of high-quality, appreciating multifamily properties among investors is relentless, as indicated by two recent North Jersey sales closed within a one-week span. Combined, the late-January transactions totaled $230 million and 1,002 units. They involved Cedar Wright Gardens, located at 77 Mary St. in Lodi (Bergen County), and Nob Hill Apartments, accessible from Eisenhower Parkway at 28 Nob Hill Rd., in Roseland (Essex County).

Known for their high visibility and distinguished presence within two of the most-densely populated counties – Bergen and Essex –in the greater New York MSA, Cedar Wright Gardens and Nob Hill are poised for value-add repositioning under new ownership. Both appeal to the region’s professional and executive-level tenant base associated with their strategic location. The transit-based commuter hubs are near retail, dining and lifestyle conveniences.

Post-Suburban/Transit Village Lifestyle Drives Multifamily Investment

“The economic recovery has fed residential demand for a more post-suburban/transit village lifestyle where there is an emphasis on neighborhood walk and transit scores,” said Uranowitz. “The children of Baby Boomers are trading in their parents’ dream of a suburban, single-family home for an urban, semi-urban or bedroom community apartment that offers better affordability and frees them of the burdens of homeownership.”

Today’s preference for apartment living has prompted many municipalities to rethink past zoning requirements and adjust master plans to incorporate residential living near downtown shopping districts and train stations. This strategy has proven effective in retaining and attracting residents seeking an easy commute and walkable, urban-like lifestyle.

Two urban hubs in which trading was extremely active during the past 12 months are East Orange/Essex County and Greater Hudson County. In total, Gebroe-Hammer’s brokerage teams closed sales of $133.02 million/1,656 units and $106.51 million/747 units in each respective multifamily hotbed.

Bergen and Passaic Counties also rival Hudson County for the state’s highest concentration of multifamily sales involving existing low-, mid- and hi-rise complexes and garden-apartment communities. In the high-barrier-to-entry Bergen/Passaic submarkets, Gebroe-Hammer’s teams recorded sales of $165.44 million/723 units.

Within Central Jersey’s Middlesex, Somerset, Monmouth and Ocean County submarkets, Gebroe-Hammer closed an astounding $889.12 million in sales encompassing 5,151 units. Some of the year’s largest transactions in these submarkets involved a sprawling apartment-home community comprised of more than 640 one- and two-bedroom layouts in Somerset; a portfolio of 1,226 units in the Woodbridge area; and a 1,142-unit garden-style community in Piscataway.

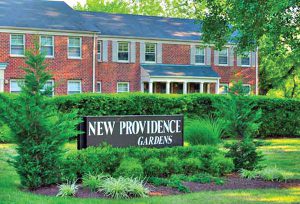

In nearby New Providence, on the northwestern edge of Union County, Gebroe-Hammer Associates kicked off and closed out last year with two prominent sales. These involved the trade of 171 units at Murray Hill Apartments for $47 million in Q1’16 as well 232 units sold for $55 million at New Providence Apartments and Gardens in Q4’16. Overall, the firm’s $242.15 million in Union County sales totaled 1,134 units.

Multifamily Feeds Private Investment

According to Uranowitz, there is heightened collaboration between local officials and private owners to reposition dated class B and C properties and redevelop underutilized or vacant properties within or near town centers. “This philosophical shift has proven extremely effective in attracting private investment and drawing and retaining residents,” he said. “Apartment buildings, both traditionally and historically, have always been recession proof, which is the leading reason why these neighborhoods are undergoing revitalization with multifamily as the catalyst.”

One example of this collaborative approach to redevelopment is the neighborhood in which Cedar Wright Gardens is located. The 31-acre property is on the border of Lodi, adjacent to an extensive redevelopment in Wood-Ridge associated with the opening of a new rail station–Wesmont Station, which launched operations in May 2016. As the former home to the Curtiss Wright airplane factory, the land tract now features newly constructed mixed-use buildings, including luxury residential housing units; high-end retail shops; first-class offices; and dining establishments.

Original builders and decades-long owners, who never considered selling in the past, are taking advantage of extremely heated demand for multifamily product. The two separate sellers of Cedar Wright Gardens and Nob Hill acquired their properties in 1952 and as the original developer/owner in 1978, respectively. Both complexes were long-time, prominent multifamily fixtures within their highly sought-after neighborhoods.

“As industry ‘veterans,’ they know from past experience that this is a cyclical business and the curtain may be coming down soon on sub 4% interest rates, thus decompressing cap rates and moderating values,” said Uranowitz. “Bidding on existing for-sale properties is becoming even more competitive and aggressive as investors seek class B capital improvement opportunities that offer long-term rent appreciation and a greater return on investment.”

While the supply curve of for-sale product continues to dip downward, demand is soaring at a time when rent growth is attainable soon after the deal closes. Many newly acquired properties are undergoing renovations that include moderate-to-high-end kitchen and bath finishes as well as community space upgrades, from laundry facilities to the addition of fitness centers, playgrounds and dog parks.

According to Uranowitz, asking rents will continue to climb over the course of 2017 and the coming year. “In turn, valuations should mirror this trend, notwithstanding an eventual interest-rate hike,” he said. “Much like the last interest-rate hike, we will have to take a ‘wait-and-see approach’ to how it will impact the multifamily industry as a whole.”

Gebroe-Hammer is one of the most active multifamily investment sales brokerage firms in the entire New Jersey/Pennsylvania/New York State region. As the trusted brokerage advisor to private owners, REITS, private equity firms and other institutional investors, the firm concentrates on suburban and urban high-rise and garden-apartment properties throughout the Northeast and nationally. Gebroe-Hammer also markets mixed-use and free-standing office and retail properties. Widely recognized for its consistent sales performance, the firm is a 12-time CoStar Power Broker.

Meridian Capital Group arranges 10-year retail lease for Mess at 236 West 10th St.

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Strategic pause - by Shallini Mehra and Chirag Doshi

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

.jpg)

.gif)