BHI provides $41 million refinance loan to Lam Group for hotel Aloft by Marriott New York Brooklyn

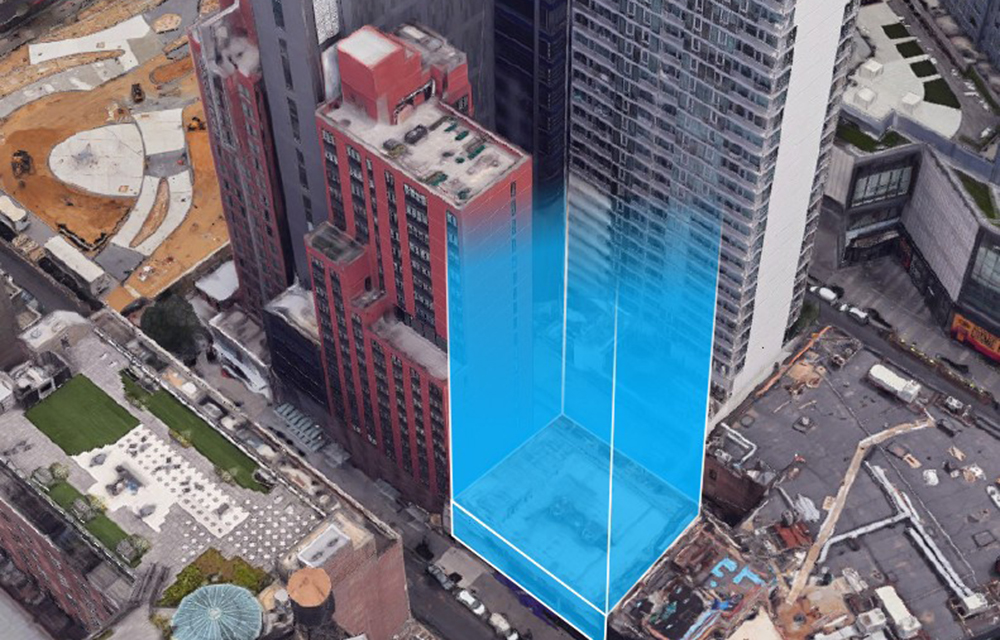

Brooklyn, NY BHI, the U.S division of Bank Hapoalim, provided a $41 million term loan to the Lam Group to refinance a 24-story, 176 room hotel located at 216 Duffield St., known as Aloft by Marriott New York Brooklyn.

Lam Group was founded by the Lam family in the 1970s and is headed by CEO and chairman, John Lam. Lam is originally an immigrant from Hong Kong who created a name for himself as a successful entrepreneur and New York City hotelier.

Lam Group has partnered with leading hotel companies including Marriott, InterContinental, Hilton, Virgin, and Wyndham. The majority of these hotels are located in Manhattan, with developments built in neighborhoods including SoHo, Chelsea, Midtown and Downtown Brooklyn.

The prolific hotel developer and operator has actively managed and operated Aloft Brooklyn since its completion in 2011.

“The Lam Group have proven to be attentive operators who have an impressive track record of crafting and maintaining modern offerings that resonate with consumers,” said Mimi Vu, senior vice president, team leader and head of CRE loan origination East region at BHI. “We were impressed with not only their expansive portfolio across Manhattan, Brooklyn and other NYC markets, but more importantly, the resolve they collectively displayed while navigating their properties through one of the most complex and challenging macro environments of the last century and coming out strong on the other side.”

“The thorough diligence that a financial partner like BHI brings to the table helps validate the direction of our group’s overall vision,” said Lam. “We appreciate their partnership as we continue maximizing our capacity to deliver exceptional hospitality experiences across the NYC market.”

Craftsman Ave relocates to 3,300 s/f at Industry City

Strategic pause - by Shallini Mehra and Chirag Doshi

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

.jpg)

.gif)

.gif)