News:

Brokerage

Posted: May 24, 2016

Ariel Property Advisors releases Multifamily Month in Review: March 2016

New York, NY Recording the highest number of sales and greatest total dollar volume so far in 2016, March multifamily sales helped drive strong 1Q 2016 figures, according to Ariel Property Advisors’ newly released Multifamily Month in Review: March 2016. The report showed a significant improvement from lagging February sales activity and showed modest appreciation across several pricing metrics.

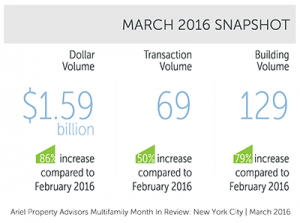

In March, New York City saw 69 transactions comprised of 129 buildings totaling $1.597 billion in gross consideration. This represents a 50% increase in transaction volume, a 79% increase in building volume and an 86% increase in dollar volume compared to February, which saw 46 transactions comprised of 72 buildings totaling $860.882 million in gross consideration. Year-over-year, March’s figures represent a 25% decline in transaction volume and a 13% dip in dollar volume.

“March’s numbers reflect a more positive shift heading into the second quarter. This reaffirms our position that New York City multifamily market is poised to continue a positive trajectory in 2016,” said Shimon Shkury, president of Ariel Property Advisors.

Manhattan saw 14 multifamily transactions consisting of 19 buildings for $786.305 million in gross consideration. The month’s largest transaction was a pair of mixed-use buildings at 1347 & 1191 2nd Avenue on the Upper East Side. Totaling $310 million, the transaction represented $832 per square foot over $900,000 per unit. Madison Realty Capital expanded its portfolio with the purchase of 160 East 48th Street, a 300-unit mixed-use building for $270 million purchase, or $907 per square foot.

The Bronx led the city in transaction and building volume in March, with 63 buildings trading across 23 transactions both of which more than tripled February’s output. The borough’s building volume was boosted significantly by one 34-building portfolio trade. At 2691 Reservoir Avenue, an elevatored mixed-use building in Kingsbridge, for $17.35 million, or $315 per square foot. For the last six months, the average multifamily price per foot in The Bronx was $173, compared to $138 in the same period a year ago.

Brooklyn had 18 trades across 25 buildings and $353.297 million in gross consideration over the course of the month. In Williamsburg, 237-261 North 9th street surpassed $1,100 per square foot, with a total price of just under $80 million. The borough’s largest trade also came out of Williamsburg with the sale of two back-to-back new construction buildings at 246 North 8th Street and 255 North 7th Street for $125 million.

Northern Manhattan was relatively flat after two months of strong gains to start the year. The largest trade of the month was the West 141st Street Elevatored Portfolio, a 144-unit package which sold for $42.1 million. In Washington Heights, another elevatored building at 854 West 80th Street sold for $16.8 million, or $361 per square foot.

Queens had a light month, with only 5 transactions occurring across 6 buildings totaling $38.345 million in gross consideration. Though heavily retail-driven, a mixed-use building at 159-01 Northern Boulevard in Murray Hill changed hands for $13.75 million, or $643 per square foot.

For the six months ended in March 2016, the average monthly transaction volume increased slightly to 57 transactions per month, but remains notably down on a year-over-year basis. The average monthly dollar volume dropped slightly to $1.965 billion.

To review the report, please click here: http://arielpa.com/report/report-MFMIR-Mar-2016

New York, NY Recording the highest number of sales and greatest total dollar volume so far in 2016, March multifamily sales helped drive strong 1Q 2016 figures, according to Ariel Property Advisors’ newly released Multifamily Month in Review: March 2016. The report showed a significant improvement from lagging February sales activity and showed modest appreciation across several pricing metrics.

In March, New York City saw 69 transactions comprised of 129 buildings totaling $1.597 billion in gross consideration. This represents a 50% increase in transaction volume, a 79% increase in building volume and an 86% increase in dollar volume compared to February, which saw 46 transactions comprised of 72 buildings totaling $860.882 million in gross consideration. Year-over-year, March’s figures represent a 25% decline in transaction volume and a 13% dip in dollar volume.

“March’s numbers reflect a more positive shift heading into the second quarter. This reaffirms our position that New York City multifamily market is poised to continue a positive trajectory in 2016,” said Shimon Shkury, president of Ariel Property Advisors.

Manhattan saw 14 multifamily transactions consisting of 19 buildings for $786.305 million in gross consideration. The month’s largest transaction was a pair of mixed-use buildings at 1347 & 1191 2nd Avenue on the Upper East Side. Totaling $310 million, the transaction represented $832 per square foot over $900,000 per unit. Madison Realty Capital expanded its portfolio with the purchase of 160 East 48th Street, a 300-unit mixed-use building for $270 million purchase, or $907 per square foot.

The Bronx led the city in transaction and building volume in March, with 63 buildings trading across 23 transactions both of which more than tripled February’s output. The borough’s building volume was boosted significantly by one 34-building portfolio trade. At 2691 Reservoir Avenue, an elevatored mixed-use building in Kingsbridge, for $17.35 million, or $315 per square foot. For the last six months, the average multifamily price per foot in The Bronx was $173, compared to $138 in the same period a year ago.

Brooklyn had 18 trades across 25 buildings and $353.297 million in gross consideration over the course of the month. In Williamsburg, 237-261 North 9th street surpassed $1,100 per square foot, with a total price of just under $80 million. The borough’s largest trade also came out of Williamsburg with the sale of two back-to-back new construction buildings at 246 North 8th Street and 255 North 7th Street for $125 million.

Northern Manhattan was relatively flat after two months of strong gains to start the year. The largest trade of the month was the West 141st Street Elevatored Portfolio, a 144-unit package which sold for $42.1 million. In Washington Heights, another elevatored building at 854 West 80th Street sold for $16.8 million, or $361 per square foot.

Queens had a light month, with only 5 transactions occurring across 6 buildings totaling $38.345 million in gross consideration. Though heavily retail-driven, a mixed-use building at 159-01 Northern Boulevard in Murray Hill changed hands for $13.75 million, or $643 per square foot.

For the six months ended in March 2016, the average monthly transaction volume increased slightly to 57 transactions per month, but remains notably down on a year-over-year basis. The average monthly dollar volume dropped slightly to $1.965 billion.

To review the report, please click here: http://arielpa.com/report/report-MFMIR-Mar-2016

Tags:

Brokerage

MORE FROM Brokerage

Hanna Commercial Real Estate brokers Agri-Plastics 64,000 s/f manufacturing facility lease at Uniland’s 2 Steelworkers Way

Lackawanna, NY Agri-Plastics, a global leader in the manufacturing of plastic products for agricultural, industrial, recreational, environmental, and home industries, has signed a 64,000 s/f lease to open a

Quick Hits

Columns and Thought Leadership

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

The state has the authority to seize all or part of privately owned commercial real estate for public use by the power of eminent domain. Although the state is constitutionally required to provide just compensation to the property owner, it frequently fails to account

Strategic pause - by Shallini Mehra and Chirag Doshi

Many investors are in a period of strategic pause as New York City’s mayoral race approaches. A major inflection point came with the Democratic primary victory of Zohran Mamdani, a staunch tenant advocate, with a progressive housing platform which supports rent freezes for rent

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Last month Bisnow scheduled the New York AI & Technology cocktail event on commercial real estate, moderated by Tal Kerret, president, Silverstein Properties, and including tech officers from Rudin Management, Silverstein Properties, structural engineering company Thornton Tomasetti and the founder of Overlay Capital Build,

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Let’s be real: if you’re still only posting photos of properties, you’re missing out. Reels, Stories, and Shorts are where attention lives, and in commercial real estate, attention is currency.

.jpg)

.gif)

.gif)