The Wizard of OZ (that’s “Opportunity Zones”) Part 2 of OZ vs. 1031: Required holding periods - by Dan Flanigan

Polsinelli

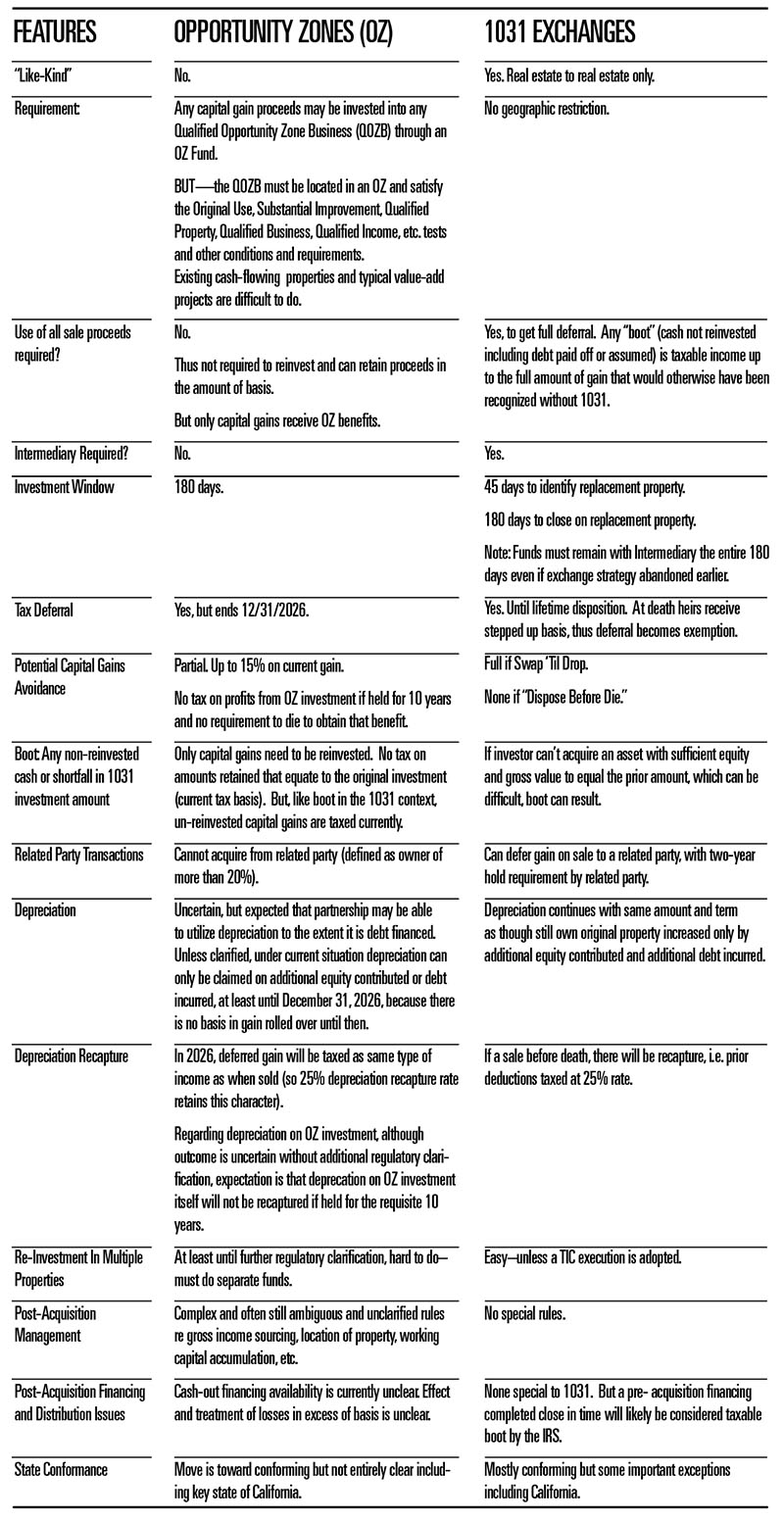

Required Holding Periods

There is no defined holding period requirement for the property acquired in a 1031 exchange, although the IRS has taken the position that a disposition shortly after the 1031 could invalidate the 1031 transaction because the replacement property is not considered to be held for investment or for use in a trade or business.

To obtain even the minimum benefits of the 15% OZ1 exemption and full deferral period, you have to hold until December 31, 2026, a long time in the investment world, even in the real estate investment world. To obtain the really valuable OZ benefit, the exemption from tax on the additional gain, you must hold for more than ten years from the date of the investment. Of course, as discussed in Part 1, to obtain the step-up under 1031 you have to die, which, with a little luck, will take even longer than 10 years.

Limitation on Range of

Investments and Operation of Properties

To obtain OZ benefits you must invest in property in an Opportunity Zone and then only if you satisfy, among other tests, conditions, and requirements, the original use or substantial improvement test.

In 1031, the whole range of commercial real estate everywhere in the U.S. is open to you including triple net leased properties, which may be disqualified “bad assets” under the OZ program (though subject to possible taxpayer-friendly clarification in the next round of OZ Treasury regulations).

But in OZ you don’t have to invest in real estate. Assuming you can deal with what are, at best, currently ambiguous (again, pending possible clarification by Treasury in the next round), and, at worst, very restrictive continuing qualifications conditions, you can invest in an operating business—for example, in a tech business (Steve Jobs, here I come!).

Uncertain Regulatory Environment

While there are uncertainties at the margins in the 1031 world, the rules are basically established, and the investor is not skating on regulatory thin ice. OZ, however, is, to mix metaphors (something I seem to be addicted to), somewhat of a dark maze easy to get lost in, or worse yet, a “fun house” with possible unpleasant surprises popping out at you at every turn. It took some time, some case law, and some mistakes (as determined by the IRS or the courts with unfailingly accurate 20-20 hindsight) made by taxpayers to their financial detriment, for the 1031 program to achieve the clarity and stability it enjoys today. A similar journey, maybe even a more difficult one, may await OZ investors.

Risk Of Future Tax Changes

How easily we might forget that the real estate world was shaken to its core by serious proposals at the time of the 2017 tax act to eliminate 1031, and, in fact, owners of personal property lost the like-kind exchange privilege in that very legislation. I would venture that 1031 is more vulnerable to legislative extermination than OZ (which at least promises some broader social good in a very specific way rather than a general lifting of the boats).

But both are somewhat dependent on the existence of the concept of a capital gain and favorable tax treatment upon disposition of a capital asset compared to receipt of ordinary income. And guess who said this recently:

“The big fortunes, if your goal is to go after those, you have to take the capital gains tax, which is far lower at like 20%, and increase that.”

Hint: Not Alexandria Ocasio-Cortes. Additional hint: The second richest person in the world. Yes, Bill Gates.

An increase of the tax on capital gains, say to match ordinary income rates, would make mockery of the deferral benefit under the OZ program and would hurt the 1031 players forced to dispose of their property before they plunge into the literal “end” zone. While optimists will likely be justified in betting that the “Swap ‘til you Drop” 1031 play and the 10-year deferral would be preserved in that situation, one can conceive of many other Internal Revenue Code modifications that could vitiate or at least substantially dilute the benefits of either or both strategies.

Which leads to the conclusion, as everyone seems to be saying (but are they doing?): Make damn sure the investment is good absent the tax benefits.

Once again, thanks to the real wizards, my tax partners, Bill Sanders, Jeff Goldman, and Pat O’Bryan, for their help with this article.

1 As usual with these columns, this column assumes readers’ knowledge of the basic OZ statutory provisions; for a summary of the basic provisions, see Polsinelli.com/intelligence/oz-ppt.

Dan Flanigan is managing partner of the New York Office of Polsinelli, an AmLaw 100 firm with offices in 22 major U.S. cities.

Flanigan and Polsinelli have provided the above material for informational purposes only. The material provided is general and not intended to be legal advice. Nothing in the material should be relied upon or used without consulting a lawyer to consider your specific circumstances, possible changes to applicable laws, rules and regulations and other legal issues. Receipt of this material does not establish an attorney-client relationship.

AmTrustRE completes $211m acquisition of 260 Madison Ave.

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

.jpg)

.gif)