Will you owe capital gains tax? Consider these strategies - by Michael Packman

If you are a property owner who is selling or has sold an investment or commercial property, you probably owe or will owe capital gains taxes. The U.S. tax code allows for options that may reduce or defer your tax liability by reinvesting your gains into real estate. Those investments provide options for active or passive property management and offer the ability to diversify your real estate investment holdings geographically and by asset class. Below are several of the most common strategies.

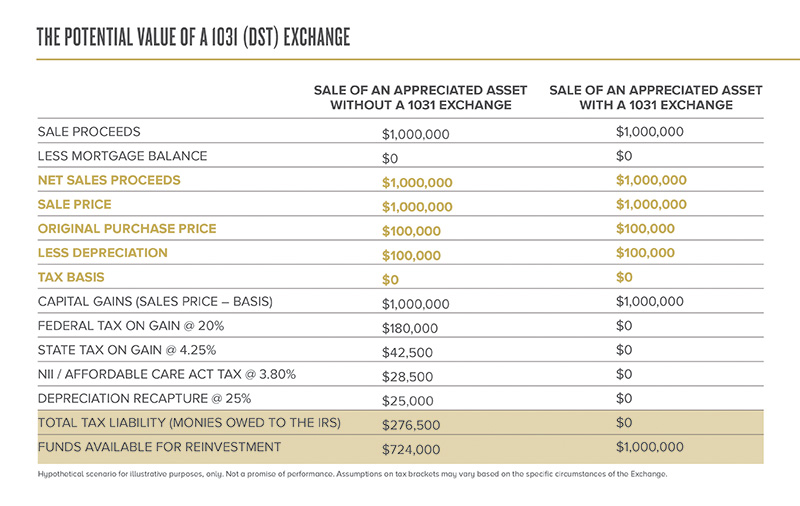

1031 Exchanges

For those that seek active property management, the IRS offers deferral of capital gains taxes when the proceeds from the sale of an investment or commercial property is “exchanged” for a like-kind property of equal or lesser value within specific time limits. Commonly referred to as a 1031 exchange, this strategy can be used to defer capital gains tax until a later date in the future, and there is no limit to the number of exchanges an individual can complete. (IRS Section 1031) For example, using the proceeds from the sale of your office building to purchase a like kind property such as multifamily, industrial, storage, land, etc. provides an opportunity to take advantage of changes in real estate trends.

DST Offerings

Others may want to continue investing in real estate but do not want the hassle of tenants, toilets, and trash. In that case, a Delaware Statutory Trust offering, more commonly known as a DST, may be for you. A DST offering can be any type of commercial or investment property—apartments, retail space, office buildings, industrial parks, land, etc.—where investors pool their money together in an investment fund. You become a passive investor but still reap the rewards of investing in real estate by receiving regular cash flow and/or capital appreciation. Investors can also choose to make investments in clean energy programs like solar or wind. In addition, you can allocate funds across asset types and invest in real estate in high-growth or high-appreciation areas.

Opportunity Zones

When the Congress passed the Tax Cuts and Jobs Act in December of 2017, a new section of the Tax Code was created which resulted in the creation of Opportunity Zones across the United States. An Opportunity Zone is a community that has been designated by the state and certified by the IRS to stimulate economic activity in certain selected areas across the country. Roughly 8,700 areas in all 50 states have been designated. Opportunity Zone investments allow investors to defer capital gains taxes until 2026. After that date, their tax liability on the original capital gains event will be due, however, if they have made the investment in the fund prior to December 31st, 2021, the amount is reduced by 10%. The biggest advantage is that if the investment is held in an Opportunity Zone Fund for 10 years or more, there is the potential to not owe federal taxes on profits earned in the Fund.

If you dig deep enough, the U.S. tax code does offer opportunities to reduce both income and capital gains taxes, and based on your situation, there may be one or more strategies that are suitable. It is important to consult your accountant and other advisors to fully understand the impact to your unique situation and determine if any of these sections of the tax code may be beneficial to you. Understanding how to offset some of your tax liability can potentially provide you with additional funds to deploy to further your business or personal goals.

Michael Packman is the founder and CEO of Keystone National Properties, LLC (KNPRE), New York, N.Y.

AmTrustRE completes $211m acquisition of 260 Madison Ave.

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Strategic pause - by Shallini Mehra and Chirag Doshi

.jpg)

.gif)