Thrive Buildings complete a case study on a New York City university

A New York City university sought to minimize energy consumption in its most energy-intensive spaces on campus to comply with the regulatory requirements of Local Law 97 (LL97). After a comprehensive assessment of the university's portfolio, Thrive Buildings identified a building with a large potential for energy reduction. Next, Thrive formulated a project specifically tailored to curtail energy usage within the laboratories while capitalizing on the utility rebates available in the NYC market.

Thrive's assessment of the entire lab building pinpointed the areas most conducive to airflow optimization. Additionally, recent expansions had amplified lab square footage, posing challenges in maintaining adequate exhaust cfm levels in various sections of the building.

To address these concerns, Thrive introduced Aircuity’s multi-parameter, centralized demand control ventilation platform, which was installed in 114 lab spaces. Thrive managed the entire project, overseeing the design, installation, and initiation of the solution, while also handling the rebate application process. The local utility company's robust rebate program covered 70% of the project costs, further enhancing its financial feasibility.

RESULTS

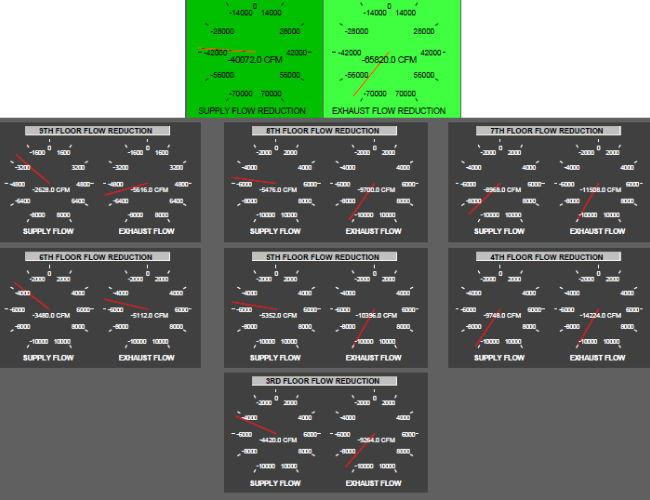

Incorporating a Niagara Control System atop the Siemens building management system, the site team achieved room-level optimization and furnished airflow and energy dashboarding. This initiative resulted in a substantial reduction in carbon emissions, effectively aligning the building with LL97 targets until 2030.

The implementation of Aircuity's system led to a reduction in overall cfm by 60,000, eliminating the need for any mechanical upgrades, despite the increase in lab square footage. This comprehensive approach not only facilitated compliance with regulatory standards but also showcased effective lab energy and Scope 1 carbon reduction practices, positioning the university on a sustainable trajectory for the future.

Hanna Commercial Real Estate brokers Agri-Plastics 64,000 s/f manufacturing facility lease at Uniland’s 2 Steelworkers Way

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

.jpg)

.gif)

.gif)