There are few things more valuable than good advice, but good advice for long-time real estate owner-operators can be hard to find. Professionals are incentivized to give a certain kind of advice: a long-time accountant or property service professional might lose the account if the owner sells. On the other hand, brokers, attorneys, title professionals, appraisers and others may only be hired when there is a sale. Long-time owner-operators of investment property understand why it is important to sell one day. Unless they have an organization or family that can continue managing the property skillfully many years into the future, there could be danger ahead. As long as the capable first or second generation owners have the time, energy, and resources to make the important decisions, the property can continue doing well. But when someone without the interest, experience, or availability takes over all bets are off, especially when the transition is combined with challenges in the economy or at the property. Inheritors of property often sell for significant discounts to potential value because of these factors.

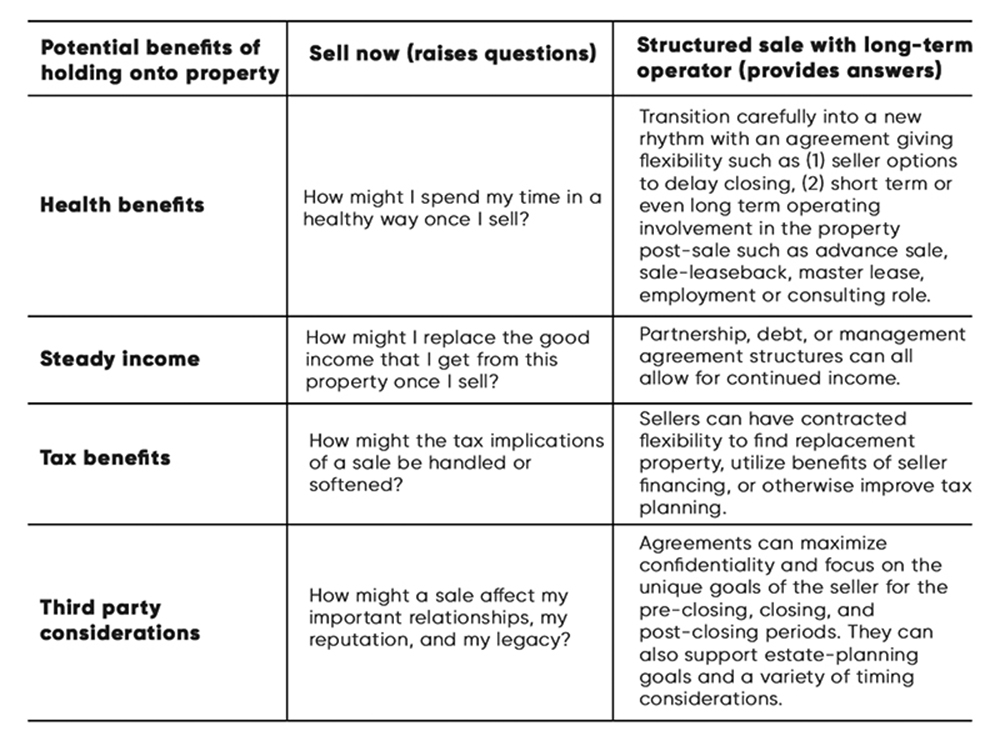

But this might not be the best time to sell investment property because there are many benefits to holding on to the property that has done well over many years. The prospect of selling commercial real estate raises questions for an owner and good planning involves finding answers to those questions.

Below are four questions we see long-time property owners asking when they are contemplating a sale in the coming years. We thought it would be helpful to share some of the considerations involved in successful sales we have been a part of.

1. How might I spend my time in a healthy way once I sell?

Operating property, like operating any small business, can be all-consuming. Tenants, suppliers, staff, service providers, inspectors, bankers, and others all ask for time and attention. From our experience, it is true that “anything you own, owns a piece of you.” But managing property can also be a good vehicle for growth and contribution–under the right conditions, working can keep a person vibrant and strong. An owner interested in spending his or her time differently in the coming years might need to start planting the seeds already in order to re-orient towards a new hobby, geography, venture, or group of acquaintances.

2. How might I replace the good income that I get from this property once I sell?

Long-time owners might have a sense of the income they need available to live comfortably and the cushion that would help them feel successful or secure. Depending on their financial picture, they might have differing appetites for certain kinds of risks and returns in stocks, bonds, or more active investments. There are many options for turning capital into a stream of income, but which are the ones that are the right fit for the owner?

3. How might the tax implications of a sale be handled or softened?

Taxes are a critical piece of the puzzle because they can significantly impact the cash flows owners can expect as well as the legacy they plan to leave behind. Figuring out the tax picture the owner faces and the various ways to soften the tax impact, especially through various timing considerations, is an important part of good advice for long-time owners.

4. How might a sale affect my important relationships, my reputation, and my legacy?

Holding onto assets allows owners to keep a low profile regarding gains (and sometimes losses), with the tax authorities and friends, family, and community members usually unaware of changes in the person’s financial situation. A sale can result in a variety of changes, financial and otherwise, with information (and perceptions) affecting a seller’s life from that point onward. Owners often think through how these issues can be mitigated in a sale or avoided altogether, especially when their legacy and estate-planning is implicated.

Daniel and Sam Pessar are principals at Elite Management Holdings, LLC, Hackensack, N.J.