The waiting game - by Michael Packman

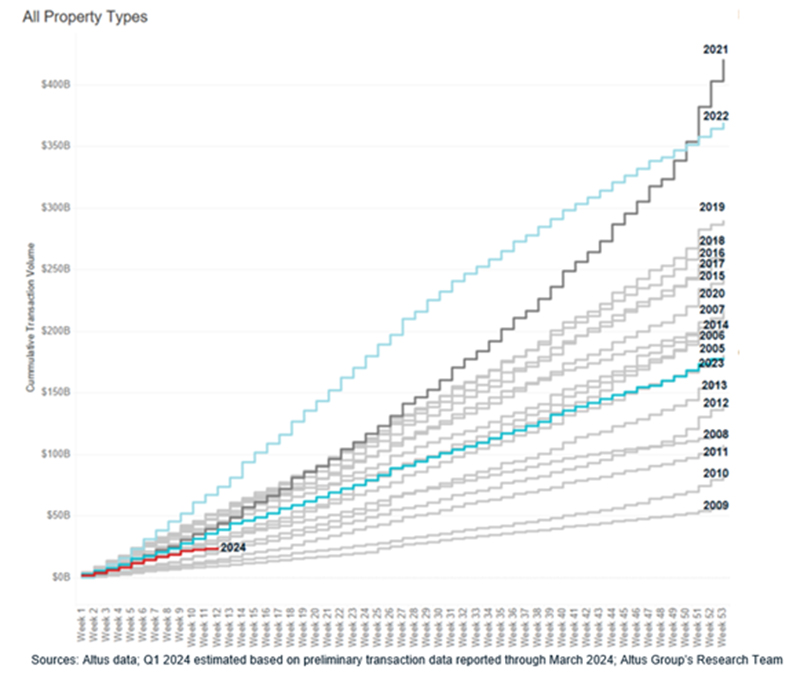

Real estate investors have been waiting for the Fed to start easing rates. Data shows that most commercial real estate transactions closing right now are mostly comprised of distressed sales. Reasons for this include loan maturities, tenants not renewing their leases, ongoing out of business, as well as the owner just having a need for liquidity. According to the Altus Group, transaction volume for 2024Q1 is down by more than 20% as compared to the same period in 2023. Looking at historic trends, we have not seen transaction volume this slow since 2013.

In prior articles, I have discussed that there is a spread in cap rate expectations between buyers and sellers; and that still is the case. Investors we talk to that have cash to invest are looking for opportunistic buys and if they cannot negotiate a decent price will walk away. Until interest rates come down, sellers that are not distressed are going to hold out if they can maximize their profits.

The Need for Positive Leverage

In 2022, the 10-year treasury rate closed over 4.0% for the first time since 2010; and the average 10-year rate over the last 20 years is approximately 2.97%.

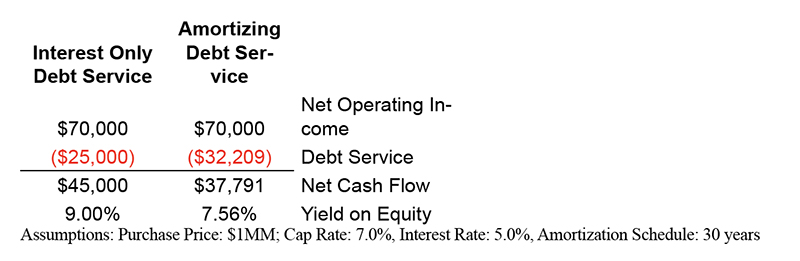

As a result, most investors have been able to use positive leverage in their transactions for quite some time and potentially increase their yield. Simply put positive leverage is a situation where the interest rate on the debt is less than cap rate, creating the potential for additional current cash flow. The sample positive leverage scenario below shows the potential benefit to investors.

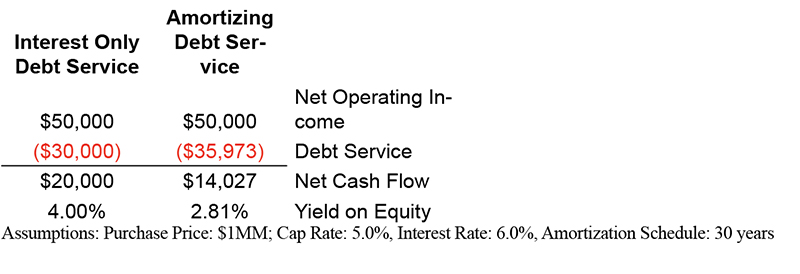

The availability of positive leverage, even at modest levels, has allowed investors to increase the cash yield on their equity as well as their overall total returns. Without positive leverage, the opposite is true:

The bottom line is that positive leverage has become a critical component for real estate investors that utilize debt. Therefore, either cap rates will have to come up, or interest rates must come down for non-distressed transaction volume to pick back up.

Economic Mixed Bag

Most investors prefer the idea of lower interest rates to higher cap rates. As a result, real estate investors watch the Fed’s moves closely. Most analysts anticipate rate cuts in 2024; the question is: when, and how much.

The analysis of all the metrics used by the Fed to determine policy is outside the scope of this article, but at a rate of 2.7% for the 12 months ending March 2024 is broadly in line with expectations. While it is up from 2.5% through February and is closer to the 2.0% Fed target than it was this time last year, the rate of decline in inflation has slowed significantly. Consumer spending remains strong. Data suggests that personal savings rates are going down slightly as consumers continue to spend even though prices continue to rise. The Fed can see these as a positive sign for the economy overall and not “rush” into lowering rates.

The analysis of all the metrics used by the Fed to determine policy is outside the scope of this article, but at a rate of 2.7% for the 12 months ending March 2024 is broadly in line with expectations. While it is up from 2.5% through February and is closer to the 2.0% Fed target than it was this time last year, the rate of decline in inflation has slowed significantly. Consumer spending remains strong. Data suggests that personal savings rates are going down slightly as consumers continue to spend even though prices continue to rise. The Fed can see these as a positive sign for the economy overall and not “rush” into lowering rates.

On the other side, GDP measured an annualized rate of 1.6% for 2024Q1 and well below analysts’ expectation of 2.2%, and the 2023Q4 rate of 3.4%. A lthough it appears that the economy is slowing down, one of the factors that contributed to the lower GDP is a sharp increase in imports over 2023Q4. It will be interesting to see how consumer spending and imports affect GPD next quarter. If overall numbers continue to soften, even slightly, it might be a good sign for lower rates.

lthough it appears that the economy is slowing down, one of the factors that contributed to the lower GDP is a sharp increase in imports over 2023Q4. It will be interesting to see how consumer spending and imports affect GPD next quarter. If overall numbers continue to soften, even slightly, it might be a good sign for lower rates.

Getting Back to Real Estate – Plan ahead

Most real estate investors want lower interest rates, but not to the detriment of the economy. Fortunately, it looks like the economy is doing ok; but that will not help interest rates come down quickly. Analysts still anticipate rate decreases in the second half of 2024 which should cause transaction volume to increase, even if only slightly.

Patient investors have a long-term view, as discussed previously. If you are an investor in a 1031 exchange, be mindful of your loan maturity dates. If you have a loan maturity date in the next 12 months, start looking at your options now. If you have cash on the sidelines, deleveraging may be an option to reduce your debt costs and not be forced to sell. In the case where an asset could be sold at an acceptable profit, start looking at what opportunities are out there that you can take advantage of when you sell.

Keystone National Properties (including its subsidiaries and affiliates) and Keystone Real Estate Investments LLC (including its subsidiaries and affiliates) do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Michael Packman is founder and CEO of Keystone National Properties (KNPRE), New York, N.Y.

Over half of Long Island towns vote to exceed the tax cap - Here’s how owners can respond - by Brad and Sean Cronin

Oldies but goodies: The value of long-term ownership in rent-stabilized assets - by Shallini Mehra

The strategy of co-op busting in commercial real estate - by Robert Khodadadian

Properly serving a lien law Section 59 Demand - by Bret McCabe

.png)

.jpg)

.gif)