The search for high quality commercial real estate in a low cap rate environment - by Michael Packman

Residential real estate is relatively simple to analyze and determine if asking prices are reasonable. With commercial real estate though, it is not quite as simple – especially in a hot real estate market. There are several characteristics and market conditions that can impact the potential return of a commercial property and the ability to assess its current and projected value.

Residential real estate is relatively simple to analyze and determine if asking prices are reasonable. With commercial real estate though, it is not quite as simple – especially in a hot real estate market. There are several characteristics and market conditions that can impact the potential return of a commercial property and the ability to assess its current and projected value.

One way to determine a property’s market value and potential return is by understanding its capitalization or “cap” rate. Cap rates are calculated by dividing net operating income (NOI) by the property price. Net operating income includes all rental income minus operating expenses such as taxes, insurance, and utilities. For example, if a commercial property is expected to generate $3M of NOI and its purchase price is $50M, the property has a 6.0% cap rate – meaning the property is likely to pay for itself at a rate of 6.0% per year.

Cap rates and property pricing have an inverse relationship, meaning when cap rates are lower, prices tend to be higher and when cap rates are higher, prices tend to be lower. Therefore, in a low cap rate environment, like the one we are experiencing now, the search for quality commercial real estate that will generate an attractive cash flow can be daunting.

Cap rates and property pricing have an inverse relationship, meaning when cap rates are lower, prices tend to be higher and when cap rates are higher, prices tend to be lower. Therefore, in a low cap rate environment, like the one we are experiencing now, the search for quality commercial real estate that will generate an attractive cash flow can be daunting.

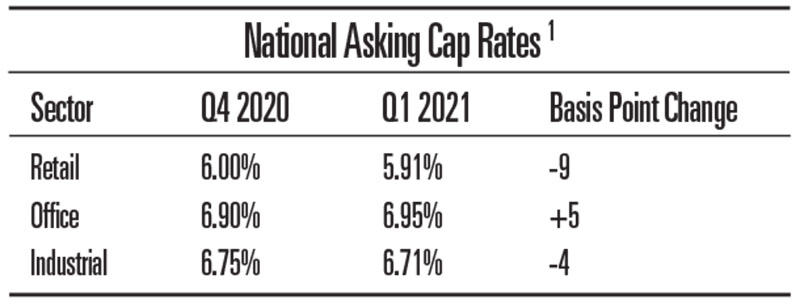

Cap Rate Compression

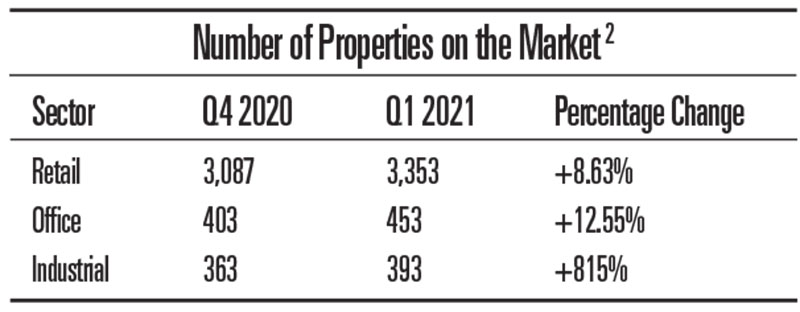

The market is experiencing a significant compression in cap rates for high quality assets. This has led to owners of lower-quality investments, who are seeking to take advantage of the demand, to bring their properties to market. While this has caused an increase to the overall supply of properties, it has not changed the competition that exists for the high-quality assets.

In the first quarter of 2021, cap rates for essential business-related tenants like 7-Eleven (NNN), CVS (NNN), and McDonald’s (NNN) fell to 4.90%, 5.00%, and 4.00%3 respectively for assets that were recently constructed. This reflects the demand for essential retail amid the uncertainty surrounding the future demands of a post-COVID workforce.

The Search for Value

Industry data tells me that the net lease sector should remain active throughout this year – with essential businesses with high quality tenants being the most sought-after properties to obtain for 1031 exchanges.4 However as I mentioned earlier, a limited supply of high-quality assets creates significant competition and adds pressure on cap rates, despite the rise in the 10-year Treasury yield.5 As interest rates rise due to the accelerating progress of COVID vaccine distribution, a new round of Federal stimulus dollars, and anticipation of some type of normalcy resuming, the net lease sector is anticipated to continue performing – especially if interest rates continue rising due to economic growth expectations rather than inflation.

So, when searching for a property for your 1031 portfolio, how do you find the right NNN in a low-cap rate environment?

- Reset Your Timeline Expectations: With NNN properties sold almost before they hit the market, you will want to reset your acquisition timeline to account for a longer search process.

- Reassess Your Criteria: If you are searching for a property in northeast, just because you are located there, broaden your search to include other areas of the country. Keep in mind, at the end of the day, you are buying a property, not just the tenant or the cash flow. Remember the golden rule in real estate, location, location, location, even if that great location is on the other side of the country from where you reside.

- Expand Your Network: Previously, you may have worked with one or two commercial brokers, expand your team to increase your visibility into the market within your search area.

- Be Patient: It may take longer than we are used to, but the right property is out there.

The search for the “right” property for your 1031 exchange may take longer in the current environment but great assets are out there. Resetting your expectations, expanding your network, reevaluating your investment criteria, and keeping a watchful eye on interest rates will help you navigate the current “hot” commercial real estate market.

1 https://www.bouldergroup.com/media/pdf/2021-Q1-Net-Lease-Research-Report.pdf

2 https://www.bouldergroup.com/media/pdf/2021-Q1-Net-Lease-Research-Report.pdf

3 https://www.bouldergroup.com/media/pdf/2021-Q1-Net-Lease-Research-Report.pdf

4 https://www.globest.com/2021/04/02/net-lease-cap-rates-hit-historic-lows/

5 https://www.cnbc.com/2021/03/23/us-10-year-treasury-yields-could-move-higher-to-2percent-fidelity.html

Michael Packman is the founder and CEO of Keystone National Properties, LLC (KNPRE), New York, N.Y.

Keystone National Properties, LLC. Information herein has been obtained from third party sources. We have not verified the information and we make no guarantee, warranty, or representation about it. This information is provided for general illustrative purposes and not for any specific recommendation or purpose nor under any circumstances shall any of the above information be deemed legal advice or counsel. Reliance on this information is at the risk of the reader and Keystone National Properties, LLC expressly disclaims any liability arising from the use of such information.

AmTrustRE completes $211m acquisition of 260 Madison Ave.

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Strategic pause - by Shallini Mehra and Chirag Doshi

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

.jpg)

.gif)