The Corbin Group at Rosewood Realty sells three building portfolio in bankruptcy

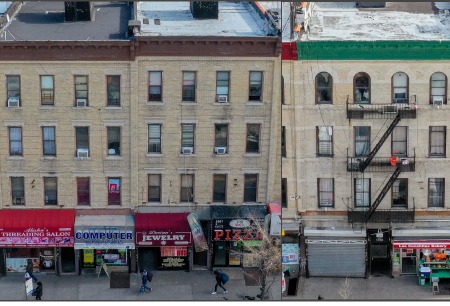

Brooklyn, NY Rosewood Realty has arranged the $5.4 million sale of a three-building mixed-use bankruptcy portfolio on the busy retail corridor of 5th Ave. in Sunset Park.

The four-story buildings at 4811, 5505, 5507 Fifth Ave. were sold under a plan of reorganization at $292 a s/f, by Rosewood's Greg Corbin and Chaya Milworn who represented both sides of the transaction.

The three buildings total 18,500 s/f and include 18 residential units and six retail stores. All of the residential units are two bedroom and are rent stabilized. The buildings were built in 1931.

Rosewood was retained by the lender to run the bankruptcy auction during the height of the pandemic. "This was challenging given that retailers were closed at that period of time," said Milworn. "The world was changing at a fast pace and buyers were very cautious."

"We found a local investor who had the foresight to sign a contract during such uncertain times, realizing property values would bounce as the world returned to normal," said Corbin. "There were a large number of violations on the properties but the purchaser is prepared to do the heavy lifting in order to maximize the value of the buildings. They are solid bricks in a strong location, and when cleaned up and stabilized will make for a great purchase.”

This area is a hotbed for investment in recent years for both public and private funding, with Sunset Park experiencing significant investment activity. The properties are surrounded by local mom and pop stores and national retailers.

It is blocks away from the N & R Subway lines and 36 minutes to Grand Central and 10 minutes from Industry City, a six million s/f, 36-acre waterfront development.

AmTrustRE completes $211m acquisition of 260 Madison Ave.

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Strategic pause - by Shallini Mehra and Chirag Doshi

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

.jpg)

.gif)