Short-term rentals are big competition for hotels, upstart industry reaching limits of urban expansion - by Mark VanStekelenburg

Short-term rentals are now big competition for hotels, but the upstart industry is reaching the limits of urban expansion. At 16.8%, New York City is among markets with highest penetration of short-term rentals.

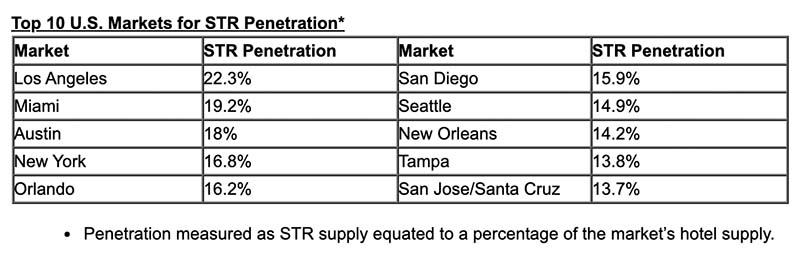

The short-term rental industry will expand to roughly 650,000 actively rented units in the U.S. this year, equal to 12.2% of U.S. hotel-room supply, as the fast-growing sector further expands in suburban, rural and resort markets, according to a new report from CBRE. New York City was the second largest short-term rental market in the U.S. in 2019, having grown 1.8% from its 2018 total.

CBRE’s analysis of data on short-term rentals shows that the industry’s growth rate overall is beginning to cool off to an expected year-over-year increase of 19% this year, down from 26% in 2019 and 39% in 2018. Part of that is the effect of growing from an increasingly larger base. Another factor, however, is that some short-term rental growth has shifted outside of big urban markets that are at or near saturation.

Short-term rentals typically are houses, condos and unoccupied apartments offered for nightly rent on distribution platforms such as AirBNB or Expedia Group’s VRBO and HomeAway. Many units are listed on multiple platforms, but not all units are available year-round.

Short-term rentals are now a $115 billion a year industry having penetrated many of the top cities in the U.S. While the influx of new short-term rentals may have slowed during 2019, New York City, one of the world’s top tourist and business destinations, is continuing to experience growth in this segment. As a result, traditional hotel valuations without consideration to the short-term rental market are no longer appropriate. We are working closely with our hotel clients to stay on top of the changes affecting their assets.

CBRE calculates that a market reaches saturation, on average, when its STR supply matches 10% to 20% of its hotel-room supply. Select markets with substantial tourist draws, like Los Angeles and Miami, can sustain ratios in the high teens and 20s. Of the 30 largest U.S. hotel markets, 14 have short-term rental ratios of 10 percent or more with New York City at 16.8%.

The short-term rental industry has a direct impact on hotels, though short-term rentals are just one of many factors that can affect hotel rates and occupancies. High penetration of short-term rentals in a market tends to limit the ability of hotels in that market to raise rates, since more short-term rentals come online during periods of high demand and low vacancy when hotel rates typically rise. Hampering rate increases directly affects a hotel’s profitability. These factors, in turn, can contribute to deterring hotel construction in a given market.

Mark VanStekelenburg is the managing director of CBRE’s Hotels Northeast Practice, Manhattan, N.Y.

Over half of Long Island towns vote to exceed the tax cap - Here’s how owners can respond - by Brad and Sean Cronin

How much power does the NYC mayor really have over real estate policy? - by Ron Cohen

The strategy of co-op busting in commercial real estate - by Robert Khodadadian

Properly serving a lien law Section 59 Demand - by Bret McCabe

.png)

.gif)

.jpg)

.gif)