Shkury of Ariel Property Advisors shares highlights from 3rd quarter market report

NYREJ recently sat down with Shimon Shkury, president of Ariel Property Advisors, an investment real estate services and advisory company, who shared key highlights from his firm’s newly released “Multifamily Quarter In Review New York City: 3Q 2016.â€

Q: How is New York City’s multifamily market performing as we head into the end of the year?

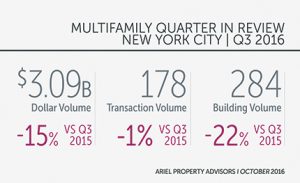

A: The 3Q of 2016 predominantly consisted of small to mid-size transactions, leading citywide dollar volume to fall on a year-over-year basis. For the 3Q16, New York City saw 178 transactions comprised of 284 buildings totaling $3.09 billion in gross consideration. This represents a 15% decline in dollar volume, a 1% decline in transaction volume, and 22% decline in building volume compared to 3Q15, which saw 363 properties trade across 180 transactions totaling $3.652 billion in gross consideration. We’re aware of several institutional-caliber transactions slated to close in the 4Q so we expect a strong finish to the year.

Q: How are multifamily prices holding up?

A:Â Strong pricing continued to hold or appreciate across most measures in Northern Manhattan, The Bronx, and Queens. Manhattan and Brooklyn, however, showed some signs of modest softening. Looking at 6-month trailing averages, Manhattan cap rates rose for the second quarter in a row, hitting 3.87% which is up 28 basis points compared to the 1Q16. In Brooklyn, average cap rates are up a more modest 13 basis points since 1Q16. Buyers appear to be pricing in higher interest rates and the supply of new rental units coming to market in the next few years. Nonetheless, our sense is that these trends reflect a modest correction from historically low cap rates and we will closely monitor how the pricing trends evolve.

Q: Did any of the boroughs stand out during the 3Q16?

A: We’ve been especially impressed with Queens multifamily activity this year. For the third straight quarter, Queens showed considerable year-over-year growth in multifamily dollar volume. The borough saw 22 trades consisting of 29 buildings and $326.6 million in gross consideration during Q316, which represents a 65% year-over-year increase in dollar volume. Prices have also shown considerable appreciation—looking at 6-month trailing averages, the average price per s/f is up roughly 17% and the average price per unit is up by 25% year-over-year. One notable trade was an elevator multifamily building in Elmhurst at 51-25 Van Kleeck St. with 76 units that sold for $21.1 million, or $325 per s/f and a reported capitalization rate of 3.35%. In Sunnyside, a 55-unit elevator multifamily building at 47-46 40th St. sold for $15 million, which equates to $298 per s/f and $272,000 per unit.

Q:Â How did the other boroughs perform during the 3Q?

Q:Â How did the other boroughs perform during the 3Q?

A: Manhattan experienced relatively light dollar volume during the 3Q16 as its $972 million in sales represents a 32% drop than that of the second quarter of 2016. In Hell’s Kitchen a portfolio of 14 mixed-use walk-up buildings at 308-310 & 318-340 West 49th St. traded for $110 million, or $804 per s/f with a reported capitalization rate of 4%. A notable Upper East Side sale was a 6-story, 27-unit elevator building at 225 East 82nd St. that sold for $11.85 million, or $1,000 per s/f.

Several institutional-caliber transactions north of $20 million drove 3Q Brooklyn multifamily dollar volume 5% higher on a year-over-year basis despite a 15% dip in transactions. Flatbush was one of the city’s most transactional neighborhoods, while Williamsburg was a leader in dollar volume during the last six months, seeing over $228.6 million in gross sales. A notable transaction was in Gowanus at 335 Carroll St., the 30-unit elevator building traded for $27.2 million, or $907 per s/f.

Northern Manhattan saw fewer terms of transactions despite a modest uptick in year-over-year dollar volume. The submarket saw 27 transactions consisting of 50 buildings, totaling $662.7 million in gross consideration, which represents a 10% increase in dollar compared to 3Q15. One notable Washington Heights sale was a 6-story, 32-unit walk-up building at 520 West 174th St. that sold for $7.95 million, or $427 per s/f. Elsewhere, in Hamilton Heights, a 21-unit walk-up building 584-586 West 152nd St. sold for $6.66 million, or $351 per s/f.

3Q16 Bronx multifamily transactions continued to show price appreciation even though transaction volume and dollar volume is down compared to 2015 levels. Similar to 2Q16, sales during 3Q16 mostly consisted of small to midsize assets. One example is the recent purchase of 1011 Carroll Pl., a 56-unit elevatored building in Melrose that sold for $11 million, which represents $184 per s/f or $196,429 per unit. Another sale demonstrating the strength of Bronx multifamily pricing took place at 1459 Taylor Ave. in Parkchester, which sold for $4.5 million or $189 per s/f.

Q: What’s shaping your thinking heading into 2017?

A: We’re keeping an eye on whether rising interest rates will lead owners to hold onto properties or whether it may push some of them to transact or refinance next year. Buyers and banks are acting with more caution; well-priced properties continue to receive a ton of interest from diverse groups of buyers.

The report can be viewed online at http://arielpa.nyc/research/report-MFQIR-Q3-2016

Shimon Shkury is president of Ariel Property Advisors, New York, N.Y.

SABRE coordinates sale of six properties totaling 199,845 s/f

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

Strategic pause - by Shallini Mehra and Chirag Doshi

.jpg)

.gif)