Significant changes in the economic and interest rate environments in the United States have foiled countless commercial real estate transactions across the country in 2022. With all of this change, is there a way for sellers to avoid the significant price declines occurring across the real estate market while still closing with reasonable terms? One option that comes into focus during these environments is seller financing. In an uncertain economic environment, seller financing can facilitate win-win commercial real estate transactions even while interest rates are on the rise.

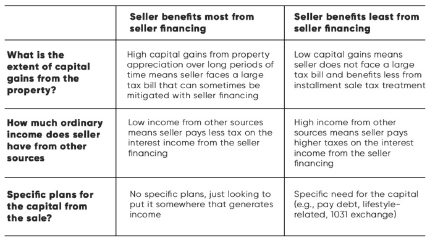

Sellers may offer financing to induce a buyer to pay a higher price and/or agree to other important terms. Seller financing can help make the project workable for buyers and make the contract-to-closing period smoother. As one seller recently described it to me: “it is like a bank loan, just without all of the headache”. But seller financing can also benefit sellers in at least three ways.

I. Deferral

Section 453 of the Internal Revenue Code provides that sellers can recognize capital gains over the principal payoff term of seller financing. For example, if a seller sells a property for $120 that was acquired for $10 (capital gains of $110) with $20 paid by buyer at a year-end closing and $15 per year ($10 in principal and $5 in interest) for ten years after that, seller would only recognize a small amount of capital gains in each of 11 tax years rather than $110 in the year of the sale. (The interest income would be taxable at ordinary income rates.) This structure allows many sellers to qualify for a lower capital gains rate by stretching gain recognition over a longer period of time as compared to recognizing all of the gains in the year of sale. Of course, sellers with capital gains from other sources, and sellers facing depreciation recapture (recognized in the year of sale), would need to evaluate how those gains affect the tax results they can expect from the transaction.

Moreover, deferral creates opportunities for further deferral. For example, seller financing that involves a principal payment of $28,000 to the seller in year three might not result in $28,000 of capital gains recognition in that tax year. Instead, the seller might decide during that tax year to use those gains to invest in a way that further defers gains, such as by investing in a qualified opportunity fund (QOF). Even if the seller did not have the QOF investment opportunity available in the year of sale, the investment qualifying for deferral can happen in the year the principal payment is received.

II. Income

Income over the course of the financing period can provide steady support for the seller and his or her family to replace the rental income from the property being sold. Depending on the seller’s annual income and tax situation, tax rates on the interest income can be favorable, with the seller sometimes staying within a relatively low tax bracket.

And because a seller earns interest over the course of the seller financing term, the seller can enjoy the benefits of compounding. For example, if a seller agrees to provide seller financing for fifteen years and $1,500 of tax is deferred to the fifteenth year as a result of the installment sale treatment by the IRS, that $1,500 in the form of mortgage principal earns interest for fifteen years. Even if post-tax income on the $1,500 were a mere $30 per year, fifteen years of interest income would result in $450 of post-tax benefit to the seller just from that one year of deferred tax.

III. Investment

Sometimes a seller has a specific need for the capital received when selling property: paying down debt, lifestyle-related expenses, or investment-related plans like purchasing Section 1031 replacement property. But for sellers without a specific plan, seller financing can provide a good alternative. Rather than investing in the equity or debt of unfamiliar buildings or businesses, sellers can remain invested (as lenders) in a building they may know very well.

Daniel and Sam Pessar are principals at Elite Management Holdings, LLC, Hackensack, N.J.