S3 Capital Partners secures $105 million financing for JCS Realty’s 447-unit Bronx project

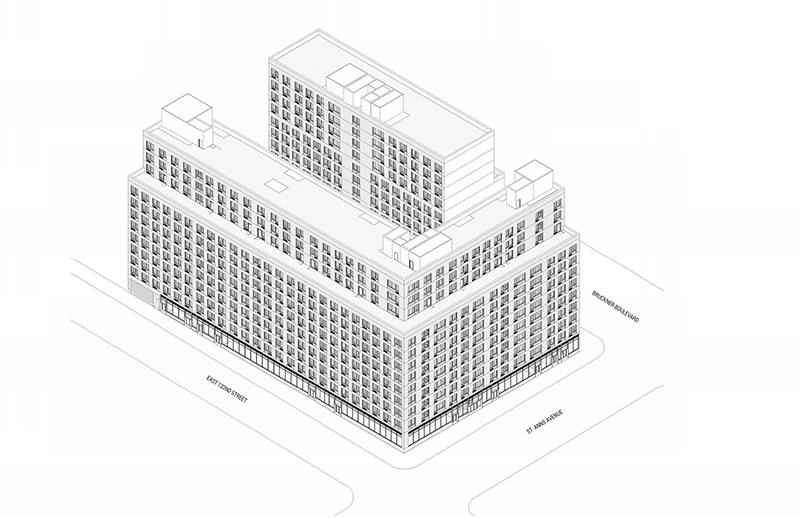

Bronx, NY S3 Capital Partners has provided a $105-million loan to Jacob Schwimmer’s JCS Realty for the development of 138 Bruckner Blvd., a new mixed-use project, including 447 rental residential units and ground-floor commercial space, in the Mott Haven neighborhood.

Bronx, NY S3 Capital Partners has provided a $105-million loan to Jacob Schwimmer’s JCS Realty for the development of 138 Bruckner Blvd., a new mixed-use project, including 447 rental residential units and ground-floor commercial space, in the Mott Haven neighborhood.

At closing, JCS Realty entered into a ground lease with Montgomery Street Partners, which provided $55 million for the acquisition and improvements to the site. The site will accommodate a new, 12-floor property, which is expected to be completed in the fourth quarter of 2023.

S3 Capital has a long-standing relationship with JCS Realty as 138 Bruckner Blvd. becomes the fifth deal to close between the two parties since 2017. S3 Capital also provided $60 million in construction financing for JCS Realty’s 215-unit rental residential development at 276 Grand Concourse, which just completed construction.

The deal comes on the heels of an active 2021 for S3 Capital, which is currently on pace to close $500 million in new loans in the first quarter of 2022.

“We are excited to complete our fifth transaction with Jacob, a best-in-class developer with a deep understanding of market dynamics,” said Robert Schwartz, managing partner and co-founder of S3 Capital. “S3 Capital is a relationship-driven lender, and a core value of the firm is our long-term commitment to support the projects and continued growth of our partners.”

“We believe there is enormous opportunity in Mott Haven and the rest of the South Bronx, and we remain excited about the prospects for housing developed near transit centers with direct access to Midtown,” said Joshua Crane, managing partner and co-founder of S3 Capital. “We have seen remarkable success with developments in this area and 138 Bruckner will continue this trend.”

138 Bruckner Blvd. is the latest S3 Capital loan to close within the Mott Haven neighborhood, where the company has financed the development of more than 1,100 new units in the past two years, including two other JCS Realty projects and “The Arches” at 228 East 135th St.

AmTrustRE completes $211m acquisition of 260 Madison Ave.

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Strategic pause - by Shallini Mehra and Chirag Doshi

.jpg)

.gif)

.gif)