Nassimian and Goldflam of Highcap Group sell Long Island City development site for $13 million

Queens, NY Rodney Nassimian, investment sales associate, and Josh Goldflam, co-founder & principal of Highcap Group, have completed the sale of the property located at 46-30 21st St. in Long Island City. The property was owned for nearly 50 years by the same family who decided to retire from the real estate business. The property had a closing deadline of year end 2020, and the buyer completed the sale on December 28th, for $13 million all cash.

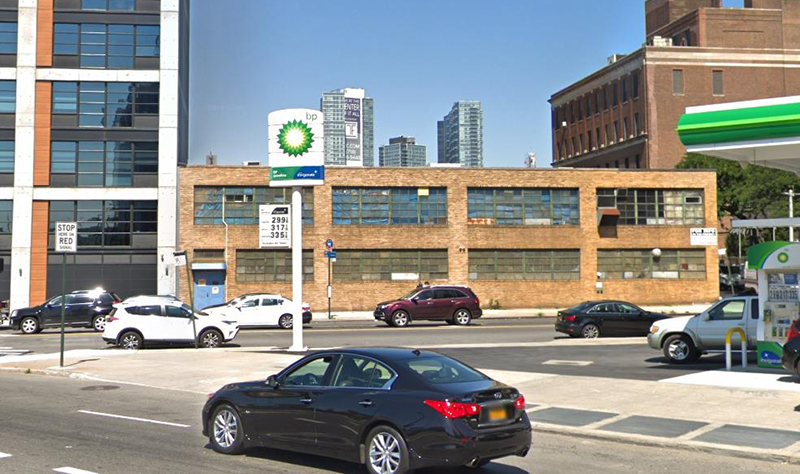

This 100 foot by 100 foot property located at the corner of 21st St. and 46th Rd. has multiple addresses of record, from 46-28 and 46-30 21st St. to 11-50 to 11-58 46th Rd. It currently houses a two-story warehouse building with 12,500 s/f existing and was delivered vacant at the time of closing. The site is adjacent to a new property development on Jackson Ave., and sits on a diagonal caddy corner which enables the property to get full light and air from the wide Jackson Ave.. The property also has views of Manhattan in addition to being situated close to the entrance/exit of the Long Island Expressway and the Midtown Tunnel into Manhattan.

The property has R7X / C1-5 zoning with an FAR of 5 which will yield a developer 47,000 s/f of development rights for a residential or commercial building. The buyer was a group of developers led by Jiashu Xu, and the seller was Jerry Offenberg.

The $13 million sales price for the property was equivalent to $277 per buildable s/f based on the 47,000 s/f. Goldflam said, “The price per buildable s/f at almost $280 totally underscores the fundamental strength of prime corner Long Island City development properties, especially ones with great light & air and views of Manhattan skyscrapers. A temporary pandemic doesn’t stand in the way of long term plans, and the condo and rental markets in Long Island City have been holding up very well considering we are still in the middle of a pandemic. Corner sites off Jackson Avenue don’t really exist anymore, and the buyer wisely jumped on this under the radar opportunity that has been owned by the same family for 50 years. Nassimian added: “We worked on this property off market for well over a year at a much higher price point, when the market was in a much better position. When the family recently decided that they would take a discount for a year-end closing, we were able to deliver them a very well qualified buyer from contract to close at market pricing within 45 days.”

Hanna Commercial Real Estate brokers Agri-Plastics 64,000 s/f manufacturing facility lease at Uniland’s 2 Steelworkers Way

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

Strategic pause - by Shallini Mehra and Chirag Doshi

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

.jpg)

.gif)