ICSC New York 2025: A Reset Market for Greater New York & New England

This year’s ICSC New York conference made one thing abundantly clear: the retail and commercial real estate markets across Greater New York and New England are not stalled — they are repositioning.

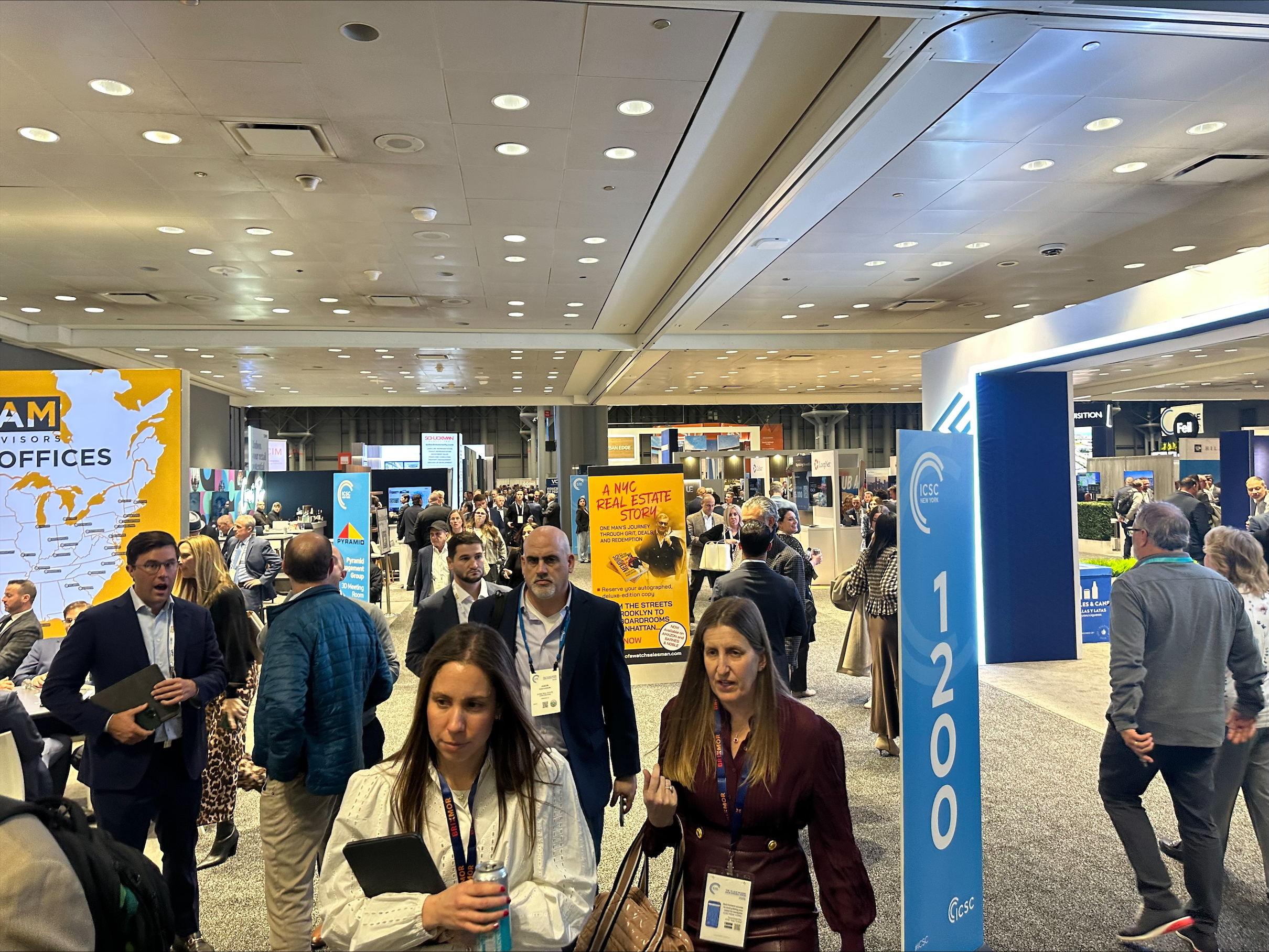

The show floor was packed with a cross-section of the industry rarely seen outside of ICSC: institutional owners, national retailers, investment managers, lenders, developers, and brokerage firms from every major market in the Northeast. From Manhattan to Boston, Westchester to Hartford, Fairfield County to Providence, the conversations were not about fear — they were about strategy.

Retailers are evolving, not disappearing. The demand today is smarter, leaner, and more location-driven than ever before. At ICSC New York, tenants were not hunting for square footage — they were hunting for performance. Walkability, density, traffic counts, and brand adjacency matter more than ever. That trend is playing out across New England’s urban cores — Boston, Cambridge, and Stamford — and throughout New York City’s strongest corridors.

Office followed quietly but forcefully into the conversation. Across Greater New York and New England, tenants are rightsizing rather than retreating. The flight to quality is real — whether in Midtown Manhattan, downtown Boston, or suburban Fairfield and Westchester Counties. Companies are selecting fewer locations with better buildings, stronger infrastructure, and greater flexibility. “Wait and see” has been replaced by “negotiate and execute.”

Across the region, capital remains cautious — but engaged. Debt markets are still tight. Sellers are adjusting expectations. And buyers are finding valuation opportunities particularly in office, mixed-use, and retail repositioning plays. What once felt like paralysis is now working itself into disciplined deployment.

Boston, Stamford, and Providence continue to see strong demand for well-located retail. New York City’s luxury core remains resilient. Neighborhood centers and lifestyle assets across New England are steady, with food, beverage, and service retail fueling stabilization.

Perhaps the most telling shift at ICSC was not in trophy announcements — but in tone.

People were back. Meetings were real. Deals were discussed with structure, not speculation.

This is not a market in retreat.

It is a market recalibrating.

Across Greater New York and New England, the future is no longer being deferred — it is being engineered deal by deal, lease by lease, and block by block.

The winners will not be the boldest.

They will be the most prepared.

Related Cos. and Sterling Equities open housing lottery for Willets Point Commons

Strategies for turning around COVID-distressed properties - by Carmelo Milio

.gif)

.jpg)

.gif)