How to double your real estate investment portfolio - by Russell Gullo

Like our bodies, which require physical attention to make sure they perform to their fullest, our real estate investments require the same attention and care.

Over the course of a holding period, a real estate investment gets soft and forms a diminishing rate of return when the property is held too long in the owner’s portfolio.

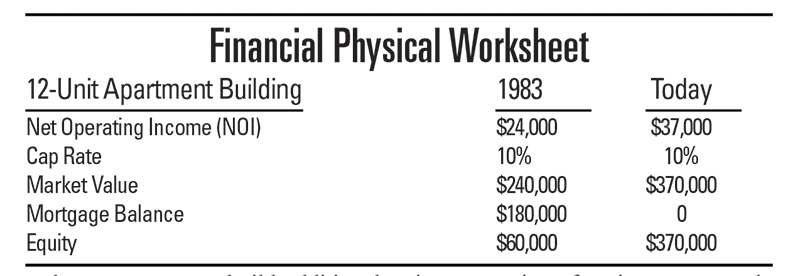

For example, let’s assume that we acquired a 12-unit apartment building in 1983 with a purchase price of $240,000; an equity (down payment) investment of $60,000 (25%); and a mortgage of $180,000 (75% LTV).

Through the holding period of this real estate asset, we build additional equity through principal reduction of the mortgage and appreciation (the increase of the value over the original purchase price).

Here is where the “financial physical” comes into play. It can determine how well the investment property is performing financially and can measure whether or not we are experiencing a diminishing rate of return on our real estate investments.

Although the rents have increased drastically over the holding period, you need to examine how fiscally sound the investment is performing. Most people think that the right thing to do is to hold the real estate investment property until it is mortgage free. That’s wrong, for the reason we just mentioned above. In addition, would you hold a property that is all paid for, or would you purchase a property using your new equity position with 25% down payment like when you acquired your investment property? With the use of leverage you can maximize your rate of return as well as control much more real estate.

With the $370,000 of equity that we have accumulated in our example today, we have the opportunity to control $1.48 million worth of real estate by putting 25% down and acquiring a mortgage $1.11 million. 75% LTV.

The bottom line is, do you want to control $370,000 of real estate in a 12-unit apartment building or control $1.48 million of real estate (four times the market value)? By using the same equity position ($370,000) and Section 1031 of the Internal Revenue Code you can own real estate with a value of $1.48 million.

The bottom line is, do you want to control $370,000 of real estate in a 12-unit apartment building or control $1.48 million of real estate (four times the market value)? By using the same equity position ($370,000) and Section 1031 of the Internal Revenue Code you can own real estate with a value of $1.48 million.

Using 100% of your equity to purchase another property is possible through the use of real estate exchange. Section 1031 of the Internal Revenue Code allows owners disposing of business or investment property to pay no tax when disposing of the property as long as another business or investment property is acquired within 180 days from the closing of the disposed property. This type of transaction must be structured through the use of a professional “qualified intermediary.”

If you are looking to achieve financial independence with the use of real estate as an investment, you can achieve it much quicker by having a financial physical performed on your real estate investment property. In many cases a current owner of a real estate investment can double, triple or even quadruple the size of their real estate portfolio.

Russell Gullo, CCIM, CEA, is founder and CEO of the R. J. Gullo Cos., Buffalo, N.Y.; founder and director of operations at the American Institute of Real Estate Exchangors; and founder of the Buffalo Investors & Exchangors Group.

Berger and Koicim of Marcus & Millichap sell 17-unit multi-family for $8.8 million

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

.jpg)

.gif)

.gif)