Hempstead LDC gives preliminary authorization for bond sale – $55 million

University - Garden City, NY

Garden City, NY The town of Hempstead Local Development Corp. (LDC) has given preliminary authorization for the sale of $55 million in tax-exempt bonds on behalf of Adelphi University.

The LDC gave its preliminary authorization for the bond sale at its March 28 board meeting. A public hearing and final authorization are required as is the approval of the town supervisor.

The bonds, to be underwritten by TD Securities, are to be repaid by Adelphi and are secured by a first-mortgage lien on the land and building. There is no out-of-pocket expense to the towns taxpayers.

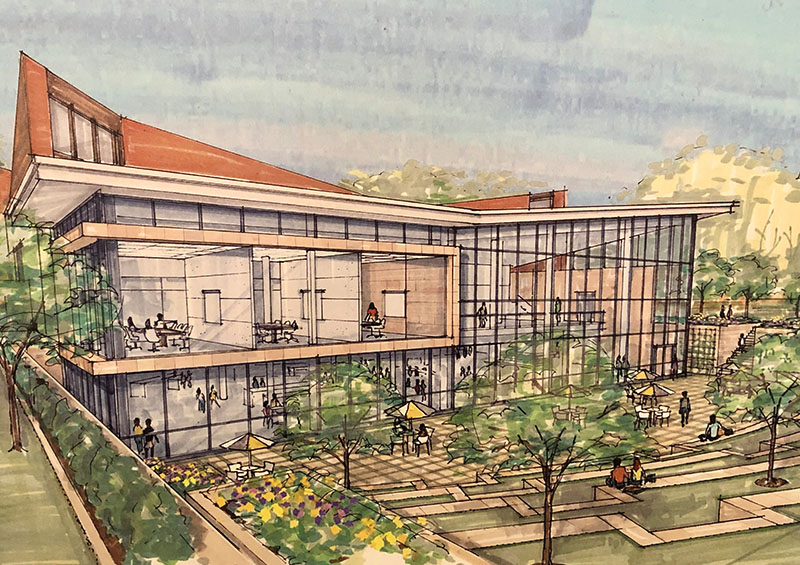

Adelphi plans to use $34 million of the bonds to expand its 74,272 s/f University Center by 24,164 s/f. The University also plans to refinance $21million in bonds that were issued through the LDC in 2009 to build dorms and renovate other campus buildings.

The planned University Center expansion will include a student dining center, a new school store and larger meeting spaces for student organizations. Also, there also will be an added enhanced art gallery with state of the art technology. Adelphi serves 8,300 undergraduate and graduate students, most of them commuters

“There is no doubt that the sale of these new bonds, once final, will have a great impact on Adelphi University, its students, as well as on the economics of the surrounding communities,” said Fred Parola, executive director of the LDC.

The Hempstead LDC is dedicated to helping non-profit organizations prosper and grow within the town, and fulfill its mission of serving our residents. The LDC offers incentives to help not-for-profit businesses and agencies — schools, hospitals, and religious organizations — relocate, expand, and build.

Over half of Long Island towns vote to exceed the tax cap - Here’s how owners can respond - by Brad and Sean Cronin

Oldies but goodies: The value of long-term ownership in rent-stabilized assets - by Shallini Mehra

Properly serving a lien law Section 59 Demand - by Bret McCabe

How much power does the NYC mayor really have over real estate policy? - by Ron Cohen

.png)

.jpg)

.gif)