Goldflam of Highcap Group arranges sale of 47-07 Broadway for $11.1m - 54,516 s/f

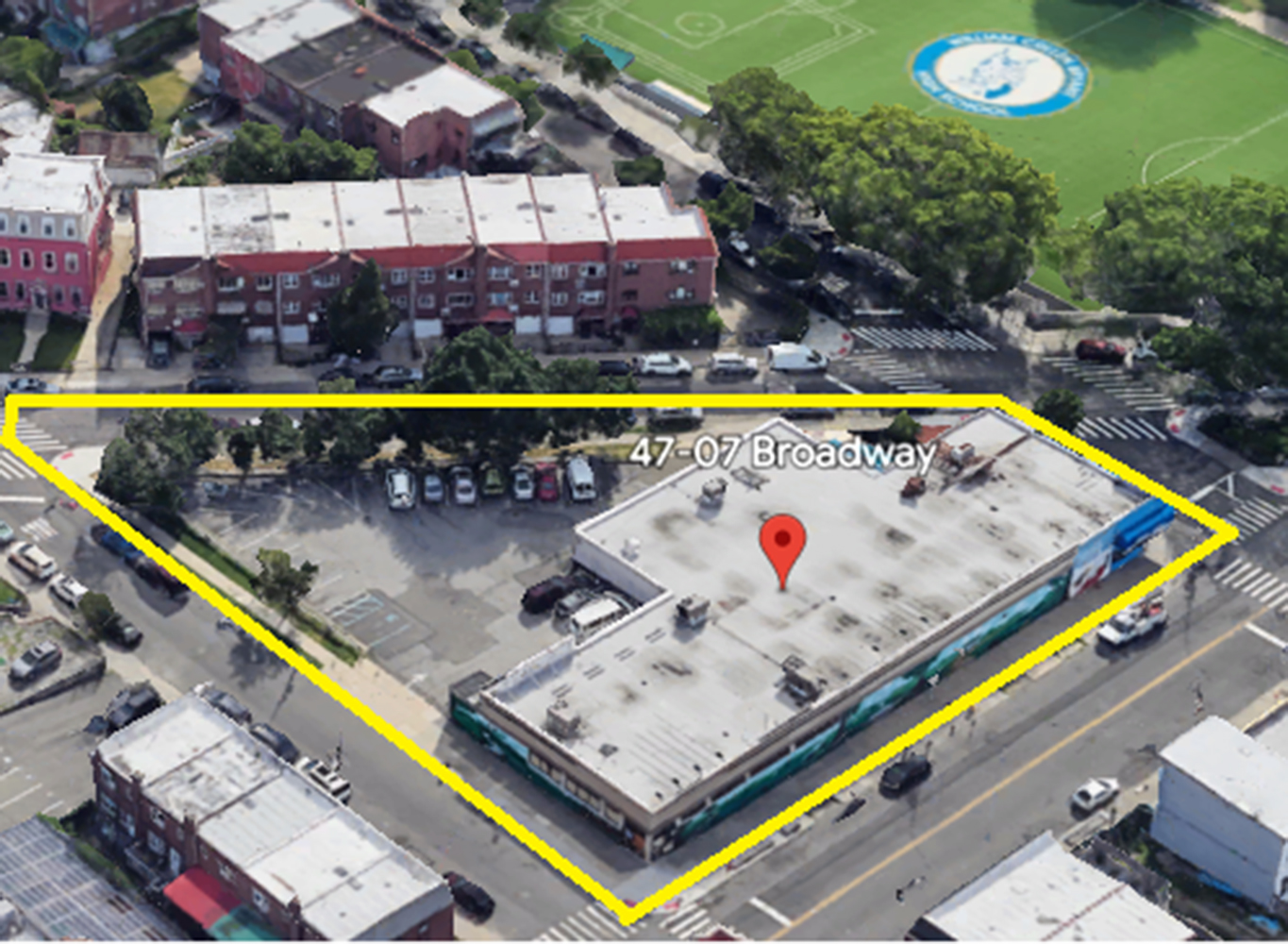

Queens, NY Josh Goldflam, co-founder & principal of Manhattan based commercial real estate firm Highcap Group, has arranged the sale of 47-07 Broadway, for $11.1 million. The building and lot are located in the Astoria neighborhood. The seller of the property was the Witkoff & Birnbaum families, who have owned the property for over 52 years. The buyer is a locally based residential developer who purchased the property under an anonymous LLC.

This property is situated on the entire block-front of Broadway between 47th St. and 48th St., and the full block-front of 47th and 48th St.’s between Broadway and Newton Rd. This gives the building and parking lot access on all four sides of the property. The property enjoys additional light, air, and views from the sports fields across the street from Bryant High School. The M & R subway station is located one block away from the property on the corner of Broadway & 46th St.

The building and parking lot are currently occupied by Rite-Aid who will be vacating the premisis in the near future. The 27,250 s/f lot has R6B zoning with a floor-to-air ratio of two, allowing for an As-of-Right retail and residential building to be developed on the property. A total of 54,516 gross s/f can be built on the lot under current zoning. The sales price of $11.1 million equates to $204 per buildable s/f.

Goldflam said, “This was a very rare sale as these days it’s nearly impossible to find a 27,000 s/f lot dead smack in the middle of a densely populated residential neighborhood like Astoria Queens. This property also checks off every single box that a residential developer would desire with any potential site, light and air on all four sides, curb cuts on multiple streets, block-front exposure on four different streets, additional light and air from the school’s recreational fields across the street, and a large floor plate with a location on a strong retail corridor one block away from the subway station. The property was able to command full retail market value in a tight high interest-rate environment because of these contributing factors.”

SABRE coordinates sale of six properties totaling 199,845 s/f

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

Strategic pause - by Shallini Mehra and Chirag Doshi

.jpg)

.gif)

.gif)