EV Infrastructure and associated risks for property owners Webinar

Manhattan, NY Over the past decade, the global demand for electric vehicles (EVs) has seen exponential growth, necessitating significant infrastructure adaptations to support widespread adoption. One critical aspect of this transition is the expansion of EV charging stations. However, alongside these advancements come complex legal and insurance considerations that are essential during planning, implementation, and operations.

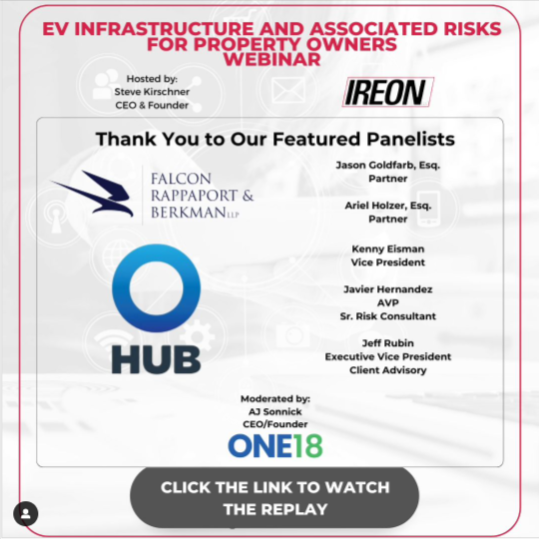

IREON, a leading non-compete business development organization established in 2016, recently hosted a webinar on navigating these challenges. The webinar was moderated by AJ Sonnick, CEO & founder of ONE18MEDIA and featured a panel of experts from HUB International and Falcon Rappaport and Berkman, focusing on strategies to enhance EV owner satisfaction while effectively managing risks for property owners, multifamily properties, and condo developments.

"With the rapid evolution in consumer preferences towards electric vehicles, the infrastructure supporting their use must adapt accordingly," said Kirschner of IREON.

The discussion provided actionable insights into maximizing EV infrastructure investments and ensuring compliance with evolving regulatory landscapes.

To listen to the webinar click here.

Veris Residential completes $75 million sale of Harborside 8/9 land parcel to Panepinto Properties

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

Strategic pause - by Shallini Mehra and Chirag Doshi

.jpg)

.gif)