Concerning 1031 exchanges: What should owners expect in 2022? - by Mike Packman

Last September, owners of appreciated investment properties and those of us in the commercial real estate industry, collectively exhaled when the proposal to limit 1031 exchanges was excluded from President Biden’s “Build Back Better” agenda. With Section 1031 intact, the industry continued to flourish.

Section 1031 of the Internal Revenue Code allows investors to defer paying capital gains taxes on investment property sales by reinvesting the proceeds into a similar investment property within a specified time frame. Securitized 1031 exchange programs are structured as securities and sold to retail investors, mainly as Delaware statutory trust (DST) offerings. Companies like ours, that are in the securitized 1031 industry, collectively raised more than $7 billion in 2021. The industry also saw some $2 billion come full cycle last year, up by nearly 50% from 2020.1

No Budget

No Budget

As we move into 2022, many clients have asked me what to expect. My response is that we are not in an election year, which is generally when the spotlight tends to focus more heavily on our industry. With no budget for 2022 approved, the United States continues to operate under continuing resolution, with our current budget extension expiring on February 18th. Another extension is anticipated, with President Biden’s March State of the Union address officially kicking off budget discussions for next year. There are plenty of time sensitive items on the agenda, which should limit the scrutiny on 1031 exchanges.

Fighting Optics

The arguments against 1031 exchanges tend to focus on one theme—that it is a tax loophole for the wealthy. The reality is that the median sales price of a property in a 1031 Exchange in 2018 and 2019 was approximately $500,000 according to CoStar. Those of us in the industry know that exchanges have been a valuable real estate investment tool for over 100 years. While the rules have changed over time, the intent has remained the same—to allow real estate investors to defer—not avoid—capital gains taxes on a property they sold if they acquire a new property of equal or greater value within the prescribed timeframe of 180 days. In fact, 88% of exchanges ultimately lead to a taxable sale.

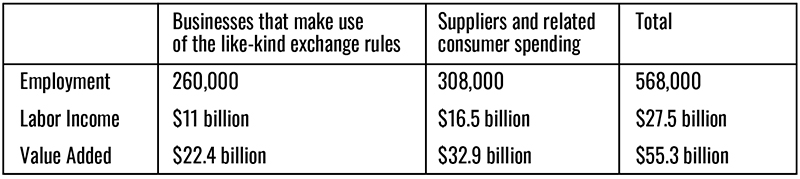

The positive impact to the economy should also not be ignored and is a strong argument for the continuation of exchanges.

No Slowing Down

As I mentioned earlier, securitized DST exchanges raised more than $7.4 billion in 2021 and projections for 2022 show no signs of slowing down. This is great news for real estate investors seeking to move from active to passive property ownership and defer capital gains tax. With interest rates on the rise, when investors are considering replacement properties, including DST investments, they might want to consider options that provide capital preservation and predictable cash flow.

The Bottom Line

Exchanges offer numerous benefits to investors and the economy which is reflected in the volume of transactions completed in 2021 and projected for 2022. Given that we are not in an election year and the government has numerous high-priority items to focus on, like approving a budget, hopefully Section 1031 remains out of the headlines.

1 Mountain Dell Consulting, LLC, Year End Market Summary

Mike Packman is the founder and CEO of Keystone National Properties (KNPRE) | KNPRE.com, New York, N.Y.

Over half of Long Island towns vote to exceed the tax cap - Here’s how owners can respond - by Brad and Sean Cronin

The strategy of co-op busting in commercial real estate - by Robert Khodadadian

Oldies but goodies: The value of long-term ownership in rent-stabilized assets - by Shallini Mehra

How much power does the NYC mayor really have over real estate policy? - by Ron Cohen

.png)

.jpg)

.gif)