News:

Brokerage

Posted: February 24, 2016

Ariel Property Advisors: Stuy-Town sale propels December multifamily sales, capping off strong 2015

New York, NY Punctuating a strong finish to 2015, December multifamily figures experienced considerable year over year gains in dollar volume, due in large part to the sale of Stuyvesant Town & Peter Cooper Village for $5.45 billion. After excluding this sale, city-wide dollar volume would be down roughly 31 percent compared to December of 2014.

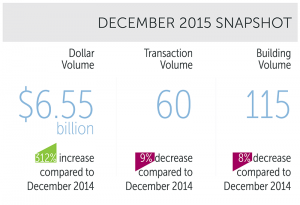

For the month, New York City saw 60 transactions comprised of 115 buildings totaling $6.551 billion in gross consideration. This represents a 312% increase in dollar volume, a 1% decrease in building volume and a 9% decrease in transaction volume compared to November 2015, which saw 66 transactions comprised of 116 buildings totaling $1.592 billion in gross consideration.

Blackstone’s purchase of Stuyvesant Town & Peter Cooper Village, one of the largest multifamily transactions ever recorded, accounted for roughly 83 percent of the entire city’s total dollar volume for December. The complex’s sale helped boost Manhattan’s dollar volume 452% year-over-year.

Queens’ increasing pricing and increased demand enabled four multifamily deals to close north of $20 million. The largest deal took place in Flushing, where Treetop Development purchased a large portfolio of 608 units – almost all of which are rent stabilized – for $138.8 million, or $261 per s/f.

The Bronx had a healthy month as the borough saw 36 buildings trade across 14 transactions totaling $178.54 million in gross consideration. The Related Companies capped off an aggressive 2015 buying spree throughout the Bronx with the purchase of a 20-building portfolio for $112.5 million – the year’s priciest Bronx transaction. The portfolio is spread across several neighborhoods in the North, West and South Bronx.

Northern Manhattan finished the year with a strong December as the submarket saw 10 transactions consisting of 23 buildings totaling $136.995 million in gross consideration – a 37% increase in dollar volume from a year ago. Rhodium Capital Advisors picked up a 13-building portfolio spread across Harlem and Washington Heights for $98 million, or $394 per square foot. The portfolio spans 248,700 square feet and contains a total of 361 rental units and 17 retail stores.

Brooklyn had a relatively quiet month, experiencing year over year declines in transaction, building and dollar volume. In Williamsburg, 119-123 Kent Ave., three contiguous mixed-use buildings, sold for a combined $15.85 million, which equates to over $1,000 per s/f—a price that largely reflects the retail portion. Down in Prospect Heights, Novel Property Ventures picked up a 55-unit rental building for $23.5 million, or $450 per s/f.

For the six months ended in December 2015, the average monthly transaction volume decreased to 58 transactions per month. The average monthly dollar volume increased significantly to $1.991 billion.

To review the report, please click on the following link: http://arielpa.com/report/report-MFMIR-Dec-2015

Tags:

Brokerage

MORE FROM Brokerage

AmTrustRE completes $211m acquisition of 260 Madison Ave.

Manhattan, NY AmTrustRE has completed the $211 million acquisition of 260 Madison Ave., a 22-story, 570,000 s/f office building. AmTrustRE was self-represented in the purchase. Darcy Stacom and William Herring

Quick Hits

Columns and Thought Leadership

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

The state has the authority to seize all or part of privately owned commercial real estate for public use by the power of eminent domain. Although the state is constitutionally required to provide just compensation to the property owner, it frequently fails to account

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Last month Bisnow scheduled the New York AI & Technology cocktail event on commercial real estate, moderated by Tal Kerret, president, Silverstein Properties, and including tech officers from Rudin Management, Silverstein Properties, structural engineering company Thornton Tomasetti and the founder of Overlay Capital Build,

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Let’s be real: if you’re still only posting photos of properties, you’re missing out. Reels, Stories, and Shorts are where attention lives, and in commercial real estate, attention is currency.

Strategic pause - by Shallini Mehra and Chirag Doshi

Many investors are in a period of strategic pause as New York City’s mayoral race approaches. A major inflection point came with the Democratic primary victory of Zohran Mamdani, a staunch tenant advocate, with a progressive housing platform which supports rent freezes for rent

.jpg)

.gif)