News:

Brokerage

Posted: February 12, 2016

Ariel Property Advisors releases “Queens 2015 Year-End Sales Report”

Queens, NY According to Ariel Property Advisors’ newly released, “Queens 2015 Year-End Sales Report,” Queens investment property sales saw strong, steady growth in 2015. Rising market rents, steady growth in condominium prices and several blockbuster commercial transactions continued to support the submarket’s evolution into a premier destination for business, residential development, and capital investment.

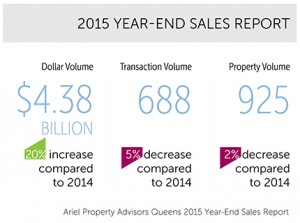

In 2015, Queens saw 688 transactions consisting of 925 properties totaling approximately $4.38 billion in gross consideration. This translates to a strong 20% increase in dollar volume despite a moderate 5% decrease in transaction volume and a 2% decrease in property sales volume compared to 2014, which saw 728 transactions comprised of 947 properties totaling $3.65 billion in gross consideration. Accounting for nearly 32% of the borough’s dollar volume and pushed by a significant number of multifamily trades, Astoria, Ridgewood, Elmhurst and Corona saw increased activity.

"While Long Island City and Astoria continue to be an anchor for the borough, we have recently seen areas like Jamaica and Flushing emerge as a new frontier for public and private investment," said Dan Wechsler, vice president at Ariel Property Advisors. "Several rezoning studies slated to be released in 2016, particularly the LIC Core Study Area and The Flushing West Study, will affect large swaths of underutilized and undervalued property."

Rising multifamily pricing metrics suggest elevated interest in Queens’ properties. As demand continued to outpace supply, the average cap rate dropped 48 basis points to 4.71%, the average price per s/f rose 25% to $284, the average gross rent multiple rose an impressive 3.46 points to 14.27 and the average price per unit rose 36% to $240,000.

Multifamily properties saw a 9% increase in gross dollar volume compared to 2014 with $1.39 billion in gross consideration. This increase occurred despite moderate decreases in both the number of transactions and properties traded. As seen by several 2015 re-sales of properties that traded 12-36 months ago, strong fundamentals and low interest rates continue to push prices higher. One example is the sale of 43-31 45th Street in Sunnyside, which sold for $27.5 million in 2015 after trading for $17 million in 2014.

Prices for development sites throughout Queens continued their upward trajectory from 2014 with developers placing a strong emphasis on Long Island City, Jamaica and Flushing.

There were fewer development site transactions in 2015 compared to 2014, but a sharp rise in prices and a lack of available properties on the market suggests this can mostly be attributed to a lack of supply than demand. Rents remain healthy and condominium buyers are ready and willing to pay top dollar for new product amidst scarce supply. Condominium sales at The View at 46-30 Center Blvd in Long Island City have sold in excess of $1,500 per s/f while rents at the Pearson at 45-50 Pearson St. in Long Island City are exceeding $60 per s/f.

Lastly, the year saw strong growth for commercial sales, particularly in Flushing, evidenced by the boroughs largest transaction, the $400 million sale of the Mall at Sky View Parc to Blackstone.

See the full report here: http://arielpa.com/report/report-APA-Queens-2015-Sales-Report

Tags:

Brokerage

MORE FROM Brokerage

Horizon Kinetics relocates new headquarters to Tishman Speyer’s Rockefeller Center

Manhattan, NY According to Tishman Speyer investment boutique Horizon Kinetics Asset Management LLC will relocate its current New York office to 18,713 s/f on the 27th floor of 1270 Avenue of the Americas at

Quick Hits

Columns and Thought Leadership

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

The state has the authority to seize all or part of privately owned commercial real estate for public use by the power of eminent domain. Although the state is constitutionally required to provide just compensation to the property owner, it frequently fails to account

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Last month Bisnow scheduled the New York AI & Technology cocktail event on commercial real estate, moderated by Tal Kerret, president, Silverstein Properties, and including tech officers from Rudin Management, Silverstein Properties, structural engineering company Thornton Tomasetti and the founder of Overlay Capital Build,

Strategic pause - by Shallini Mehra and Chirag Doshi

Many investors are in a period of strategic pause as New York City’s mayoral race approaches. A major inflection point came with the Democratic primary victory of Zohran Mamdani, a staunch tenant advocate, with a progressive housing platform which supports rent freezes for rent

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Let’s be real: if you’re still only posting photos of properties, you’re missing out. Reels, Stories, and Shorts are where attention lives, and in commercial real estate, attention is currency.

.jpg)

.gif)

.gif)