News:

Brokerage

Posted: April 28, 2016

Ariel Property Advisors releases “Multifamily Quarter in Review: 1Q16”

New York, NY New York City’s multifamily sector defied a pessimistic macro-environment during the first quarter of 2016 as total dollar volume was even on a year-over-year basis and, after excluding the $5.45 billion sale of Stuyvesant Town & Peter Cooper Village, was up significantly from 4Q15 figures, according to Ariel Property Advisors’ newly released “Multifamily Quarter in Review: 1Q16.â€Â With modest increases in the average price per square foot and continued cap-rate compression being seen across most submarkets, multifamily pricing metrics also held strong throughout the city.

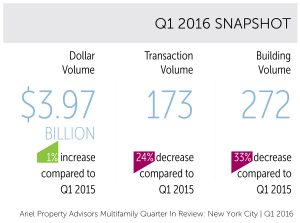

For the 1Q15, New York City saw 173 transactions comprised of 272 buildings totaling $3.977 billion in gross consideration. This represents a 1% increase in dollar volume, a 24% decrease in transaction volume and a 33% decrease in building volume compared to 1Q15, which saw 403 properties trade across 229 transactions totaling $3.942 billion in gross consideration.

The multifamily market continues to be supported by larger, institutional-sized deals as the number of transactions and buildings traded decreased year-over-year, while dollar volume is holding. This is particularly seen in the city’s average transaction size, which grew significantly to $22.498 million in 1Q16 from $17.213 million in the 1Q15. Large deals are especially dominating core Manhattan multifamily sales as the average deal size nearly doubled, jumping to $59.620 million from $32.165 million over the same period.

Compounding this point, trailing six-month averages show the city seeing 57 multifamily transactions take place per month, which is down significantly from 75 per month seen in July of 2015.

“First quarter figures reaffirm our position that New York City multifamily assets are poised to have another great year in 2016,†said Shimon Shkury, president of Ariel Property Advisors. “Recent contract signings and aggressive bidding activity suggest that investors believe in the continued persistence of today's low-inflation, low-interest-rate environment.â€

Submarket Overview

Manhattan:

Manhattan dollar volume hit $1.792 billion in the first quarter, more than doubling the next highest submarket’s total. Four transactions north of $200 million – with two over $300 million – helped push dollar volume. Three of these four deals were single-asset transactions, again accentuating the trend of lower transaction & building volume while maintaining strong dollar volume. Madison Realty Capital shelled out $270 million for The Buchanan, a nearly 300,000 square foot mixed use property located on the corner of East 48th Street and 3rd Avenue. The elevatored building, which contains 289 residential units and 16,000 square feet of retail space, sold for $907 per square foot. The sale marks the first time in 64 years ownership changed hands. In the West Village, Benchmark Real Estate Group sold 194 West 10th Street, a 20-unit walk-up building, for $13 million, which equates to $1,364 per square foot.

Brooklyn:

Brooklyn bounced back from a sluggish 4Q15 with $766.026 million in gross consideration. Akelius Real Estate Management, the U.S. real estate arm of Swedish investment firm Akelius, continued its Brooklyn multifamily spending, picking up the Mohawk Apartments, a six-building complex in Clinton Hill, for $56.5 million, or $496 per square foot. The buildings originally made up the Mohawk Hotel until they were converted to apartments in the early 1980’s. Farther south in Flatbush, a 95,000 square foot elevatored building located at 1302 Newkirk Avenue traded hands for $25 million, or $263 per square foot. Prior to the sale, the building had been under the same ownership for the past 40 years.

Northern Manhattan:

Similar to core Manhattan, Northern Manhattan saw a large increase in its average deal size when compared to 1Q15, climbing from $11.12 million to $21.18 million year-over-year. For the quarter, the submarket saw 46 buildings trade across 29 transactions totaling $613.535 million in gross consideration. The trailing six month average cap rate in Northern Manhattan fell below 4%, currently sitting at 3.92%. In Hamilton Heights, the 107,350 square foot Beaumont Apartments located at 730 Riverside Drive, sold for just over $33 million, which translates to $310 per square foot, or $520,820 per unit. The landmarked building was last purchased by A&E Real Estate Holdings in 2013 for $18.2 million.

Bronx:

The Bronx’s multifamily trailing 6-month average price per square foot throughout the borough has reached $172 and trailing 6-month average cap rate has compressed to just below 5.25%. The largest single asset to trade hands over the course of the quarter was 1511 Sheridan Avenue in Mount Hope, which sold for $34.711 million, or $171 per square foot. In Kingsbridge, a 93,767 square-foot elevatored building located at 3873 Orloff Avenue sold for $19 million, which equates to $202 per square foot and a sub-5% cap rate.

Queens:

Queens had 20 transactions made up of 24 buildings totaling $335.903 million in gross consideration. 42% of the borough’s dollar volume was recorded over the course of two days in January, combining for $140 million. 41-23 Crescent Street in Long Island City, a 140,000 square-foot mixed use building, sold for $97 million, or $693 per square foot. The sale marked the third time in four years the building has traded hands since its completion in 2012. In Flushing, 142-20 Franklin Avenue, a 142-unit elevatored building, sold for $43 million, which equates to $333 per square foot.

New York, NY New York City’s multifamily sector defied a pessimistic macro-environment during the first quarter of 2016 as total dollar volume was even on a year-over-year basis and, after excluding the $5.45 billion sale of Stuyvesant Town & Peter Cooper Village, was up significantly from 4Q15 figures, according to Ariel Property Advisors’ newly released “Multifamily Quarter in Review: 1Q16.â€Â With modest increases in the average price per square foot and continued cap-rate compression being seen across most submarkets, multifamily pricing metrics also held strong throughout the city.

For the 1Q15, New York City saw 173 transactions comprised of 272 buildings totaling $3.977 billion in gross consideration. This represents a 1% increase in dollar volume, a 24% decrease in transaction volume and a 33% decrease in building volume compared to 1Q15, which saw 403 properties trade across 229 transactions totaling $3.942 billion in gross consideration.

The multifamily market continues to be supported by larger, institutional-sized deals as the number of transactions and buildings traded decreased year-over-year, while dollar volume is holding. This is particularly seen in the city’s average transaction size, which grew significantly to $22.498 million in 1Q16 from $17.213 million in the 1Q15. Large deals are especially dominating core Manhattan multifamily sales as the average deal size nearly doubled, jumping to $59.620 million from $32.165 million over the same period.

Compounding this point, trailing six-month averages show the city seeing 57 multifamily transactions take place per month, which is down significantly from 75 per month seen in July of 2015.

“First quarter figures reaffirm our position that New York City multifamily assets are poised to have another great year in 2016,†said Shimon Shkury, president of Ariel Property Advisors. “Recent contract signings and aggressive bidding activity suggest that investors believe in the continued persistence of today's low-inflation, low-interest-rate environment.â€

Submarket Overview

Manhattan:

Manhattan dollar volume hit $1.792 billion in the first quarter, more than doubling the next highest submarket’s total. Four transactions north of $200 million – with two over $300 million – helped push dollar volume. Three of these four deals were single-asset transactions, again accentuating the trend of lower transaction & building volume while maintaining strong dollar volume. Madison Realty Capital shelled out $270 million for The Buchanan, a nearly 300,000 square foot mixed use property located on the corner of East 48th Street and 3rd Avenue. The elevatored building, which contains 289 residential units and 16,000 square feet of retail space, sold for $907 per square foot. The sale marks the first time in 64 years ownership changed hands. In the West Village, Benchmark Real Estate Group sold 194 West 10th Street, a 20-unit walk-up building, for $13 million, which equates to $1,364 per square foot.

Brooklyn:

Brooklyn bounced back from a sluggish 4Q15 with $766.026 million in gross consideration. Akelius Real Estate Management, the U.S. real estate arm of Swedish investment firm Akelius, continued its Brooklyn multifamily spending, picking up the Mohawk Apartments, a six-building complex in Clinton Hill, for $56.5 million, or $496 per square foot. The buildings originally made up the Mohawk Hotel until they were converted to apartments in the early 1980’s. Farther south in Flatbush, a 95,000 square foot elevatored building located at 1302 Newkirk Avenue traded hands for $25 million, or $263 per square foot. Prior to the sale, the building had been under the same ownership for the past 40 years.

Northern Manhattan:

Similar to core Manhattan, Northern Manhattan saw a large increase in its average deal size when compared to 1Q15, climbing from $11.12 million to $21.18 million year-over-year. For the quarter, the submarket saw 46 buildings trade across 29 transactions totaling $613.535 million in gross consideration. The trailing six month average cap rate in Northern Manhattan fell below 4%, currently sitting at 3.92%. In Hamilton Heights, the 107,350 square foot Beaumont Apartments located at 730 Riverside Drive, sold for just over $33 million, which translates to $310 per square foot, or $520,820 per unit. The landmarked building was last purchased by A&E Real Estate Holdings in 2013 for $18.2 million.

Bronx:

The Bronx’s multifamily trailing 6-month average price per square foot throughout the borough has reached $172 and trailing 6-month average cap rate has compressed to just below 5.25%. The largest single asset to trade hands over the course of the quarter was 1511 Sheridan Avenue in Mount Hope, which sold for $34.711 million, or $171 per square foot. In Kingsbridge, a 93,767 square-foot elevatored building located at 3873 Orloff Avenue sold for $19 million, which equates to $202 per square foot and a sub-5% cap rate.

Queens:

Queens had 20 transactions made up of 24 buildings totaling $335.903 million in gross consideration. 42% of the borough’s dollar volume was recorded over the course of two days in January, combining for $140 million. 41-23 Crescent Street in Long Island City, a 140,000 square-foot mixed use building, sold for $97 million, or $693 per square foot. The sale marked the third time in four years the building has traded hands since its completion in 2012. In Flushing, 142-20 Franklin Avenue, a 142-unit elevatored building, sold for $43 million, which equates to $333 per square foot.

Tags:

Brokerage

MORE FROM Brokerage

AmTrustRE completes $211m acquisition of 260 Madison Ave.

Manhattan, NY AmTrustRE has completed the $211 million acquisition of 260 Madison Ave., a 22-story, 570,000 s/f office building. AmTrustRE was self-represented in the purchase. Darcy Stacom and William Herring

Quick Hits

Columns and Thought Leadership

Strategic pause - by Shallini Mehra and Chirag Doshi

Many investors are in a period of strategic pause as New York City’s mayoral race approaches. A major inflection point came with the Democratic primary victory of Zohran Mamdani, a staunch tenant advocate, with a progressive housing platform which supports rent freezes for rent

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Last month Bisnow scheduled the New York AI & Technology cocktail event on commercial real estate, moderated by Tal Kerret, president, Silverstein Properties, and including tech officers from Rudin Management, Silverstein Properties, structural engineering company Thornton Tomasetti and the founder of Overlay Capital Build,

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Let’s be real: if you’re still only posting photos of properties, you’re missing out. Reels, Stories, and Shorts are where attention lives, and in commercial real estate, attention is currency.

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

The state has the authority to seize all or part of privately owned commercial real estate for public use by the power of eminent domain. Although the state is constitutionally required to provide just compensation to the property owner, it frequently fails to account

.jpg)

.gif)

.gif)