News:

Brokerage

Posted: February 11, 2016

Ariel Property Advisors releases "Manhattan 2015 Year-End Sales Report"

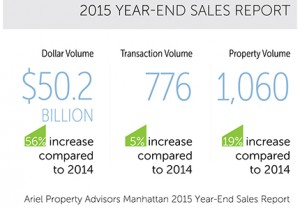

New York, NY Manhattan investment property sales skyrocketed in 2015, reaching a total dollar volume of $50.2 billion, a 56% increase from 2014, as reported by Ariel Property Advisors’ newly released, “Manhattan 2015 Year-End Sales Report.” For the year, 1,060 investment properties traded over 776 transactions in Manhattan compared to 2014, which saw 736 transactions comprised of 891 properties totaling $32.1 billion in gross consideration.

The massive upsurge in Manhattan’s 2015 total dollar volume can partly be credited to several unique trades in Midtown East, which led the borough with $26.197 billion in spending. Transactions like the enormous $2.29 billion sale of 11 Madison Avenue was the largest single building trade in Manhattan since the 2008 acquisition of the General Motors Building and one of the largest commercial real estate transactions in U.S. history.”

“Excluding the $5.5 billion sale of Stuyvesant Town / Peter Cooper Village, the multifamily asset class was extremely dynamic in 2015, with $7.81 billion spent on 296 transactions and 508 properties, which represent a 21% increase in dollar volume compared to 2014,” said Howard Raber, vice president of Ariel Property Advisors.

The average multifamily price per square foot, price per unit and gross rent multiple all showed moderate growth despite capitalization rates being roughly even, year-over-year. Investors seeking prime long-term financing opportunities continued to pay premium costs, as demonstrated by Stone Street Properties’ purchase of two rental buildings situated at 210 and 220 East 22nd St. for $123 million, or $972 per s/f.

In addition to the continuing strength in the rental market, there was an increased demand for condominium conversion projects, such as the sale of 520 5th Avenue to Ceruzzi Properties and Chinese partner, SMI USA for $275 million. The site is slated to become a newly constructed 71-story tower which will offer retail space, condominiums and a hotel, according to plans filed by the developer.

A wave of interest from international investors was seen throughout 2015 with sales like the landmark Waldorf Astoria Hotel situated at 301-319 Park Ave. for $1.95 billion to Anbang Insurance Group Co. of China. This trade set a new record as the highest price paid for a hotel in the U.S.

“An incredible $23.5 billion was spent in total dollar volume by foreign investors,” said Jesse Deutch, vice president at Ariel Property Advisors. “This data emphasizes that Manhattan served as a very attractive destination in 2015 for financiers who wished to capitalize on its mix of an aggressive residential market, growing retail presence and rising hotel costs.”

Manhattan development site sales volume went up by 36%, reaching $8.53 billion year-over-year, while the number of transactions increased only 5% due to several development site transactions selling for millions of dollars. The $870 million purchase of an entire block at 501 West 17th St. by HFZ is a prime example of this trend.

Rising rents supported by a growing economy drove another historic year for office building deals in 2015. A noteworthy transaction was the sale of the landmarked Helmsley building at 230 Park Avenue which traded for $1.207 billion to Blackstone Group and RXR realty, who are planning to upgrade both the office and retail space. On a smaller scale, 88 University Place, a $70 million building in the West Village traded for approximately $1,000 per s/f and 34 Howard Street in Soho sold for $13.8, or $1,030 per s/f.

Manhattan’s market for commercial / retail properties was very active in 2015, seeing dollar volume rise by 20% to $8.65 billion and transaction volume increase by 10% for a total of 107 deals. A notable trade includes Kushner Companies’ $296 million purchase of a retail condo at the former New York Times building, located at 229 West 43rd Street, which translates to $1,184 per s/f. On a smaller scale, a retail site at 202 Canal Street sold for $48 million or $2,800 per s/f.

The borough’s most transactional areas were the Upper East Side, which saw 31 multifamily transactions totaling $500 million in gross consideration, and the Lower Manhattan neighborhoods of the East Village, Lower East Side and Chinatown, which together saw 40 transactions totaling $891 million.

Tags:

Brokerage

MORE FROM Brokerage

Horizon Kinetics relocates new headquarters to Tishman Speyer’s Rockefeller Center

Manhattan, NY According to Tishman Speyer investment boutique Horizon Kinetics Asset Management LLC will relocate its current New York office to 18,713 s/f on the 27th floor of 1270 Avenue of the Americas at

Columns and Thought Leadership

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

The state has the authority to seize all or part of privately owned commercial real estate for public use by the power of eminent domain. Although the state is constitutionally required to provide just compensation to the property owner, it frequently fails to account

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Last month Bisnow scheduled the New York AI & Technology cocktail event on commercial real estate, moderated by Tal Kerret, president, Silverstein Properties, and including tech officers from Rudin Management, Silverstein Properties, structural engineering company Thornton Tomasetti and the founder of Overlay Capital Build,

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Let’s be real: if you’re still only posting photos of properties, you’re missing out. Reels, Stories, and Shorts are where attention lives, and in commercial real estate, attention is currency.

Strategic pause - by Shallini Mehra and Chirag Doshi

Many investors are in a period of strategic pause as New York City’s mayoral race approaches. A major inflection point came with the Democratic primary victory of Zohran Mamdani, a staunch tenant advocate, with a progressive housing platform which supports rent freezes for rent

.jpg)

.gif)

.gif)