News:

Brokerage

Posted: January 20, 2016

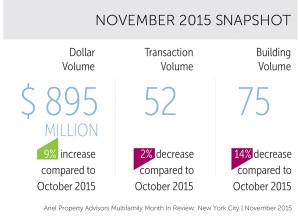

Ariel Property Advisors: New York City’s November multifamily sales reaches $894 million; Market anticipates big finish as year end numbers are finalized

New York, NY Compared to October’s lackluster multifamily figures in New York City, November figures showed an uptick heading into the final month of the year. This fares well for 2015 which is poised to post significant numbers when all the data is tallied, in part due to the sale of Stuyvesant Town and Peter Cooper Village.

For the month, New York City saw 52 transactions comprised of 75 buildings totaling $894.9 million in gross consideration. This represents a 47% increase in dollar volume, a 5% decrease in transaction volume and a 26% decrease in building volume compared to November 2014, which saw 55 transactions comprised of 102 buildings totaling $606.781 million in gross consideration.

Manhattan led the city in terms of dollar, transaction and building volume with 23 buildings trading across 15 transactions totaling $573.334 million in gross consideration – accounting for almost two thirds of the month’s total dollar volume. A joint venture consisting of Slate Property Group and GreenOak Real Estate purchased the RiverTower at 420 East 54th St. for $390 million, marking the month’s largest transaction. The tower, which sold for $944 per s/f, was originally developed by Harry Macklowe in 1984.

Brooklyn experienced a solid month with 14 transactions consisting of 23 buildings totaling $139.5 million in gross consideration, a 24 percent increase from November 2014. The borough’s largest transaction took place in Bedford-Stuyvesant, where Black Spruce Management purchased a package of two elevatored rental buildings for a combined $39 million, which equates to $481 per s/f. In Sheepshead Bay, an 84,375 s/f elevatored building located at 2306 Ocean Avenue sold for $15.6 million, or $185 per s/f.

Northern Manhattan had another relatively quiet month in November as the submarket saw 10 buildings trade across 5 transactions totaling $65.212 million in gross consideration. In Central Harlem, 137 West 137th St. sold for $12 million, or $388 per s/f, which is more than double what the sellers purchased the asset for in 2007. In Washington Heights, a 35,135 s/f walk-up building located at 133-143 St. George Ave. sold for $7.9 million, which translates to $225 per s/f. The asset’s price reportedly translates for close to a 3% cap rate.

The Bronx also registered a quiet month as mostly single-asset trades occurred with 14 buildings trading across 13 transactions totaling $60.279 million in gross consideration. Highbridge was one of the borough’s most active neighborhoods, accounting for the month’s three most expensive sales. One such transaction was the sale of 1514 Sedgwick Ave., a 94,430 s/f elevatored building constructed in 2007. The property sold for $21.65 million, or $229 per s/f and $225,000 per unit.

Queens’ multifamily market saw five transactions totaling $56.575 million in gross consideration. The borough’s largest transaction took place in Ridgewood at 10-71 Cypress Ave. This 44-unit mixed use building sold for $10.575 million or $316 per s/f. In Flushing, a 17,000 s/f mixed use building sold for $6.2 million, translating to $365 per s/f.

For the six months ended in November 2015, the average monthly transaction volume decreased to 61 transactions per month. The average monthly dollar volume also decreased slightly to $1.057 billion.

View the full report here http://arielpa.com/report/report-MFMIR-Nov-2015

New York, NY Compared to October’s lackluster multifamily figures in New York City, November figures showed an uptick heading into the final month of the year. This fares well for 2015 which is poised to post significant numbers when all the data is tallied, in part due to the sale of Stuyvesant Town and Peter Cooper Village.

For the month, New York City saw 52 transactions comprised of 75 buildings totaling $894.9 million in gross consideration. This represents a 47% increase in dollar volume, a 5% decrease in transaction volume and a 26% decrease in building volume compared to November 2014, which saw 55 transactions comprised of 102 buildings totaling $606.781 million in gross consideration.

Manhattan led the city in terms of dollar, transaction and building volume with 23 buildings trading across 15 transactions totaling $573.334 million in gross consideration – accounting for almost two thirds of the month’s total dollar volume. A joint venture consisting of Slate Property Group and GreenOak Real Estate purchased the RiverTower at 420 East 54th St. for $390 million, marking the month’s largest transaction. The tower, which sold for $944 per s/f, was originally developed by Harry Macklowe in 1984.

Brooklyn experienced a solid month with 14 transactions consisting of 23 buildings totaling $139.5 million in gross consideration, a 24 percent increase from November 2014. The borough’s largest transaction took place in Bedford-Stuyvesant, where Black Spruce Management purchased a package of two elevatored rental buildings for a combined $39 million, which equates to $481 per s/f. In Sheepshead Bay, an 84,375 s/f elevatored building located at 2306 Ocean Avenue sold for $15.6 million, or $185 per s/f.

Northern Manhattan had another relatively quiet month in November as the submarket saw 10 buildings trade across 5 transactions totaling $65.212 million in gross consideration. In Central Harlem, 137 West 137th St. sold for $12 million, or $388 per s/f, which is more than double what the sellers purchased the asset for in 2007. In Washington Heights, a 35,135 s/f walk-up building located at 133-143 St. George Ave. sold for $7.9 million, which translates to $225 per s/f. The asset’s price reportedly translates for close to a 3% cap rate.

The Bronx also registered a quiet month as mostly single-asset trades occurred with 14 buildings trading across 13 transactions totaling $60.279 million in gross consideration. Highbridge was one of the borough’s most active neighborhoods, accounting for the month’s three most expensive sales. One such transaction was the sale of 1514 Sedgwick Ave., a 94,430 s/f elevatored building constructed in 2007. The property sold for $21.65 million, or $229 per s/f and $225,000 per unit.

Queens’ multifamily market saw five transactions totaling $56.575 million in gross consideration. The borough’s largest transaction took place in Ridgewood at 10-71 Cypress Ave. This 44-unit mixed use building sold for $10.575 million or $316 per s/f. In Flushing, a 17,000 s/f mixed use building sold for $6.2 million, translating to $365 per s/f.

For the six months ended in November 2015, the average monthly transaction volume decreased to 61 transactions per month. The average monthly dollar volume also decreased slightly to $1.057 billion.

View the full report here http://arielpa.com/report/report-MFMIR-Nov-2015

Tags:

Brokerage

MORE FROM Brokerage

AmTrustRE completes $211m acquisition of 260 Madison Ave.

Manhattan, NY AmTrustRE has completed the $211 million acquisition of 260 Madison Ave., a 22-story, 570,000 s/f office building. AmTrustRE was self-represented in the purchase. Darcy Stacom and William Herring

Columns and Thought Leadership

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Last month Bisnow scheduled the New York AI & Technology cocktail event on commercial real estate, moderated by Tal Kerret, president, Silverstein Properties, and including tech officers from Rudin Management, Silverstein Properties, structural engineering company Thornton Tomasetti and the founder of Overlay Capital Build,

Strategic pause - by Shallini Mehra and Chirag Doshi

Many investors are in a period of strategic pause as New York City’s mayoral race approaches. A major inflection point came with the Democratic primary victory of Zohran Mamdani, a staunch tenant advocate, with a progressive housing platform which supports rent freezes for rent

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

The state has the authority to seize all or part of privately owned commercial real estate for public use by the power of eminent domain. Although the state is constitutionally required to provide just compensation to the property owner, it frequently fails to account

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Let’s be real: if you’re still only posting photos of properties, you’re missing out. Reels, Stories, and Shorts are where attention lives, and in commercial real estate, attention is currency.

.jpg)

.gif)

.gif)