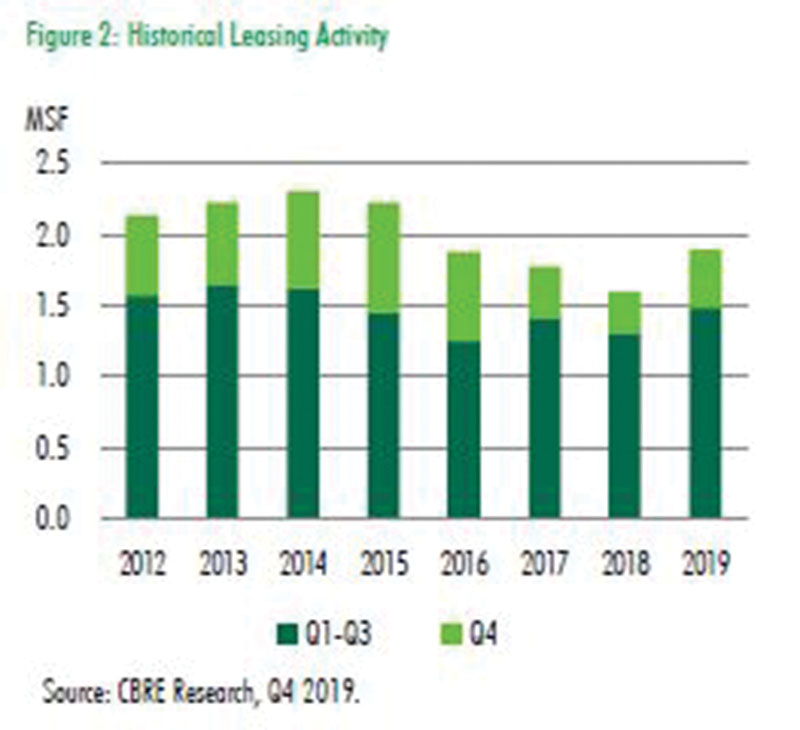

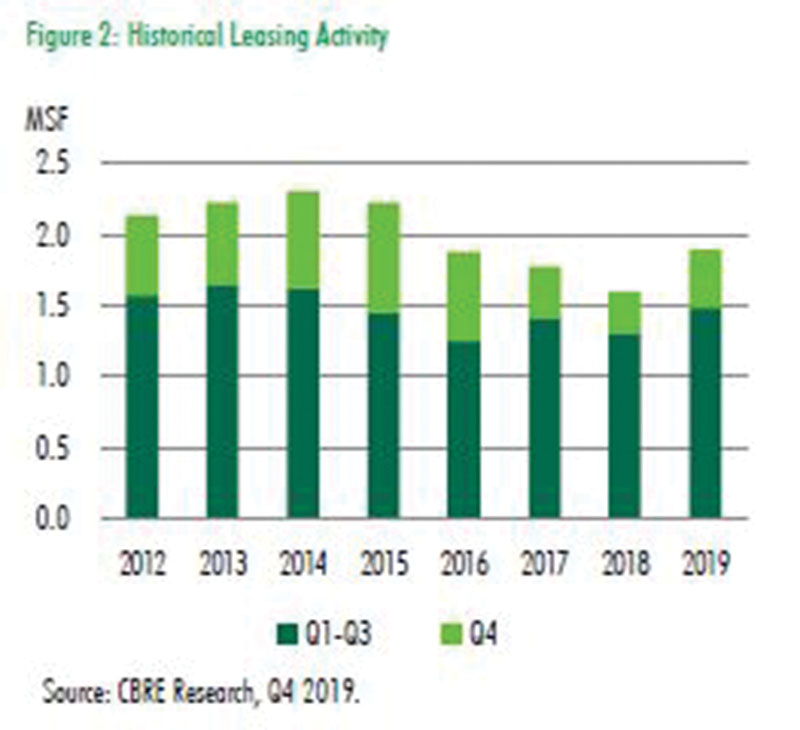

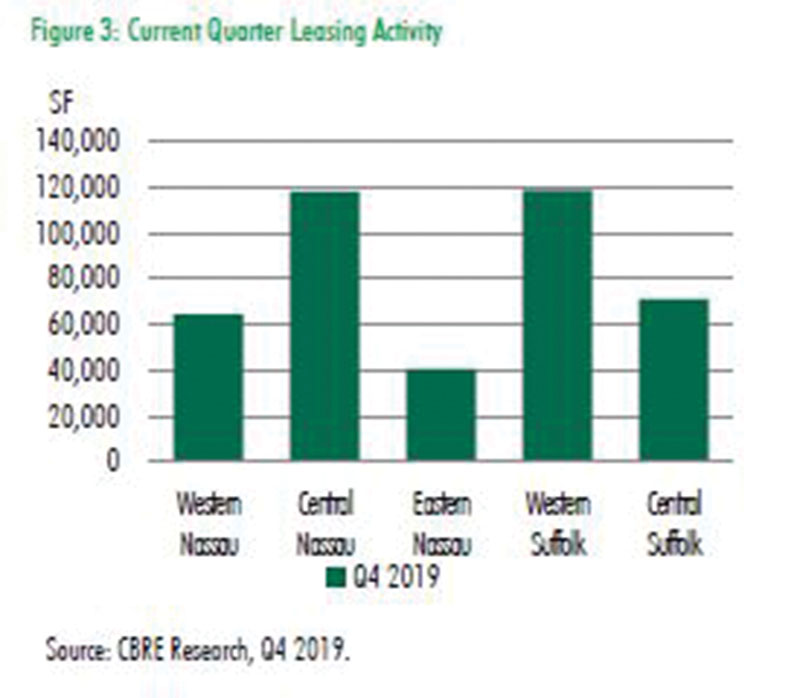

The Long Island office market maintained its strength throughout the final quarter of 2019, closing out the year with the highest volume of year-end leasing activity since 2016. According to our most recent data produced by CBRE’s Long Island office, the market experienced 412,000 s/f of total leasing activity during the fourth quarter, a 6% increase from the previous quarter. This brought the overall year-to-date activity total to 1.89 million s/f, a 19% jump from 2018’s year-to-date total. A new trend we observed was the substantial demand for class B office space on Long Island, which account for 56% of the quarter’s lease transactions.

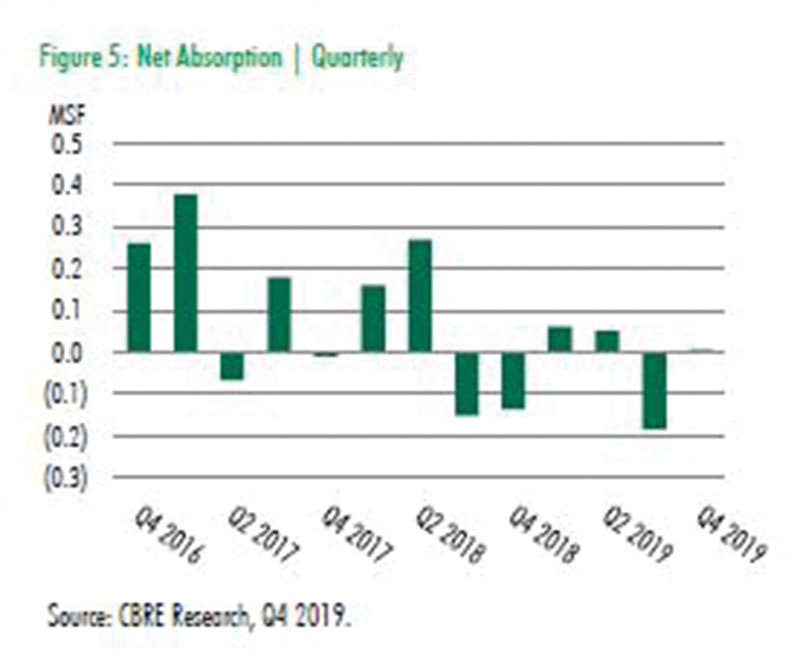

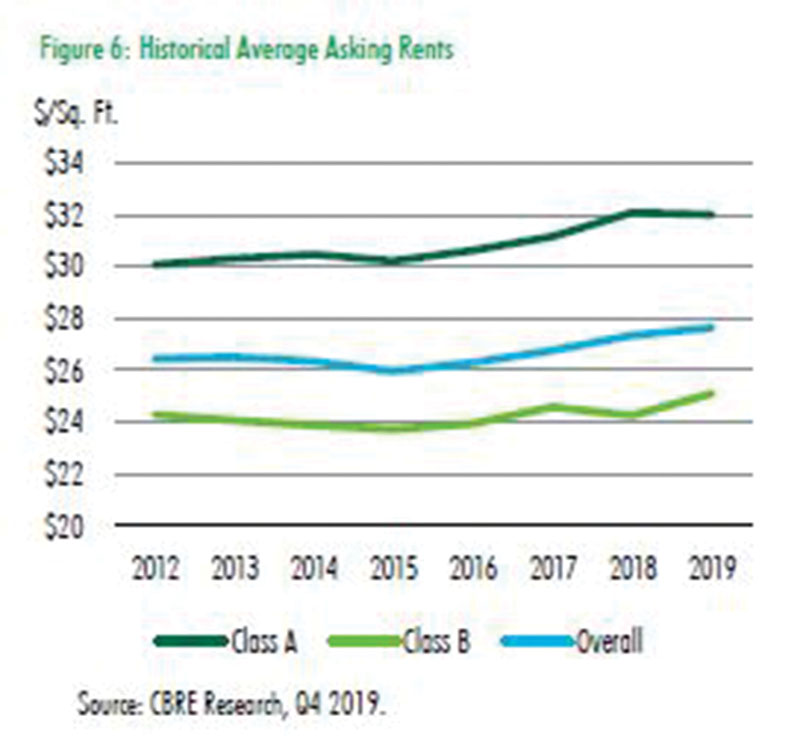

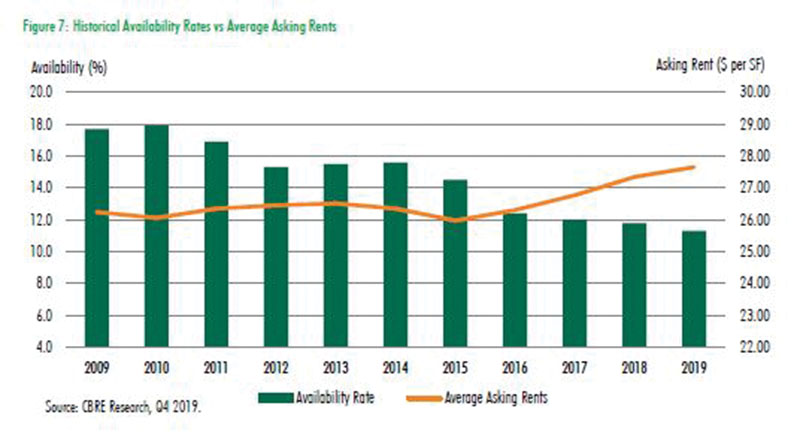

Despite the impressive leasing velocity, the total square footage leased during Q4 fell below the five-year quarterly average. However, the quarter’s strong performance helped propel Long Island into positive net absorption, increasing 6,650 s/f from the third quarter. As a result, overall asking rents remained steady throughout the year, ending the quarter at $27.65 per s/f. Availability on Long Island hovered at 11.3%, relatively unchanged from the previous quarter and down 11.8% from this time last year.

Additionally, we witnessed office transaction volume increase on Long Island in 2019 from the previous year, totaling $46.5 million and bringing the year-to-date figure to $353 million. The top sale of the quarter was the $31 million acquisition of 585 Stewart Ave. in Garden City, KMR Equity Partners’ 155,000 s/f office building and JFR Global Investments’ 550,000 s/f acquisition at 900 and 990 Stewart Ave. in Garden City for $91 million was one of the largest sales of the year.

Between the steady demand and rising asking rates, the momentum on Long Island is poised to continue throughout 2020.

Janet Wachter is a senior research analyst at CBRE Long Island, Melville, N.Y.

When Environmental Site Assessments (ESA) were first part of commercial real estate risk management, it was the lenders driving this requirement. When a borrower wanted a loan on a property, banks would utilize a list of “Approved Consultants” to order the report on both refinances and purchases.