Top Stories

Aufgang Architects designs two 100%

affordable multifamily projects totaling 446 units

Bronx, NY Aufgang Architects has released details on two new, award winning, 100% affordable multifamily design projects. An 18-story 266-unit building at 860 Village Concourse East, featuring a community health services facility, is being developed by Gilbane. At 1810 Randall Ave., an eight story 180-unit building is being developed by Vertical Community Development

Merrell, Monahan and Delisle of Island Associates

sell 8,388 s/f retail building for $2 million

Franklin Square, NY Island Associates has completed the sale of an 8,388 s/f retail property located at 636 Hempstead Tpke., formerly home to Movin’ On Sounds, for a purchase price of $2 million.

Arrow Real Estate Advisors arranges $46 million refinance

for The Marshall at Rochester

West Henrietta, NY Arrow Real Estate Advisors arranged a $46 million refinance for The Marshall at Rochester, a Class A student housing community located at 3948 East River Rd. The financing was secured on behalf of Aptitude Development, a national

Mitsui Fudosan America’s vision for 1251 Avenue of the Americas achieves nearly 200,000 s/f of new leasing

Manhattan, NY Mitsui Fudosan America, Inc. (MFA) has completed more than 198,000 square feet of office leasing activity at 1251 Avenue of the Americas. Mitsui Fudosan America has redefined Midtown office space with a strategic $100 million-plus reinvestment into one of the most iconic buildings in Midtown Manhattan,” said John Kessler,

Latest News

Check out NYREJ's Developing Westchester Spotlight!

Check out NYREJ's Devloping Westchester Spotlight!

NYREJ’s Developing Westchester Spotlight is Out Now!

Explore our Developing Westchester Spotlight, featuring exclusive Q&As with leading commercial real estate professionals. Gain insight into the trends, challenges, and opportunities shaping New England’s commercial real estate landscape.

Avison Young brings office portion of 416 West 13th St. to 100%

Manhattan, NY Avison Young has leased 62,364 s/f across eight leases at 416 West 13th St., bringing the office portion of the 144,000 s/f neoclassical Meatpacking District building to 100% occupancy. The lease-up was achieved in six months, a notable accomplishment in a submarket still facing elevated availability.

Dept. of Social Services and Inst. of Community Living celebrate opening of 835 affordable Brooklyn homes

Brooklyn, NY Department of Social Services (DSS) commissioner Molly Wasow Park, and Institute of Community Living (ICL) president Jody Rudin celebrated the opening of 182 deeply affordable homes at 2886 Atlantic Ave. for New Yorkers exiting the shelter system. The opening of the building marks the first Affordable Housing Services (AHS) site in the city, and the creation of 835 deeply affordable homes

Starhill Phase I reaches completion; $189m housing dev. led by S:US and NY Homes and Comm. Renewal

Bronx, NY According to New York State Homes and Community Renewal commissioner RuthAnne Visnauskas, Starhill Phase I, a $189 million affordable housing development featuring 326 affordable apartments, including 200 supportive apartments for individuals struggling with homelessness, has been completed. Under governor Hochul’s leadership,

Cronheim Hotel Capital secures $18 million for Residence Inn Middletown

Middletown, NY Cronheim Hotel Capital (CHC) has secured an $18 million permanent loan for the Residence Inn Middletown Goshen. The five-year fixed-rate loan is interest only for the full term. The hotel opened in 2020 and is located near numerous corporate demand drivers.

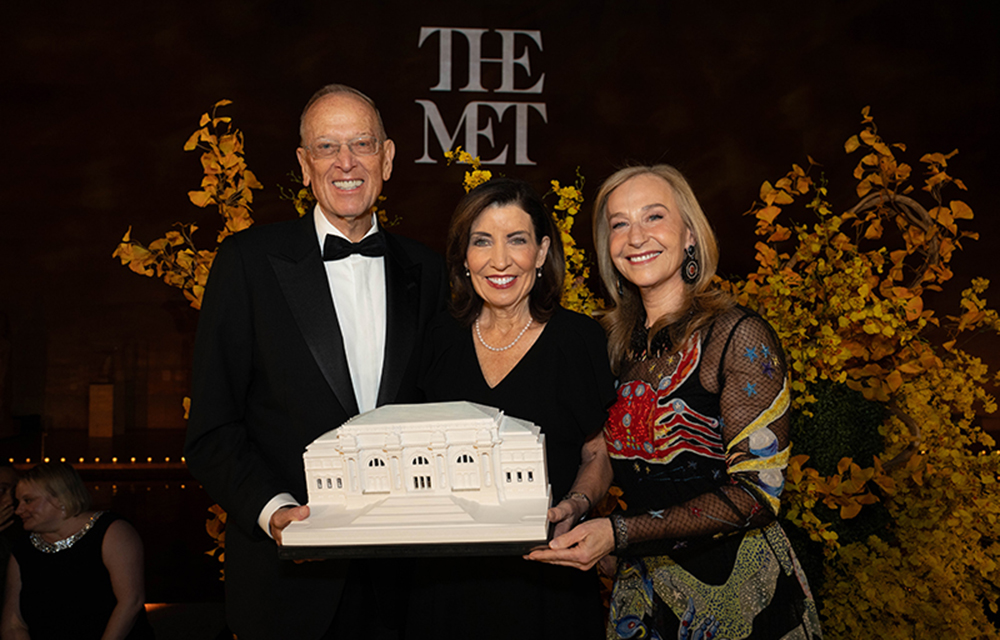

The Levines of Douglaston Development honored at Met Real Estate Council Benefit

Manhattan, NY Douglaston Development chairman and founder, Jeffrey Levine and former U.S. ambassador to Portugal Randi Charno Levine were honored at The Metropolitan Museum of Art’s Real Estate Council Benefit, a signature annual event celebrating leaders in real estate, civic life, and the cultural community. The event brought together industry executives, public-sector leaders,

Most people join their board because they care. They’re volunteering nights and weekends to make their building safer, smarter, and friendlier. Those first 100 days are when that fresh energy can do the most good. Homeowners spend more than 60% of their lives inside their buildings, so every early decision — good or bad — echoes through bedrooms, hallways, and common spaces.

As we head into 2026, one thing is clear: deals aren’t won by who has the best asset; they’re won by who presents it best. Yet many owners, operators, and brokers are entering the new year with outdated photos, inconsistent branding, and limited digital presence. This

In today’s competitive real estate environment, owners, boards, and property managers are increasingly focused on identifying upgrades that improve property value while delivering meaningful benefits to residents. Rising operating costs, limited capital budgets, and heightened

It’s heartening to consider the progress New York City’s commercial market has made since the COVID pandemic. Heading into 2026, New York City’s office market is leading the way nationally in many metrics

The act of borrowing money itself in a self-directed IRA is not a taxable event. However, using borrowed funds (debt financing) to acquire or improve rental properties can subject the IRA to taxes on unrelated debt-financed income (UDFI), which is a form of unrelated business taxable income (UBTI). This means

.gif)

.jpg)

.png)

.gif)

.jpg)

.gif)