1031 exchanges: Proposed legislation & inflation - by Mike Packman

The market environment can change so quickly! A few months ago, the Federal Government was operating under a continuing resolution – with no budget in sight. On March 28th, the Biden administration released its proposed $5.8 trillion budget and, once again, limitations to 1031 exchanges are proposed. In addition, rising interest rates are beginning to impact the sale and purchase of real estate.

Moving a 100-Year-Old Mountain

On March 28th, the Biden Administration proposed a limitation on Section 1031 capital gains deferrals to $500,000 per taxpayer per year (or $1 million for married couples filing jointly). Anything above those amounts would be recognized as capital gains in the year the property transaction occurs.

Once again, our industry finds itself fighting the optics that the 1031 exchange is a tax loophole for the wealthy. The reality is that the median sales price of a property in a 1031 Exchange in 2018 and 2019 was approximately $500,000 according to CoStar. Those of us in the industry know that exchanges have been a valuable real estate investment tool for over one hundred years. While the rules have changed over time, the intent has remained the same—to allow real estate investors to defer—not avoid—capital gains taxes on the sale of a property if they acquire a new property of equal or greater value within the prescribed timeframe of 180 days. In fact, 88% of exchanges lead to a taxable sale.

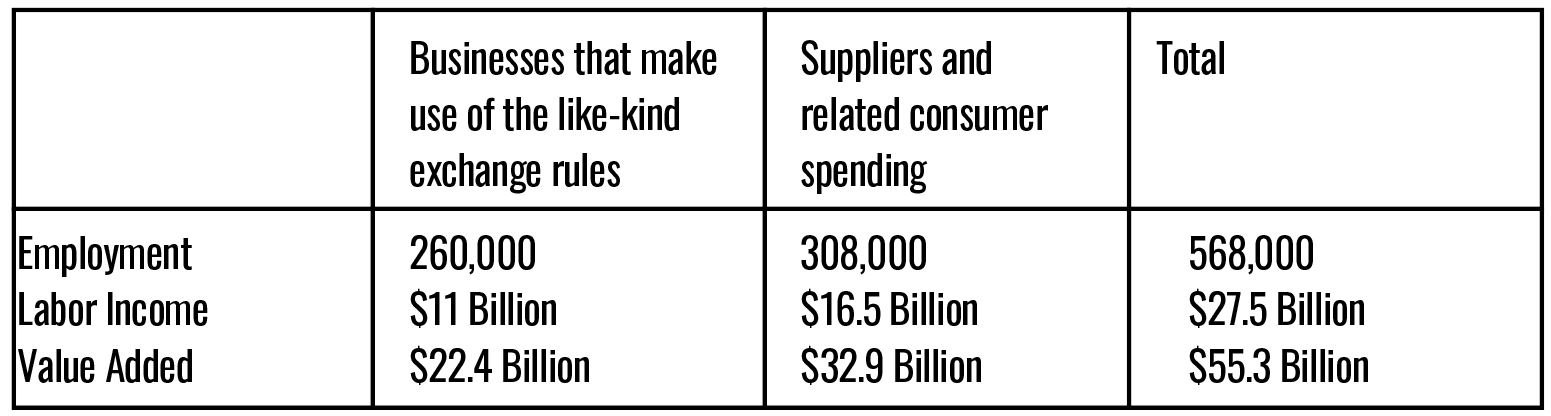

It is worth restating, that the positive impact exchanges have on the economy should not be ignored and is a strong argument for the continuation of exchanges.

Note: All estimates are for economic activity in the United States and are relative to the U.S. economy in 2021. Labor income is a component of value added. Figures are rounded. Source: EY analysis.

Only time will tell if the proposed changes will be realized but what we do know is that the proposal of changes can heighten investor concerns when they are considering the sale of their appreciated asset(s). History has shown that despite many attempts to repeal or change Section 1031, this important section of the tax code has remained virtually unchanged for more than one hundred years.

A Hedge Against Inflation

For some time now, we have felt the pinch of rapidly rising prices. In February of 2022, the annual inflation rate in the United States rose to 7.9% - the highest since January of 1982. The Consumer Price Index (CPI) has seen its highest increase in 40 years. The Federal Reserve originally forecasted inflation to ease towards the end of 2022, but it may be with us for the foreseeable future.

What impact might an inflationary period have on real estate? Increased costs, for one. Labor and construction material costs tend to rise during inflationary periods. This can benefit real estate investors because those shortages can limit supply and increase demand – which can cause property values to rise.

Increased demand for leasable space. As property values rise, so does the demand for leasable space. For property owners tenanting buildings or executing contracted rent increases, there is an opportunity to raise rents at rates that outpace inflation.

The other impact of rising rates can also be the downward pressure on prices. Investors seeking to purchase property right now may have “sticker shock” with current interest rates. Coming off all-time lows, current interest rates may force investors to delay their purchase or lower their purchase price range. If higher interest rates persist, and potential net cash flow decreases with the higher cost of the interest on a loan for the property, values may drop to compensate. Investors expecting a certain cash flow may find that while lower prices will result in higher yield on the property level, rising rates could negate the expected returns.

This environment creates a “balancing act” for investors as one of the benefits of owning real estate is that it acts as a hedge against inflation which makes the case for owning property in this environment. However, you do not want to pay too high a price as that may cause your overall yield to be less you are searching for.

1031 Exchange Demand

Securitized DST exchanges raised more than $7.4 billion in 2021 and projections for 2022 show few signs of slowing down. This is great news for real estate investors seeking to move from active to passive property ownership and defer capital gains tax. With interest rates on the rise, when investors are considering replacement properties, including DST investments, they might want to consider options that provide capital preservation and predictable cash flow.

The Bottom Line

While limitations to 1031 exchanges are proposed, their value to individuals and the economy should not be ignored. Inflation and rising interest rates may cause a slow down in the purchase and sale of real estate but the demand for quality investment properties remains higher than ever. This has caused certain markets to be out of balance while others are beginning to adjust. One thing is certain, it is going to be another interesting year and one where you want to make sure to take your time evaluating opportunities, look at the long-term picture, and do your due diligence!

Mike Packman is founder and CEO of Keystone National Properties (KNPRE), New York, N.Y.

Meridian Capital Group arranges 10-year retail lease for Mess at 236 West 10th St.

Strategic pause - by Shallini Mehra and Chirag Doshi

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

.jpg)

.gif)