New York remains a top market for life sciences research talent according to CBRE analysis

Manhattan, NY The Greater New York market ranked fourth in the nation for life sciences research talent, according to a recent analysis conducted by CBRE. Nationally, the growth of U.S. life sciences researchers remains resilient in the face of economic concerns, with the number of life sciences researchers in the U.S. increasing by 87% over the past 20 years, compared with 14% for all U.S. occupations. Research jobs have not fallen across those 20 years, through three recessions and amid the tight labor market of recent years.

Manhattan, NY The Greater New York market ranked fourth in the nation for life sciences research talent, according to a recent analysis conducted by CBRE. Nationally, the growth of U.S. life sciences researchers remains resilient in the face of economic concerns, with the number of life sciences researchers in the U.S. increasing by 87% over the past 20 years, compared with 14% for all U.S. occupations. Research jobs have not fallen across those 20 years, through three recessions and amid the tight labor market of recent years.

“New York’s high placement is thanks to a dense concentration of talent in the region’s core in the vicinity of Manhattan, Brooklyn, and Queens with additional concentrations of talent in Central New Jersey, Northern New Jersey, Westchester County, and Long Island,” said Bill Hartman, vice chairman of CBRE based in the Midtown New York office.

New York’s robust performance is supported by a workforce of 38,700 life sciences research professionals – the largest in the country – and 9,500 annual relevant degree completions at area universities – also the largest in the country.

“New York’s strong position as a top market for life sciences research talent is bolstered by some of the region’s top universities and colleges, including New York University, Columbia University, Weill Cornell, Rockefeller University, Memorial Sloan Kettering and Stony Brook University,” said Joseph DeRosa, CBRE senior vice president.

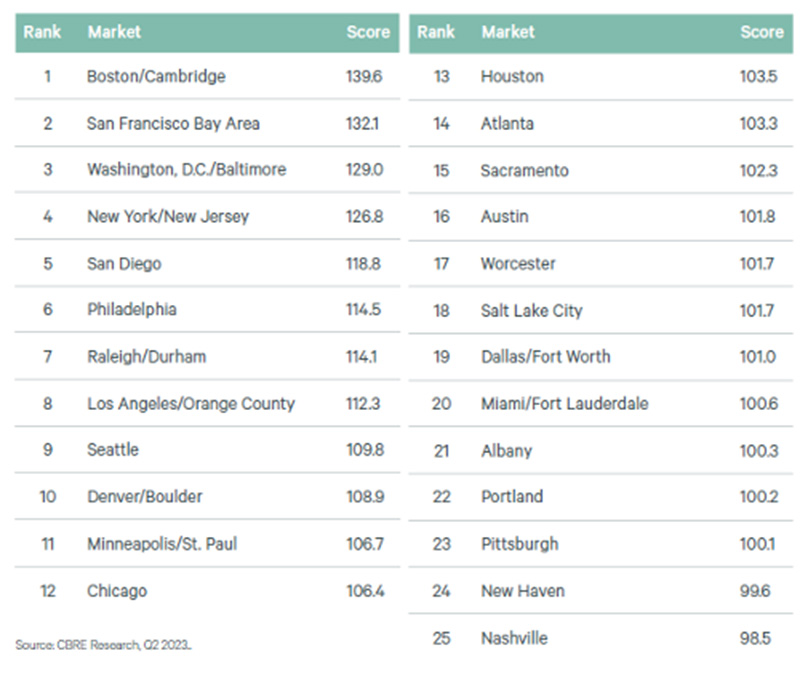

New York is situated at the center of a cluster of life sciences powerhouses that spans 450 miles along the northeast corridor and includes other top-ranked markets including Boston (1), Washington, D.C./Baltimore (3), and Philadelphia (6) and includes promising smaller markets such as Worcester (17), Albany (21), and New Haven (24). Altogether, northeastern markets account for four of the top ten and seven of the top 25 markets. Among the ten leading markets, the Northeast accounts for 57% of life sciences talent and 56% of annual graduates.

According to CBRE’s report, New York boasts some of the highest wages in the life sciences market ranging from $128,274 for biochemists to $98,669 for chemists. The yearly cost of living in the area as of 2021 was $69,246 and the median home value stood at $517,738, while the average apartment rent for a one bedroom was $2,857.

Life sciences research professions – from biochemists to epidemiologists and data scientists – increased in headcount by 3.1% in 2022 to a record 545,000 specialists. In comparison, the overall U.S. job growth rate last year was 2.2%. The continued growth in life sciences research jobs is driven by established markets such as Boston/Cambridge and the San Francisco Bay area and emerging hubs, including Atlanta, Dallas/Fort Worth and Miami/Fort Lauderdale.

CBRE evaluated each of the largest 74 U.S. life sciences labor markets against multiple criteria, including the number and concentration of life sciences researchers, number of new graduates with life sciences degrees and specifically with doctorate degrees in life sciences, concentration of all doctorate degree holders, and concentration of jobs in the broader professional, scientific, and technical services professions. The analysis produced CBRE’s second annual ranking of the leading markets for U.S. life sciences talent.

SABRE coordinates sale of six properties totaling 199,845 s/f

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Strategic pause - by Shallini Mehra and Chirag Doshi

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

.jpg)

.gif)