News:

Brokerage

Posted: March 8, 2017

Inflation and USD: Impact on New York residential real estate - by Donald Dye

On the back of the recent election results, there has been significant discussion of how the broader economy will perform under President Trump's administration. Much analysis has been devoted to the top-line study of how Democratic and Republican administrations impact broader economic growth. At the same time, however, there has also been speculation and analysis around Trump policy impacts on U.S. dollar and inflation and the resulting influences on various asset markets including the New York residential real estate market. General statistical and historical analysis illustrate that, for a variety of reasons, the level of inflation as captured by the Consumer Price Index (CPI) will be a much more important determinant of New York residential real prices than the value of the USD.

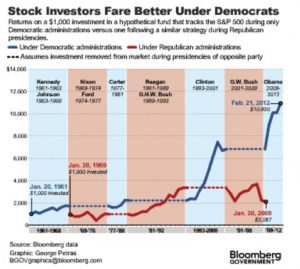

According to a study by Alan Binder and Mark Watson, based on history, looking at economic performance, one contest is clear: the broader economy outperforms under a Democratic presidency by, what the economists call, an “astoundingly large,†1.79% percentage point gap. Their study asserts that analyzing real gross domestic product growth under all the U.S. presidents since World War II, from Truman to Obama, average expansion ran 4.33% under Democrats versus a much lower 2.54% under Republicans. Adjusting for recession changes the relative performance significantly, as Republican administrations were, as Blinder and Watson cite, more likely to be in office when one hits.Â

Averages of daily figures. A weighted average of the foreign exchange value of the U.S. Dollar against the currencies of a broad group of major U.S. trading partners. Broad currency index includes the Euro Area, Canada, Japan, Mexico, China, United Kingdom, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile and Colombia. For more information about trade-weighted indexes see http://www.federalreserve.gov/pubs/bulletin/2005/winter05_index.pdf.

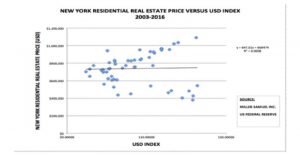

Using very general statistical analysis the level of the USD, as captured by the USD Index (NDY), has over the past 13 years, shown to have little correlation or ultimate influence on the New York residential real estate market. .The USD Index is a weighted average of the foreign exchange value of the U.S. Dollar against the currencies of a broad group of major U.S. trading partners.

Numerous qualitative factors may obfuscate the conclusions that this two-factor regression presents. Aggregation of all residential prices together may blur the impacts that specific currency exchange rates have on various segments of the New York real estate market. The high end of New York, for example, may be impacted more significantly by movements in the Ruble or Renminbi than the US Index illustrates. Moreover, foreign inflows into the New York property market may be driven by local factors (i.e. anti-corruption drives or stock market instability in China) than any specific movement in the U.S. dollar. Other non-market or Central Bank factors such as pegging, central bank interventions and capital flows may drive relative values of exchange rates. Currency markets are as complex yet more unpredictable than real estate.

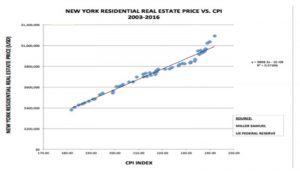

The same analysis applied to the relationship between inflation and the level of New York City residential real estate is more pronounced and sustained.  The conclusion of this basic analysis is that inflation, in this case muted and predictable, shows a very high correlation with the level of New York Sales prices.

In conclusion, with the context of a historical pull for lower economic growth under a Republican president, rises in the CPI may be a stronger predictor for increases in the rise of New York residential real estate prices than the USD. The rate and amount of increases in inflation may prove to be as important as the direction of CPI for the New York Real estate market.

Donald Dye is a founder of Sky Lake Partners, New York, N.Y.

Averages of daily figures. A weighted average of the foreign exchange value of the U.S. Dollar against the currencies of a broad group of major U.S. trading partners. Broad currency index includes the Euro Area, Canada, Japan, Mexico, China, United Kingdom, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile and Colombia. For more information about trade-weighted indexes see http://www.federalreserve.gov/pubs/bulletin/2005/winter05_index.pdf.

Using very general statistical analysis the level of the USD, as captured by the USD Index (NDY), has over the past 13 years, shown to have little correlation or ultimate influence on the New York residential real estate market. .The USD Index is a weighted average of the foreign exchange value of the U.S. Dollar against the currencies of a broad group of major U.S. trading partners.

Numerous qualitative factors may obfuscate the conclusions that this two-factor regression presents. Aggregation of all residential prices together may blur the impacts that specific currency exchange rates have on various segments of the New York real estate market. The high end of New York, for example, may be impacted more significantly by movements in the Ruble or Renminbi than the US Index illustrates. Moreover, foreign inflows into the New York property market may be driven by local factors (i.e. anti-corruption drives or stock market instability in China) than any specific movement in the U.S. dollar. Other non-market or Central Bank factors such as pegging, central bank interventions and capital flows may drive relative values of exchange rates. Currency markets are as complex yet more unpredictable than real estate.

The same analysis applied to the relationship between inflation and the level of New York City residential real estate is more pronounced and sustained.  The conclusion of this basic analysis is that inflation, in this case muted and predictable, shows a very high correlation with the level of New York Sales prices.

In conclusion, with the context of a historical pull for lower economic growth under a Republican president, rises in the CPI may be a stronger predictor for increases in the rise of New York residential real estate prices than the USD. The rate and amount of increases in inflation may prove to be as important as the direction of CPI for the New York Real estate market.

Donald Dye is a founder of Sky Lake Partners, New York, N.Y.

Averages of daily figures. A weighted average of the foreign exchange value of the U.S. Dollar against the currencies of a broad group of major U.S. trading partners. Broad currency index includes the Euro Area, Canada, Japan, Mexico, China, United Kingdom, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile and Colombia. For more information about trade-weighted indexes see http://www.federalreserve.gov/pubs/bulletin/2005/winter05_index.pdf.

Averages of daily figures. A weighted average of the foreign exchange value of the U.S. Dollar against the currencies of a broad group of major U.S. trading partners. Broad currency index includes the Euro Area, Canada, Japan, Mexico, China, United Kingdom, Taiwan, Korea, Singapore, Hong Kong, Malaysia, Brazil, Switzerland, Thailand, Philippines, Australia, Indonesia, India, Israel, Saudi Arabia, Russia, Sweden, Argentina, Venezuela, Chile and Colombia. For more information about trade-weighted indexes see http://www.federalreserve.gov/pubs/bulletin/2005/winter05_index.pdf.

Tags:

Brokerage

MORE FROM Brokerage

AmTrustRE completes $211m acquisition of 260 Madison Ave.

Manhattan, NY AmTrustRE has completed the $211 million acquisition of 260 Madison Ave., a 22-story, 570,000 s/f office building. AmTrustRE was self-represented in the purchase. Darcy Stacom and William Herring

Quick Hits

Columns and Thought Leadership

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

The state has the authority to seize all or part of privately owned commercial real estate for public use by the power of eminent domain. Although the state is constitutionally required to provide just compensation to the property owner, it frequently fails to account

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Let’s be real: if you’re still only posting photos of properties, you’re missing out. Reels, Stories, and Shorts are where attention lives, and in commercial real estate, attention is currency.

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Last month Bisnow scheduled the New York AI & Technology cocktail event on commercial real estate, moderated by Tal Kerret, president, Silverstein Properties, and including tech officers from Rudin Management, Silverstein Properties, structural engineering company Thornton Tomasetti and the founder of Overlay Capital Build,

Strategic pause - by Shallini Mehra and Chirag Doshi

Many investors are in a period of strategic pause as New York City’s mayoral race approaches. A major inflection point came with the Democratic primary victory of Zohran Mamdani, a staunch tenant advocate, with a progressive housing platform which supports rent freezes for rent

.jpg)

.gif)

.gif)