Fletcher of Greystone arranges $413m for Douglaston and Ares; HSBC leads financing syndicate; design by FXCollaborative

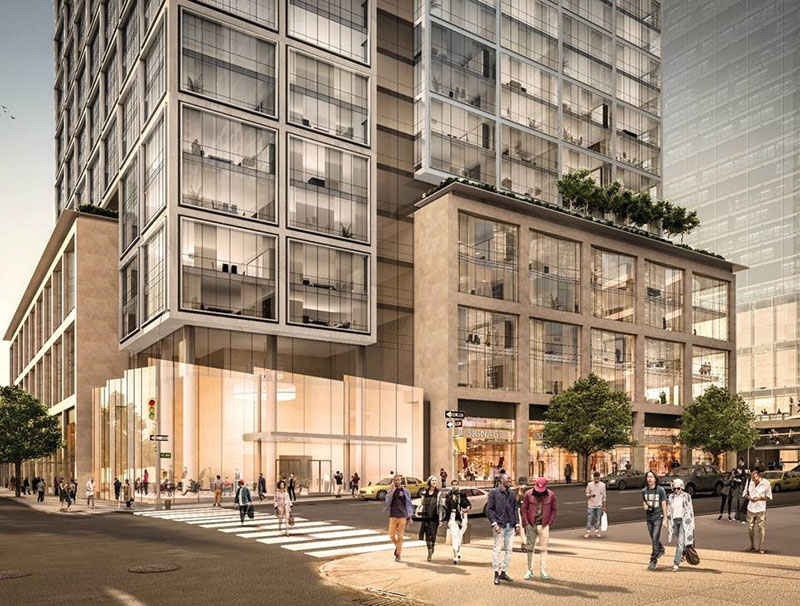

Manhattan, NY Greystone has arranged equity and debt for Douglaston Development’s 931-unit mixed-use residential development at 601 W. 29th St. Spanning the full block-front on 11th Ave. between 29th and 30th Sts., the project site is located at the crossroads of West Chelsea and Hudson Yards. An affiliate of Ares Management LLC, a U.S.-based publicly traded alternative asset manager, has committed to invest joint-venture equity into the project, and a syndicate of banks led by HSBC, with co-lenders Bank of China and Landesbank Hessen-Thüringen (Helaba), provided a $415 million construction loan. Santander Bank and Raymond James Bank also participated in the loan facility.

Greystone

Greystone’s Structured Finance Group, led by president Drew Fletcher, was tapped to serve as exclusive advisor on behalf of Douglaston and Ares in arranging the full capital stack for the project. Paul Fried, executive managing director and head of equity capital markets for Greystone’s debt and equity advisory platform, led the effort to raise the joint-venture equity, with support from vice president Matthew Hirsch and associate Bryan Grover, who also contributed to the debt raise. Ken Lore from Katten Muchin Rosenman LLP and Shapiro & Gellert PLLC served as transaction counsel for the joint-venture.

Designed by FXCollaborative, the project will consist of 931 residential units, 697 market-rate units and 234 units reserved for residents earning an average of 60% of area median income. The project also includes 186 parking spaces and 15,000 s/f of class A retail. Demolition and site work are underway, and the project is expected to open in 2023.

“The Douglaston team did an incredible job assembling the site and creating what will undoubtedly become one of New York City’s signature multifamily developments. We are extremely proud to have represented both Douglaston and Ares on this market-leading transaction,” said Fletcher.

“The combination of elite sponsorship, great basis, and an unparalleled location adjacent to Hudson Yards creates a truly one-of-a-kind opportunity for an institutional investor like Ares,” said Fried.

Marked by its early entry into the Far West Side in 2010 with its 369-unit residential property, Ohm, Douglaston was one of the first developers to recognize the potential for the area to become a premier residential neighborhood. Over a five-year period, Douglaston assembled and rezoned the Ohm’s large, underutilized project site and structured a 99-year ground lease to create residential development opportunities located on the High Line and close to Hudson Yards.

Douglaston’s chairman Jeffrey Levine and president Steven Charno in a joint statement said: “Douglaston is thrilled to kick-off our new partnership with Ares on this ground-breaking development. We are equally proud to deepen our relationship with Greystone. Drew and his team demonstrated incredible commitment working alongside us for nearly four years as we rezoned the site. Their professionalism, market knowledge and credibility with capital providers enabled us to achieve a financing structure that exceeded our expectations and created significant value for the project.”

AmTrustRE completes $211m acquisition of 260 Madison Ave.

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Strategic pause - by Shallini Mehra and Chirag Doshi

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

.jpg)

.gif)

.gif)