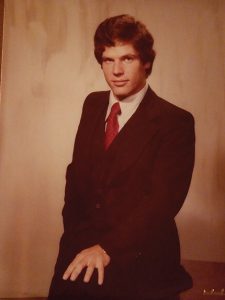

Executive of the Month: Steven Levy, principal of Kamber Management Co.

New York, NY Steven Levy, principal of Kamber Management Company, sat down with the New York Real Estate Journal for a Question & Answer session.

Q: How did you get your start in real estate?

A: During my junior year at Connecticut College, I had the opportunity to work with a developer focused on the J51 conversion of office space to apartments in Manhattan. I was intrigued by the creativity and reuse of a property that was built for one purpose, yet was being updated to serve another. Upon graduation, Mike Solomon and Rick Marek of Julien Studley hired me and I haven’t looked back. By the way, for all those Liberal Arts education skeptics, Mike confided to me two years later that he hired me because he was impressed with how creative I was with my self-designed, interdisciplinary major.

Q: Given your family’s background in real estate, did you always have it in the back of your mind to join the field in one capacity or another?

A: My grandfather, Abraham Kamber, was a skilled real estate investor and owned several major properties throughout New York City, Philadelphia, Pittsburgh and Chicago. To me, however, he was simply “Grandpa.” Our business was family and not square footage. Sadly, I landed the job at Studley the day before his passing. The only advice he gave me about business stuck: “get tenants.”

Q: Can you talk about some of the deals that would have made your Grandpa proud?

A: Three years into Studley, I left the company to join William White & Sons as a sales broker. One of my first major deals was brokering the sale of 461 Eighth Ave. which was renamed 5 Penn Plaza – which was my idea, by the way. To think that the building sold for a mere $17 million – a 550,000 s/f property with and an additional 33,000 s/f on a thru-block parking lot to its west, is a reminder of how far New York real estate has come. That same year, Richie Rosenthal, Lou Smadbeck and I were the recipients of REBNY’s “Most Ingenious Deal” award for the sale of 1560 Broadway. The transaction made it possible for the Actors’ Equity Union to remain in the heart of the Theater District. That deal remains one of the highlights of my career and seeing the pride on my grandmother’s face when I was given that prestigious award made it even sweeter. That was an unforgettable moment.

Q: Who do you consider to be your greatest influence?

A: My father, despite that fact that he was an attorney who was not active in the real estate industry, taught me the fundamentals of how to conduct myself in business. In 1986, I decided to join my father and build a family office. I reviewed, rationalized and organized our investments and created a corporate structure which allowed us to take the right amount of risk in order to reap the benefits of my grandfather’s acquisitions. One year after joining my father, I brokered the sale of the former Siegel Cooper Department Store at 620 Sixth Ave. to Tishman Speyer Properties. I remember using the commission for the equity in my first house in Greenwich. Since that time, I have managed and leased our family’s real estate interests as well as the firm’s broader spectrum of investments. My brother Peter joined us in 1989 after graduating from Columbia with a masters of architecture degree.

Q: What are some of the nuances of working in a family business?

A: Working side-by-side with the people you trust most in life, the people you admire and the people with whom you spend your holidays is rewarding. Succeeding for them has become the driving force behind all of my decisions. It is a responsibility that I take very seriously.

The company’s business objective has always been to gain equity by discerning value and growth in the acquisition of office or mixed use properties. Equally important has been our commitment to maintaining long-standing relationships with partners, tenants and vendors. I value my long relationships with tenants. They foster trust and loyalty.

Q: How has the industry changed since you first joined and since you started running your family business?

A: The rise of the REIT has certainly “corporatized” the industry. During my Studley days, brokers took an “on-the-ground” approach to sales and leasing. Today’s approach is much more Internet-driven. Technology has enabled our industry to push forward in many ways that we would have otherwise deemed impossible. A longtime friend of mine though, a giant in the retail business who did not go to college likes to say, “I have an MBABW: a Masters of Business Administration by Walking.” That is to say that there is no substitute for being “on the ground and talking to people.” That is true for real estate as well as retail.

Q: What do you think of as the largest driving force of Kamber Management’s success through the years?

A: Kamber Management has a history of being early adopters of proven technologies. We started with a 32 kb “pre-PC” computer in the mid 70’s. The advent of the PC revolutionized our office. I actually ended up writing the programs that ran our business for 15 years. It should not be so surprising given there were no accounting and management programs back then.

Technology continues to be the driving force of our platform. As the latest example of maintaining this philosophy, Kamber Management has installed AtmosAir, a new state-of-the-art air quality system, throughout the entire Tower 45 building. We can now say that Tower 45 has the freshest air in Manhattan with all the attendant health benefits.

Q: That is very impressive. Can you tell us a bit more about the Tower 45 purchase?

A: We purchased our “crown jewel,” the 40-story, 458,446 s/f class-A office building in the fall of 2015 after trading the leasehold at 1407 Broadway and 20 West 33rd St. This building has been widely recognized for its boutique size floor plates and incredible vista views. Within only a few months after acquiring the building, we embarked on a first-class restoration and modernization of the property, which includes renovation of the HVAC systems, the replacement of building management, security and communications systems and elevator cabs. We are currently working with Pei Cobb Freed & Partners and have engaged Milo Kleinberg Design Associates on new interior design concepts. Avison Young is managing the leasing. As you can tell, we have an all-star team in place and I would not have it any other way.

Q: What else is in the Kamber Management portfolio?

A: The current Kamber Management portfolio consists of more than one million s/f of office and retail space in New York City, Long Island, Connecticut, Maryland, Illinois, North and South Carolina, and Texas. Our other New York-based interests include 15 West 37th St. as well as a busy neighborhood shopping center known as New City Center in Rockland County.

Q: What is in the cards for 2017?

A: Capital improvement plans, seeking out new tenants and keeping an open mind regarding new potential opportunities in both the commercial and residential space. We will be looking to buy more property this coming summer.

AmTrustRE completes $211m acquisition of 260 Madison Ave.

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

Strategic pause - by Shallini Mehra and Chirag Doshi

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

.jpg)

.gif)