Kay Properties

About Kay Properties and www.kpi1031.com

Kay Properties team members have helped over 2,270 investors nationwide purchase over 9,100 Delaware Statutory Trust investments, have over 340 years of combined real estate, 1031 exchange and DST experience and have participated in over $39 Billion of DST 1031 exchange offerings.

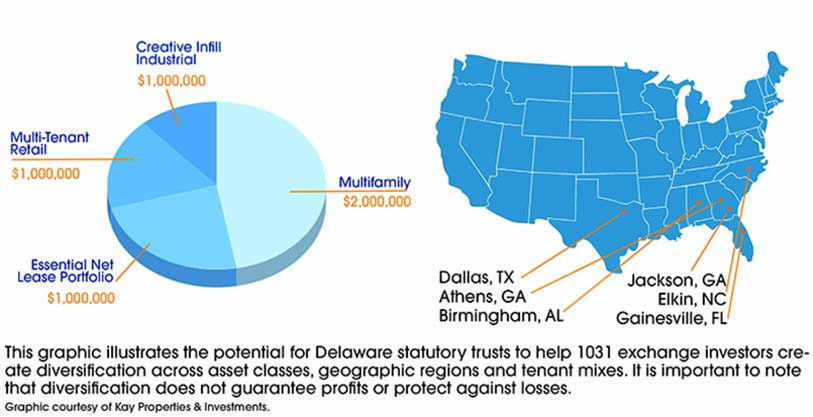

The kpi1031.com platform provides 1031 exchange investors access to typically 20-40 DST offerings from over 25 different sponsor companies as well as custom DSTs only available to Kay clients. Login today to view our current DST inventory at kpi1031.com

Past performance does not guarantee or indicate the likelihood of future results. Diversification does not guarantee profits or protect against losses. All real estate investments provide no guarantees for cash flow, distributions or appreciation as well as could result in a full loss of invested principal. Please read the entire Private Placement Memorandum (PPM) prior to making an investment. This case study may not be representative of the outcome of past or future offerings. Please speak with your attorney and CPA before considering an investment.

There are material risks associated with investing in real estate, Delaware Statutory Trust (DST)properties and real estate securities, including illiquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short-term leases associated with multifamily properties, financing risks, potential adverse tax consequences, general economic risks, development risks and long hold periods. All offerings discussed are Regulation D, Rule 506c offerings. There is a risk of loss of the entire investment principal. Past performance is not a guarantee of future results. Potential distributions, potential returns, and potential appreciation are not guaranteed. For an investor to qualify for any type of investment, there are both financial requirements and suitability requirements that must match specific objectives, goals, and risk tolerances. Securities offered through FNEX Capital, member FINRA, SIPC.

Potential distributions, potential returns, and potential appreciation are not guaranteed. For an investor to qualify for any type of investment, there are both financial requirements and suitability requirements that must match specific objectives, goals, and risk tolerances. Securities offered through FNEX Capital, member FINRA, SIPC.

.gif)