CBRE handles $79.5 million sale of Chappaqua Crossing

Chappaqua, NY CBRE brokered the $79.5 million sale of Chappaqua Crossing, a 120,986 s/f grocery-anchored shopping center in Westchester County. The CBRE team of Jeffrey Dunne, David Gavin, Steve Bardsley, Jeremy Neuer and Travis Langer represented the owner, a joint venture between Summit Development and The Grossman Cos., while also procuring the buyer, an investment management firm. In 2017, CBRE also structured the joint venture for the development of the center.

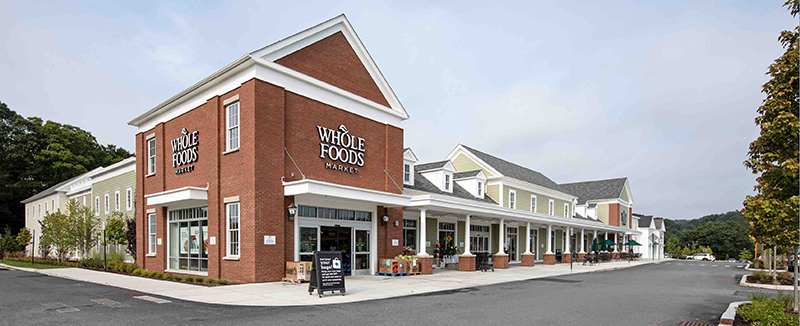

Chappaqua Crossing is newly developed and anchored by Whole Foods, Life Time Fitness, Starbucks and Chase Bank, and is situated between the Saw Mill Parkway and Route 117. The center, which took over 12 years to secure approvals and construct, is part of the redevelopment of the former Reader’s Digest Headquarters, which encompasses 114-acres and also includes over 500,000 s/f of medical/office space, 64 apartments, and 91 luxury townhomes to be constructed by Toll Brothers. Combined with the high-volume Whole Foods-anchored center, the mixed-use site has become the city’s town center and will continue to grow with the development of additional residential units adjacent to Chappaqua Crossing.

Dunne said, “The offering represented a highly unique opportunity to purchase a newly-developed Whole Foods anchored center in Westchester County, NY. Chappaqua Crossing provides highly stable income with a 14+ year weighted average lease term and a rent roll dominated by strong national tenants as well as additional upside through lease-up of the remaining inline suites.”

Gavin said, “Chappaqua Crossing has become the dominant grocery-anchored center in the market as a result of Whole Foods’ wide draw, limited grocery competition nearby, and the center’s regional and local accessibility with a direct exit off the Saw Mill Parkway.”

Berger and Koicim of Marcus & Millichap sell 17-unit multi-family for $8.8 million

Strategic pause - by Shallini Mehra and Chirag Doshi

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

.jpg)

.gif)