Ariel Property Advisors’ report shows Queens investment sales totaled $2.95 billion in 2024

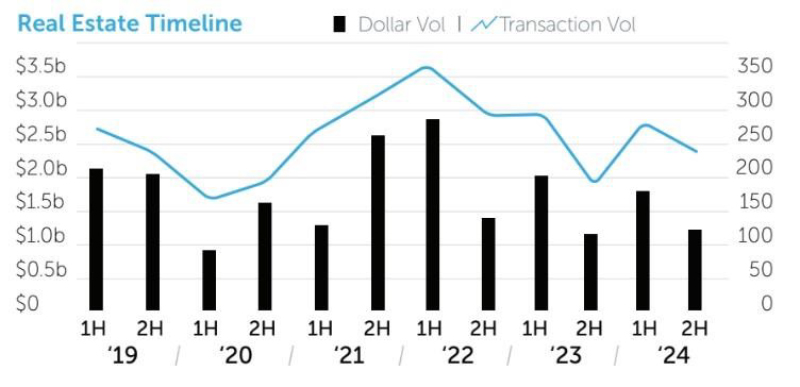

Queens, NY Investment sales in Queens totaled $2.95 billion in 2024, a 7% year-over-year decline, while transactions rose 5% to 507 over this period, according to Ariel Property Advisors’ Queens 2024 Year-End Commercial Real Estate Trends report.

“One of the largest transactions in Queens last year was Terreno Realty’s acquisition of an industrial portfolio for $246 million, an indication that investors view this asset type as a stable investment with room for growth,” said Ariel partner Sean Kelly, Esq. “The transaction also underscores confidence in the JFK area, where a $19 billion public-private redevelopment is transforming the airport into a world-class hub, fueling economic growth and supporting 149,000 jobs.”

Multifamily Highlights

• In 2024, multifamily dollar volume in Queens totaled $851.4 million across 249 transactions, a 13% and 10% increase, respectively, from 2023.

• Buildings with over 50% rent stabilized units accounted for 72% of the dollar volume and 77% of the transactions, while buildings with regulatory agreements accounted for 15% of the dollar volume and 2% of the transactions. The remaining sales were free market.

• One significant trade was the sale of 34-34 77th St., 40-40 79th St., and 56-11 94th St., where approximately 94% of residential units are rent-stabilized. Benedict Realty Group acquired the three elevator buildings from Algin Management Company for $46.5 million, equating to $120 per s/f and $109,000/unit.

Industrial/Warehouse/Storage Highlights

• The industrial/warehouse/storage sector saw a 25% increase in dollar volume to $726.9 million and 9% decline in transactions to 73.

• Terreno Realty Corp. acquired the Blackstone Group’s Queens Industrial Portfolio for $246 million, part of a larger $346.5 million national portfolio. The Queens portfolio includes 28 buildings totaling 1.2 million s/f that are 91.6% leased to 70 tenants.

• Carlyle Group expanded its portfolio in this sector, acquiring two self-storage buildings at 74-16 Grand Ave. and 87-16 121st St. for a combined $101.3 million.

Retail Highlights

• Sales of retail assets in Queens jumped 44% to $500.1 million in 2024 compared to 2023. Transactions also increased 10% to 80.

• Flushing saw nearly $400 million in retail sales across 10 transactions, leading Queens in both metrics, and posted an average price of $1,396 per s/f in 2024, the highest in the borough. California-based Asian supermarket chain, 99 Ranch Market, signed a 44,000 s/f lease at 37-11 Main St. in Flushing, marking its first store in Queens.

• Across the borough, pricing rose nearly $100 per s/f year-over-year to $697 per s/f — the highest level since 2018. A CVS Pharmacy at 61-15 Metropolitan Ave. and Fresh Pond Rd. sold for $15.5 million ($1,148 per s/f), illustrating rising values.

Development Highlights

• Development sales in 2024 experienced a 32% decline in dollar volume to $418.6 million, marking the lowest level since 2012. Transactions rose 4% to 57.

• The top five sales within the borough occurred during the first half of the year. The largest transaction in the second half was Z.D. Jasper Realty’s $16.6 million ($233/BSF) purchase of 34-49 Steinway St. in Astoria.

• Long Island City led the borough in both dollar volume and transactions, recording $190 million in development sales across 10 transactions.

AmTrustRE completes $211m acquisition of 260 Madison Ave.

Strategic pause - by Shallini Mehra and Chirag Doshi

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

.jpg)

.gif)