Ariel Property Advisors arranges $15.875 million

sale of development site

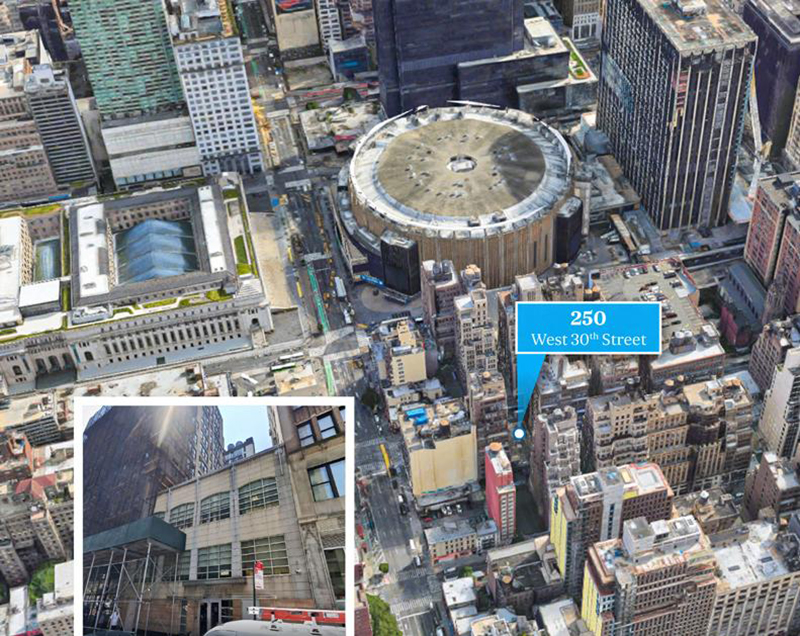

Manhattan, NY Ariel Property Advisors (Ariel) has negotiated the sale of a development site offering nearly 50,000 buildable s/f at 250 West 30th St. in the Chelsea neighborhood. The property traded for $15.875 million.

An Ariel team comprised of founding partner Victor Sozio; director Howard Raber, Esq.; president and founder Shimon Shkury; and associate director Gabriel Elyaszadeh, along with Harold Bordwin, Heather Mil-azo, and Matthew Bordwin of Keen-Summit Capital Partners LLC, represented the seller, Bridget Realty LLC.

Currently home to a vacant 50-ft. wide, three-story, 14,811 s/f commercial building, the site’s flexible M1-6D zoning offers the potential to build a commercial and residential mixed-use development up to 49,375 total buildable s/f as of right.

“The sale of 250 West 30th St. confirms that there is still robust demand for well-located Manhattan development sites suitable for condo projects,” Sozio said. “Located between 7th and 8th Aves., one block south of Penn Station, this area is seeing a number of new residential developments.”

Raber said, “Condo development sites have remained attractive in Manhattan because their construction isn’t dependent on the expired 421a tax abatement program, whose absence has contributed to a downturn in development sales in the outer boroughs.”

The property is near Madison Square Garden and Hudson Yards as well as transportation via several major subway lines including the 1, A, C, and E lines, and the West Side Highway, providing quick and easy access to the rest of the city and the Tri-State area.

AmTrustRE completes $211m acquisition of 260 Madison Ave.

AI comes to public relations, but be cautious, experts say - by Harry Zlokower

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Strategic pause - by Shallini Mehra and Chirag Doshi

.jpg)

.gif)

.gif)