News:

Brokerage

Posted: November 10, 2015

Quarterly Market Report: 3Q 2015 Executive interview with Shimon Shkury, president of Ariel Property Advisors

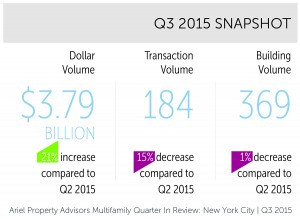

New York, NY NYREJ recently sat down with Shimon Shkury, president of Ariel Property Advisors, a New York City investment property sales firm, who shared some of the highlights from Ariel Property Advisors’ Multifamily Quarter in Review New York City: Q3 2015.

Q: How did the multifamily market perform in the third quarter?

A: A strong month of September and a number of large portfolio sales propelled a strong 3Q figures for New York City multifamily. Coupled with the seasonal factor of many buyers and sellers looking to close 2015 deals before the end of the year, we’re heading into the 4Q with significant momentum.

Q: What contributed to the big gains in this quarter?

A: The multifamily market in Manhattan remained strong with several institutional caliber sales achieving over $950 per s/f which helped to drive the boroughs dollar volume. Brooklyn also outpaced expectations yet again. The borough saw a 50% gain in dollar volume year over year with $751.310 million in gross consideration. The Bronx saw a slew of portfolios trade above $11 million. A package in the Bronxwood section of the Bronx, consisting of 649,655 & 690 Allerton Ave., sold for $34.3 million, which impressively translates to over $200 per s/f.

Q: What pricing trends are you seeing?

A: In New York City today, the supply of available buildings constantly lags demand, which helps prices maintain elevated levels. Whenever we take a new multifamily property to market we receive dozens of offers on a property, so clearly demand is not the issue. The average price per foot across NYC in 2015 has increased 17% year-over-year, after an already robust 15% increase from 2013 to 2014. Cap-rates across the city have compressed by an average of 26 basis points from 2014 to 2015, following two consecutive years of 58-basis point decreases. This means that over just three years, cap-rates have compressed by a total of 142 basis points. In Manhattan alone, 2015’s average price per s/f stands at just over $900 per s/f, which is 50% higher than 2013’s average of $600. Comparing other 2015 pricing metrics to 2013 levels, cap-rates compressed 102 basis points to 3.61%, and the gross rent multiple increased to 19 times from 15 times.

Q: How did the submarkets perform in the third quarter?

A: Manhattan led the way in the 3Q as the submarket accounted for almost half of the city’s dollar volume with $1.816 billion in gross consideration. That healthy figure was propelled by the $670 million sale of the Caiola Portfolio, which consisted of approximately 1,000 apartments throughout 25 buildings, concentrated mostly in Chelsea and the Upper East Side. In Gramercy, Stone Street Properties picked up a package of elevatored buildings on East 22nd St. for $123 million, or roughly $1,000 per s/f. The buildings were marketed as a potential condo conversion, but it is believed new ownership will continue to operate the buildings as rentals.

As mentioned earlier, Brooklyn continued its very strong 2015. The quarter’s largest transaction involved one of the city’s most active multifamily players this year, Akelius Management, who picked up a 6-building, 393,000 s/f portfolio scattered throughout Crown Heights, Prospect Lefferts Gardens and Flatbush. The Swedish investment firm purchased another 200-unit Crown Heights portfolio in May, strengthening their presence in the neighborhood. In Brooklyn Heights, Benchmark Real Estate Group picked up 25 Monroe Place, a 67-unit elevatored rental building, for $50 million, or $823 per s/f. This is another great example of a successful firm that has largely focused on Manhattan paying attention to prime Brooklyn assets.

Northern Manhattan posted impressive 3Q numbers, recording quarter to quarter and year over year gains in dollar volume of 29% and 12% increases, respectively. The submarket saw the largest trade outside of core Manhattan, as a 24-building, 578-unit portfolio located in West Harlem sold for $148.5 million, which equates to $365 per s/f and $257,000 per unit. The portfolio last exchanged hands in 2013 for $75 million. In East Harlem, a 36-unit mixed use building located at 124-128 East 107th St. sold for $9.15 million, or $449 per s/f. The sale represents a 140% increase from the last time the property exchanged hands in 2012 for $3.81 million.

Bronx multifamily figures were aided by a surge of large-scale portfolios trading in July, as the borough saw three sell for more than $40 million. One such portfolio included a 272-unit, 264,241 square foot portfolio concentrated in Belmont and West Farms that sold for just over $41 million, which translates to $155 per s/f and $151,029 per unit.

Queens experienced an uptick in dollar volume compared to 2Q15 with$203.262 million in gross consideration. This can largely be attributed to the $134 million sale of The Opal located at 75-25 153rd St. in Flushing, accounting for well over half of the volume. The luxury rental building sold for $248 per s/f and was the city’s fourth largest transaction in the 3Q. Otherwise, the quarter was relatively light for the borough.

Q: What do you see on the horizon for the multifamily market this year?

A: Investor confidence continues to grow stronger as 2015 progresses. Local economic growth is strong, unemployment is low and New York is drawing people from around the world to live and invest. So far, the market has showed no signs of slowing down. We’re paying attention to strengthened rent regulations and the Federal Reserve’s position on interest rates, but New York remains the best destination for capital seeking safety in today’s volatile global environment.

Q: Where can we get a copy of Ariel Property Advisors’ Multifamily Quarter in Review New York City: Q3 2015?

A: Copies of the Multifamily Quarter in Review New York City: Q3 2015 and all of our research reports are available on our website at http://arielpa.com/research/reports/.

Shimon Shkury is founder and president of Ariel Property Advisors, New York, N.Y.

Tags:

Brokerage

MORE FROM Brokerage

SABRE coordinates sale of six properties totaling 199,845 s/f

Huntington, NY SABRE Real Estate Advisors has completed the sale of six commercial properties across Long Island and Northern New Jersey, further underscoring the firm’s strength as a trusted partner in complex real estate transactions. The deals were led by executive vice presidents Jimmy Aug and Stu Fagen, whose combined expertise continues to drive exceptional results for clients across the region.

Columns and Thought Leadership

Strategic pause - by Shallini Mehra and Chirag Doshi

Many investors are in a period of strategic pause as New York City’s mayoral race approaches. A major inflection point came with the Democratic primary victory of Zohran Mamdani, a staunch tenant advocate, with a progressive housing platform which supports rent freezes for rent

Lasting effects of eminent domain on commercial development - by Sebastian Jablonski

The state has the authority to seize all or part of privately owned commercial real estate for public use by the power of eminent domain. Although the state is constitutionally required to provide just compensation to the property owner, it frequently fails to account

Behind the post: Why reels, stories, and shorts work for CRE (and how to use them) - by Kimberly Zar Bloorian

Let’s be real: if you’re still only posting photos of properties, you’re missing out. Reels, Stories, and Shorts are where attention lives, and in commercial real estate, attention is currency.

Lower interest rates and more loan restructuring can help negate any negative trending of NOI on some CRE projects - by Michael Zysman

Lower interest rates and an increased number of loan restructurings will be well received by the commercial real estate industry. Over the past 12 months there has been a negative trend for NOI for many properties across the country.

.jpg)

.gif)