A pause in interest rate hikes <br>- by Michael Packman

On October 19th, Fed chair Jerome Powell suggested that the Fed would not raise interest rates at their next meeting and reminded us that there has not been an increase since the July meeting. The goal of the Fed continues to be tightening the economy, while maintaining low unemployment and (hopefully) avoiding a major recession.

The Effects on Real Estate Operations

Observing trends in real estate over the past year, it is interesting to see how the increase in interest rates has had an impact on various components of the real estate industry; the largest impact being the cost, and availability of debt. As mentioned in my August 29th, 2023 article, if you are in a 1031 exchange and have existing debt on the property you sell, that debt needs to be replaced. If the debt on your property matured in the last 6-12 months, and you were able to refinance, it is more than likely you are in a negative leverage situation where the debt interest rate is higher than your acquisition cap rate and therefore your potential cash flow for distribution has gone down due to the higher debt cost.

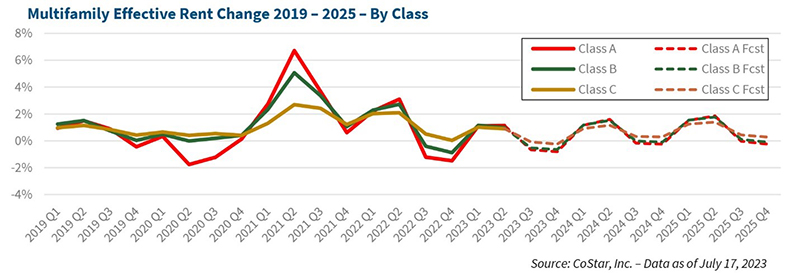

If you are the owner of commercial real estate, you have seen your expenses increased considerably. According to Yardi, expenses for multifamily properties grew by 9.3% on average nationally in the trailing 12-month period through June 2023; the growth the year prior was 5.7%. Expenses increased across the board, with insurance up 18.8% (in certain Florida markets insurance is up more than 50% year-over-year). Unfortunately, asking rents are up only 1.5% year-over-year as of August 2023 as affordability is becoming a large factor. CoStar anticipates rent growth in apartments to be modest to flat in coming years:

Alternatively, Net Lease

Often real estate investors in a 1031 exchange are familiar with the economics of residential real estate investments because they are exchanging out of a rental home, or a smaller multifamily property. They may not be as familiar with net lease properties. There are distinct types of net leases, but 1031 exchangers may want to think about triple net leases, or NNN leases, in an uncertain economic environment. With a NNN lease, the tenant under the lease is responsible for all the operating and capital expenses for the property in addition to paying a stated rent amount to the landlord.

These leases are usually long-term (5-10 years or more) with the rent terms specifically stated in the lease. There may or may not be periodic increases in rent, but often the tenant will have the option to renew the lease at the end of its term with a specified increase in rent. The disadvantage for the landlord is that the rent has been predetermined and may not include rate increases until the tenant exercises its option to renew. The significant advantage, however, is that the landlord does not absorb the rising costs of insurance, taxes, or operating expenses. With the long-term lease, the landlord has a level of assurance that the tenant has a commitment to the location for its business, employees, and customers. This consistency could potentially be a stable alternative for 1031 exchanges riding out the economic cycle and preserving gains, especially if the lease is with a credit tenant. In an uncertain economic environment, having a long-term NNN lease with a muti billion-dollar corporation guaranteeing it might be something to consider.

Location, Location, Credit

With any real estate acquisition, location is important. A retailer wants to have convenient access to their customers. Now that companies are pushing to bring employes back to the office, they want to be conveniently located to reduce their employee commute time. Industrial tenants need locations near their supply chain, and on major transportation corridors. The better the location, the more likely they will be to renew and extend their leases.

Rent and lease structure are factors of the location and credit worthiness of the tenant. There are rating agencies (e.g., Moody’s, Standard & Poor’s, and Fitch) that rate the debt of corporations, much like individuals with debt will have a FICO Score. For the credit tenant, like an individual with a high FICO Score, highly rated corporations receive more favorable lease terms since they are less at risk of defaulting on their lease obligations.

The Bottom Line

Volatility is constant for the current U.S. economy. For investors in need of a 1031 exchange with large capital gains to protect, consistent income provided by NNN tenants may be the conservative answer. If an investor is in a 1031 exchange now, it may not be entirely by choice. There may have been a debt maturity that could not be refinanced, or the fear of losing value from the potential of continued rising cap rates might have been reason enough.

Regardless, there are opportunities for investors to “de-risk” their investment from rising expenses and plateauing revenues. For exchangers seeking to diversify, or those with smaller 1031 exchange needs, exploring Delaware Statutory Trusts (DSTs) may be a worthwhile effort. DSTs can provide access to larger, institutional size investments (further reducing potential volatility) to investors that would not ordinarily have access to opportunities of that size and scale.

Keystone National Properties (including its subsidiaries and affiliates) does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

Michael Packman is founder and CEO of Keystone National Properties (KNPRE), New York, N.Y.