Examining the Pass-Through Entity Tax - by Sandy Klein

The Tax Cuts and Jobs Act (TCJA) limits an individual’s deduction for state and local taxes (the “SALT limitation”) to $10,000 for tax years beginning after December 31, 2017 and ending before January 1, 2026. The Conference Committee report accompanying the legislation indicated that “taxes imposed at the entity level, such as business tax imposed on pass-through entities, that are reflected in a partner’s or S corporation shareholder’s distributive or pro-rata share of income or loss on a Schedule K-1 (or similar form), will continue to reduce such partner’s or shareholder’s distributive or pro-rata share of income as under present law.”

In late 2020, the Internal Revenue Service (IRS) issued Notice 2020-75 indicating that it intended to issue proposed regulations to provide “certainty to individual owners of partnership and S corporations in calculating their SALT deduction limitations.” Essentially, the notice provided the IRS approval for pass-through entity tax (PTET) legislation that was enacted (or was being enacted) by various states in response to the $10,000 federal cap on the deduction of state and local income taxes.

New York State recently released a Technical Memorandum (TSB-M-21(1)C, (1)l) providing guidance on the operation of the New York State PTET. A partnership that is required to file a New York State partnership return of income either because it has a resident partner, or it has income derived from New York State sources is eligible to elect to pay the PTE tax. A New York State S corporation is also eligible to elect to pay the PTE tax.

Eligible partnerships and S corporations may annually elect to pay PTET for tax years beginning on or after January 1, 2021. The election must be made online on an annual basis and is irrevocable. For tax years beginning on or after January 1, 2021, the election had to have been made by October 15, 2021. For tax years beginning on or after January 1, 2022, the election may be made online on or after January 1, 2022 but not later than March 15, 2022.

A trust, other than a trust that is disregarded for tax purposes, that is a direct partner, member or shareholder in an electing entity is allowed a PTET credit on the trust’s income tax return, but it is not permitted to distribute any PTET credit it receives to its beneficiaries. A partner, member or shareholder that is not subject to tax under Article 22 (i.e., personal income tax) is not eligible for the PTET credit. Additionally, a partner that is itself a partnership is not eligible for the PTET credit.

A detailed discussion of all the aspects of the PTET election is beyond the scope of this article. The following example taken from TSB-M-21(1)C, (1) illustrates the calculation of the PTET and related credit as it applies to a partnership and its partners.

A detailed discussion of all the aspects of the PTET election is beyond the scope of this article. The following example taken from TSB-M-21(1)C, (1) illustrates the calculation of the PTET and related credit as it applies to a partnership and its partners.

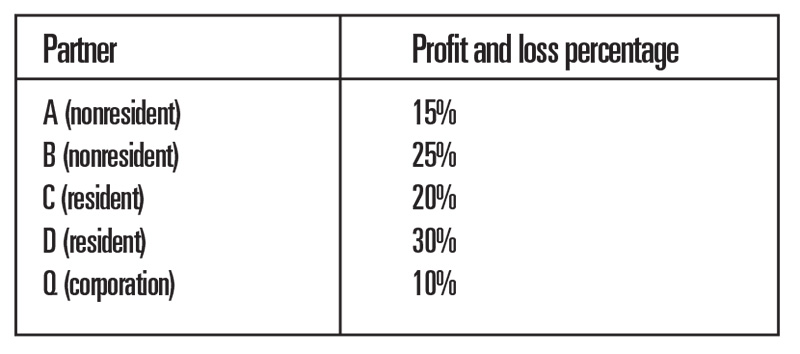

Partnership XYZ has five partners (see chart).

To compute its PTE taxable income, XYZ partnership must compute both a resident PTE taxable income pool and a nonresident PTE taxable income pool and add these amounts together. Corporate partner Q is not eligible for a PTET credit as a corporation and corporate partner Q’s income from Partnership XYZ is not included in the PTE taxable income calculation. Partnership XYZ computes a nonresident PTE taxable income pool of $4 million and a resident PTE taxable income pool of $10 million, for a total PTE taxable income pool of $14 million. Using the tax rate chart provided in the TSB-M, Partnership XYZ computes and pays a PTET of $1,353,500 ($426,500 plus 10.30% of the excess of PTE taxable income greater than $5 million). The PTET must be paid by December 31 of XYZ’s current taxable year to be deductible against current year taxable income.

The nonresident PTET credit pool is calculated by dividing the nonresident PTE taxable income pool by the total taxable income pool and then multiplying that percentage by the total PTET to arrive at a nonresident credit pool of $386, 694.95 ($4M/$14M = 28.57%; $1,353,500 x 28.57% = $386,694.95).

Partner A and Partner B, combined, have a profit and loss ownership percentage of 40% of Partnership XYZ. Their respective credit percentages and PTET credits are calculated by dividing their respective ownership percentages by 40% and then multiplying the result by the $386,694.95 nonresident credit pool. Partner A’s PTET credit is $145,010.61 (15/40 x $386,694.95). Partner B’s PTET credit is $241,684.34 (25/40 x $386,694.95).

The resident partner PTET credit pool and the respective amounts of PTET credit for partners C and D is calculated in a similar manner.

Eligible taxpayers that receive a PTET credit from an electing entity may claim the credit on Form IT-653, Pass-Through Entity Tax Credit, and attach it to their New York State personal income tax returns.

Although New York State has issued guidance, there are many questions that remain unanswered about the practical application of the new law to real life situations.

Sandy Klein, CPA, is a partner at Shanholt Glassman Klein Kramer & Co., New York, N.Y.