The good, the bad and the ugly of renting in America today: A lot has changed in 30 years - by Ellen Sirull

Apartment Guide

A lot has changed in the last 30 years for renters – some for the better and some still leaving much to be desired. The Joint Center for Housing Studies of Harvard University released its 30th anniversary State of the Nation’s Housing report this year and it provides an opportunity to reflect on how housing market conditions in the U.S. have evolved over time, looks at current trends and reveals how we still have progress to make when it comes to all Americans having decent, affordable homes.

Here are some of the key takeaways from the study.

1. Most people are paying more of their income towards rent. Many renters now are cost-burdened, meaning they use more than 30% of their income to pay for housing and may have trouble paying for other necessities such as food, clothes, transportation and medical care.

This is mostly due to massive increases in housing costs, with the national median rent rising 20% faster than overall inflation from 1990 to 2016. (Homeowners aren’t immune either as the median home price rose 41% faster than inflation in the same timeframe.)

Quality of housing has improved some, but the main cause is the increased expenses involved in housing construction and land. If you’re a renter, you may be thinking, “Yeah, no kidding.” But this just means that budgeting well, saving what you can and researching all your options are critical to not spending any more money than you need to on renting your home.

2. There is a slight shift to more people buying (vs. renting.) After ten years of rental demand growing, Americans are starting to get back into the homebuyer market. From 2005 – 2015, the number of U.S. households renting grew by an average of 850,000 each year, yet from 2015 – 2017 rental households grew only 220,000 annually. It’s still a bit early to qualify as a rebound in home buying, but the U.S. homeownership rate does look to be stabilizing.

Deciding whether to own or rent involves weighing many factors, including how long you plan on staying in one place, relative costs, your ability to tolerate financial risk and the benefits you see with each option.

Deciding whether to own or rent involves weighing many factors, including how long you plan on staying in one place, relative costs, your ability to tolerate financial risk and the benefits you see with each option.

Many Americans are still opting to rent because it makes sense for them. Down payments require a solid savings, especially in markets with expensive housing markets. Many millennials are waiting to buy homes later than the older generations (Generation X and Baby Boomers) according to another study by the Urban Institute in 2018.

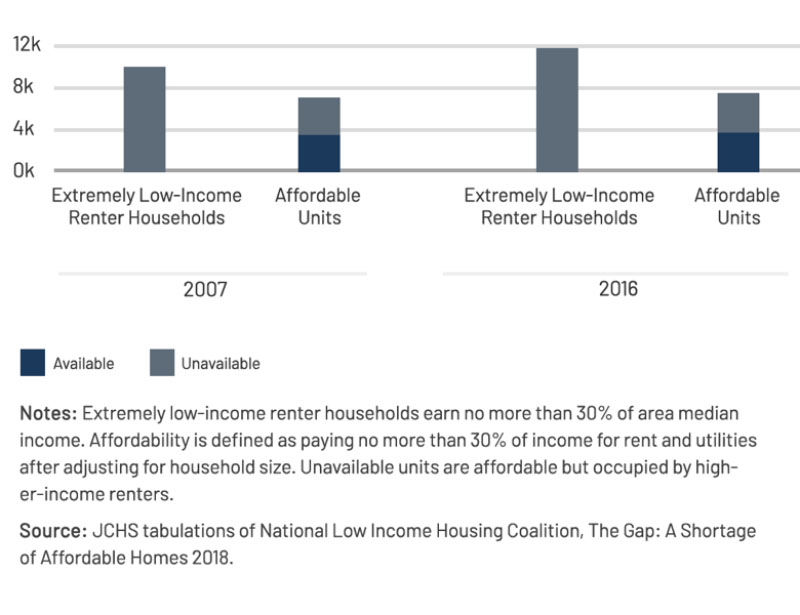

There are differences based on income as well – the number of high-income renters is growing while the supply of rentals those with the lowest incomes can afford continues to shrink.

3. Rental housing demand remains positive. While growth in rentals may have slowed, the overall demand is still positive. Millennials still often rent before buying when they move or combine households, and many older households are making the switch from owning to renting in order to reduce upkeep and downsize.

There is also a huge demand for affordable rental housing, with 15.5 million households having very low- and extremely low-incomes as well as the increase in cost-burdened households mentioned previously.

4. Renters are moving less. Renters historically move more often than homeowners, yet their mobility rate (how frequently they move) has dropped substantially.

The decrease in renters moving is likely because of a variety of trends, including the increased likelihood that adult children live with their parents, rising student loan debt that makes it more difficult for young adults to move out on their own and the scarcity of low-cost rentals in some areas which may mean tenants stay in one rental longer even if it’s not the ideal place for them.

Also, while many older Americans do downsize, a growing number of older renters are staying in their homes longer than previous generations.

Though rental growth rates rent inflation and the percent people pay towards renting may change, there will always be a need for many Americans to rent homes. Thus, it’s important to understand the details of your market and weigh the amenities and features you want (and need) against the availability and cost of the rental.

Ellen Sirull is a content specialist at Apartment Guide in Atlanta, GA.

Suffolk County IDA supports expansion of A&Z Pharmaceuticals

The evolving relationship of environmental consultants and the lending community - by Chuck Merritt

When Environmental Site Assessments (ESA) were first part of commercial real estate risk management, it was the lenders driving this requirement. When a borrower wanted a loan on a property, banks would utilize a list of “Approved Consultants” to order the report on both refinances and purchases.

.jpg)