A Wild Ride - by Mike Packman

In January we talked about rising interest rates and considering capital preservation and predictable cash flow to potentially mitigate risk. Since then, the Fed has made it a wild ride for real estate investors.

Rising Interest Rates

Rising Interest Rates

The Fed has hiked interest rates three times so far this year. Most recently, the Fed raised interest rates seventy-five basis points at the end of July; quite a difference from keeping the rates near zero during the pandemic.

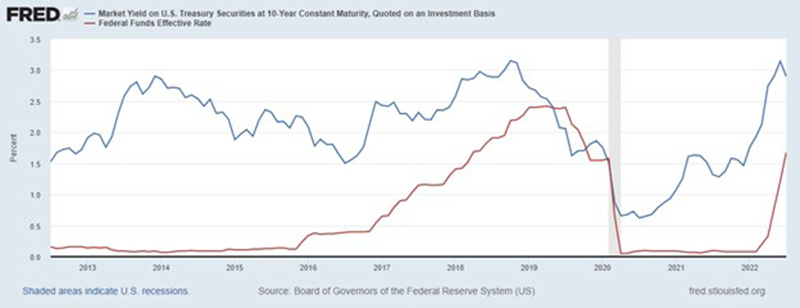

The red line is the Effective Fed Funds Rate over the last 10 years. In 2015, the Fed began a modest trend of raising rates after having been near zero since the credit crisis. In 2019 and 2020, the Fed acted to bring rates back down to zero and began a massive quantitative easing to keep the economy moving during the pandemic.

The 10-year Treasury rate is in blue. While not all commercial mortgages are priced off Treasuries (some price off LIBOR, Swaps or even SOFR Swaps) it is an indicative index. Historically, the 10-year Treasury tracks with the Fed Funds rate, but there is some spread over the “risk free” Fed Funds rate.

The immediate impact of the current inflationary environment to commercial real estate can be seen in rising operating expenses. In the world of net leased real estate, property owners are less impacted by the expense shift as the tenants bear the responsibility for the increased expenses and in this type of environment, owning real estate with credit tenants can be a real advantage.

Relatively Unchanged Cap Rates

At the start of the year, we experienced record acquisition levels and 1031 exchange activity thanks to investor demand, rising sale prices, and low interest rates. Sellers of commercial properties continue to be able to demand high sales prices, even in a rising interest rate environment.

Throughout the pandemic, cap rates trended down, thus prices continued to climb. Our analysts conducted a 12-month look-back on cap rates for retail, industrial, and multifamily - three of the major asset classes and found that despite the large uptick in interest rates in the past few months, cap rates have not yet been drastically impacted. Typically cap rates have an inverse relationship with interest rates, so conventional wisdom suggests that we should see adjustments at some point. As you analyze your real estate investment decisions, it may be helpful to note:

The 10-year treasury rate is trading near its pre-pandemic rates. If I recall correctly, our economy had been growing steadily up to early 2019, thus why the Fed had been raising rates prior to the pandemic.

From a 1031 perspective, there are still many investors that have had the opportunity to take profits in 2022. With the clock ticking on their 45-day identification window, they are willing to pay for an investment that meets their needs to satisfy their exchange.

Not all buyers require leverage. Some buyers prefer to buy real estate all-cash and are more focused on unleveraged Internal Rates of Return (IRR) than they are leveraged IRRs and therefore the cost of debt capital is less of a factor in their investment decision making.

The Bottom Line

If you have been in commercial real estate for any length of time and worked through at least one real estate cycle, then you know investing is as much an art as it is a skill. With rising interest rates, seemingly high inflation, the specter of a recession, and cap rates only adjusting slightly, it is not easy to know what the “right” investment move is; especially if you are in the middle of a 1031 exchange. However, focusing on long-term leases with credit tenants in good locations for the product or service the tenant is providing, may reduce your investment risk. Regardless, buy property you are comfortable holding for the long-term. We all want to make investments that are as profitable as possible, but right now it may be prudent to focus on conservative underwriting and longer-term time horizons.

Mike Packman is founder and CEO of Keystone National Properties (KNPRE), New York, N.Y.