Tenants optimistic as searches for commercial listings slowly pick up in April & May - by Diana Sabau

This year will likely mark a key turning point for the commercial real estate market, as designers and employers rethink the way office spaces are designed and occupied.

So, to better understand the public’s outlook on the future of the industry, we surveyed visitors to the CommercialCafe and Property Shark websites about how COVID-19 had affected their search for a new office space. We also examined traffic data for commercial listings on CommercialCafe and used Google Trends to measure the popularity of industry-relevant terms in online searches over the past 12 months. The responses and data we gathered indicate faith in the market and the likeliness of business to resume as usual, despite the slowdown.

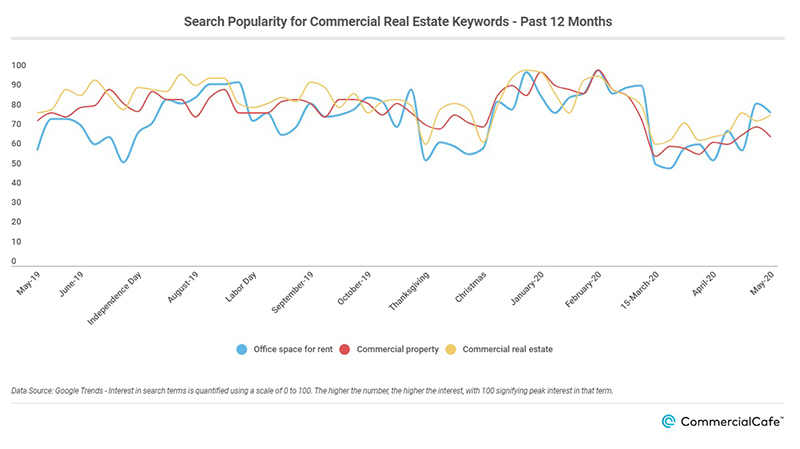

Searches for Commercial Real Estate Terms Slowly Recover After Mid-March Slump

In mid-March, headlines about the spread of the coronavirus took over the news cycle. Subsequently, Google Trends data registered a predictable fall in the number of searches for three important commercial real estate terms. However, traffic for “commercial real estate,” “commercial property” and “office for rent” slowly picked up throughout April and the beginning of May.

As you can see, the popularity of these terms fluctuates during the course of a year, either because of national holidays or due to the seasonality of tenant interest in finding a new office space. Of course, it’s important to note that the variance is typically less pronounced than the recent drop following the lockdown.

44% of CommercialCafe Respondents Continue Their Office Space Searches Despite the Crisis

A two-month timeline for commercial property searches on CommercialCafe, a real estate listings platform, revealed that March 15th was the lowest point for traffic, generally aligning with the beginning of the crisis in the U.S. Commercial searches that week went down by 27%–the most substantial fall in weekly numbers in the past three months.

However, by the end of March and beginning of April, declines in traffic had slowed compared to previous weeks. Subsequently, between April 5th and April 25th, CommercialCafe listing searches began to recover. The following week they increased by 3%, growing a further 8% a from May 3rd to May 9th. Overall, the data points toward a slow, but steady recovery.

Turning to the survey, one of the questions CommercialCafe visitors were asked was about the status of their office space searches. Nearly half of the respondents indicated that they were not only still looking, but that they were ready to commit to a lease if they found a good match. Another 39% reported being unsure about their next move or that they had given up looking altogether for the time being. Approximately 8% are still searching but less persistently then before and 8% are keeping an eye on the market.

Regarding whether the pandemic had changed their office selection process, 38% responded negatively. However, 25% reported visiting fewer locations at this time or suspending their searches altogether. Another 36% were making full use of available remote-viewing technologies, with 22% relying on pictures and virtual property tours, and 14% using virtual reality staging software.

For more details about how businesses, entrepreneurs and other prospective tenants view the effect of the coronavirus crisis on the commercial real estate market, read the full article on CommercialCafe.

Diana Sabau is a contributing author for CommercialCafe.